Photo by Maxim Hopman on Unsplash

Introduction

In the world of finance, the stock market stands as an embodiment of economic activity, wielding extensive influence over global economies. To fathom its complexities, one must embark on a deep exploration of its fundamental principles and the advanced strategies that define its functionality.

The Foundation: What is the Stock Market?

At its core, the stock market serves as a forum where buyers and sellers converge to trade shares of publicly listed companies. It serves as a conduit for companies to amass capital by selling ownership stakes to investors in the form of stocks or shares. These stocks represent a proportional ownership interest in the company and confer upon the holder the right to a share of its profits through dividends and capital appreciation.

The stock market is instrumental in enabling companies to raise capital for various purposes, including financing expansion, funding research and development, and supporting operational activities. By issuing stocks, companies can tap into a vast pool of investors, thereby facilitating the flow of capital.

Moreover, the stock market serves as a barometer of economic health, with stock prices reflecting investor confidence in the future prospects of companies and the broader economy. A rising stock market is often seen as a sign of economic strength, while a falling market can indicate underlying economic challenges. Understanding the stock market's role in capital formation and economic signaling is essential for investors seeking to navigate its complexities.

Market Participants: Who Moves the Market?

The stock market is a bustling marketplace inhabited by a diverse array of participants, each playing a distinctive role in its dynamics. These include individual investors, institutional investors such as mutual funds and pension funds, and market makers who facilitate trading by providing liquidity. Additionally, regulatory bodies such as the Securities and Exchange Board of India (SEBI) oversee the market to ensure fair and transparent trading practices.

Individual investors, often referred to as retail investors, are individuals who engage in buying and selling stocks for personal investment purposes. They range from small individual investors to high-net-worth individuals, each with their own investment objectives and risk tolerance levels. Institutional investors, on the other hand, are large financial entities such as banks, insurance companies, and hedge funds that invest on behalf of their clients or shareholders. These institutional investors play a pivotal role in shaping market trends and influencing stock prices through their trading activities.

Market makers are entities that facilitate trading by providing liquidity to the market. They do so by quoting both a buy and sell price for a security and standing ready to execute trades at these prices. This ensures that there is a continuous flow of trading activity in the market, even in the absence of natural buyers or sellers. Market makers play a crucial role in maintaining market efficiency and ensuring that securities are traded at fair prices.

Market Mechanics: How Does Trading Work?

Trading on the stock market takes place through exchanges such as the Bombay Stock Exchange (BSE) or the National Stock Exchange (NSE), where buyers and sellers submit orders to buy or sell stocks. These orders are matched electronically based on price and time priority, with trades executed through a process known as clearing and settlement, where securities and funds are exchanged between parties.

The trading process commences when an investor places an order to buy or sell a stock through their brokerage account. This order is then relayed to the exchange, where it is matched with a corresponding order from another investor. Upon the execution of a trade, the transaction details are recorded, and the securities and funds are exchanged between the buyer and seller. The clearing and settlement process ensures that the transaction is completed seamlessly and securely, with the securities transferred to the buyer's account and the funds to the seller's account. Currently, the Indian stock market operates from 9:15am to 3:30pm daily with Saturdays, Sundays and national holidays alluded to as zero days. Meanwhile, other countries across the world have their own local times of operations.

Furthermore, the stock market operates on the principle of price discovery, whereby stock prices are determined based on the forces of supply and demand. When there is high demand for a stock, its price tends to rise, and when there is low demand, its price tends to fall. Understanding the mechanics of trading and price discovery is essential for investors seeking to navigate the stock market landscape.

Market Indices: Gauging Market Performance

Market indices, such as the Sensex (benchmark index of BSE) and the Nifty 50 (benchmark of NSE), serve as barometers of market performance, tracking the prices of a basket of stocks to provide a snapshot of the overall market direction. They are utilized by investors to assess the health of the economy and make informed investment decisions.

Market indices are constructed using a weighted average of the prices of the constituent stocks. The weighting methodology may vary, with some indices being weighted by market capitalization, while others are weighted equally. The index value is calculated based on the prices of the constituent stocks, which are adjusted for corporate actions such as stock splits and dividends to ensure that the index accurately reflects the market's performance.

Moreover, market indices provide an ideal mark for investors to evaluate the performance of their investment portfolios. By comparing the performance of their portfolios to that of a market index, investors can quantify the effectiveness of their investment strategies and make adjustments as necessary. Understanding the role of market indices in assessing market performance is crucial for investors seeking to make informed investment decisions.

Market Trends: Understanding Market Movements

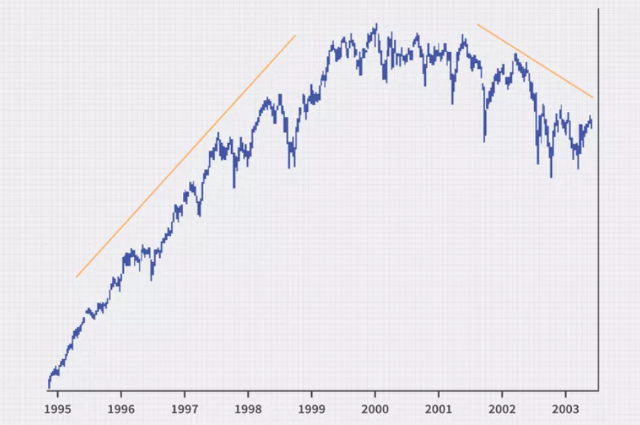

The stock market is subject to various trends and cycles, influenced by factors such as economic indicators, geopolitical events, and investor sentiment. Bull markets, characterized by rising prices, are periods of optimism and economic growth, while bear markets, marked by falling prices, signify pessimism and economic downturns.

Market trends can be driven by a myriad of factors, including macroeconomic trends such as changes in interest rates or inflation, as well as company-specific factors such as earnings reports or corporate actions. Understanding these trends and their underlying drivers is essential for investors seeking to traverse through the market and make informed investment decisions.

Furthermore, investor sentiment plays a crucial role in driving market trends. Positive news, such as strong economic data or corporate earnings, can boost investor confidence and lead to higher stock prices. Conversely, negative news, such as geopolitical tensions or economic uncertainty, can dampen investor sentiment and cause stock prices to decline. Understanding the interplay between market trends and investor sentiment is crucial for investors seeking to anticipate market movements and make profitable investment decisions.

Parameters for Assessing Stock Performance

Assessing stock performance involves a deep dive into various parameters, known as financial ratios, that provide insights into a company's financial health and future potential. These ratios encompass profitability, efficiency, liquidity, solvency, valuation, growth, dividend, market performance, corporate governance, and industry comparisons, offering a comprehensive view of a company's performance and aiding investors in making informed decisions.

1. Profitability Ratios:

- Return on Equity (ROE): This ratio evaluates how effectively a company utilizes shareholders' equity to generate profits. A high ROE indicates efficient utilization of equity.

- Profit Margin: This ratio measures the percentage of revenue that transforms into profit after accounting for all expenses. A higher profit margin signifies better profitability.

2. Efficiency Ratios:

- Asset Turnover Ratio: This ratio gauges how efficiently a company uses its assets to generate revenue. A higher asset turnover ratio indicates efficient asset utilization.

- Inventory Turnover Ratio: This ratio indicates how quickly a company sells its inventory and replaces it. A higher inventory turnover ratio suggests efficient inventory management.

3. Liquidity Ratios:

- Current Ratio: This ratio compares a company's current assets to its current liabilities, indicating its ability to cover short-term obligations. A current ratio of 2 or higher is generally considered healthy.

- Quick Ratio: Similar to the current ratio, the quick ratio excludes inventory from current assets, providing a more stringent measure of liquidity.

4. Solvency Ratios:

- Debt-to-Equity Ratio: This ratio compares a company's total debt to its shareholders' equity, indicating its long-term financial leverage. A lower debt-to-equity ratio suggests lower financial risk.

- Interest Coverage Ratio: This ratio measures a company's ability to meet its interest payments on outstanding debt. A higher interest coverage ratio indicates a lower risk of default.

5. Valuation Ratios:

- Price-to-Earnings (P/E) Ratio: This ratio compares a company's stock price to its earnings per share (EPS), indicating how much investors are willing to pay for each dollar of earnings. A higher P/E ratio may indicate overvaluation.

- Price-to-Book (P/B) Ratio: This ratio compares a company's stock price to its book value per share, reflecting the market's valuation of the company's assets.

6. Growth Ratios:

- Earnings Growth Rate: This ratio measures the percentage increase in a company's earnings over a specified period, indicating its growth potential.

- Revenue Growth Rate: This ratio indicates the percentage increase in a company's revenue over a specified period, reflecting its ability to increase sales.

7. Dividend Metrics:

- Dividend Yield: This ratio measures the annual dividend income as a percentage of the stock price, indicating the return on investment from dividends. A higher dividend yield may suggest a higher income potential.

- Dividend Payout Ratio: This ratio indicates the percentage of earnings paid out as dividends, providing insights into the sustainability of dividend payments.

8. Market Performance Metrics:

- Beta: This metric measures a stock's volatility relative to the overall market, helping investors assess risk. A beta of 1 indicates the stock moves in line with the market.

- Total Return: This metric reflects the total percentage increase or decrease in the value of an investment, including dividends and capital appreciation.

9. Corporate Governance Indicators:

- Board Structure: Evaluates the composition and independence of the company's board of directors, which can impact decision-making and oversight.

- Executive Compensation: Assesses the alignment of executive compensation with company performance and shareholder interests, ensuring prudent management practices.

10. Industry Comparisons:

- Peer Comparison: Compares a company's financial ratios with those of its industry peers to assess its relative performance and valuation. This comparison provides context and helps identify outliers and trends within the industry.

Risk and Reward: Managing Investment Risk

Investing in the stock market entails inherent risks, including market volatility and the potential for loss of capital. However, with risk comes reward, as the stock market has historically delivered robust returns over the long term. Diversification, asset allocation, and risk management strategies are indispensable tools for investors seeking to navigate the complexities of the market.

Diversification involves spreading investments across different asset classes, such as stocks, bonds, and real estate, to reduce risk exposure. Asset allocation refers to the strategic allocation of investments across different asset classes based on the investor's risk tolerance and investment objectives. Risk management strategies, such as stop-loss orders and hedging, can help investors mitigate potential losses and protect their investment portfolios.

Furthermore, understanding the relationship between risk and reward is essential for investors seeking to achieve their financial goals. While investing in the stock market can offer the potential for high returns, it also carries the risk of significant losses. By adopting sound risk management strategies and maintaining a diversified investment portfolio, investors can minimize their exposure to risk and maximize their chances of achieving long-term financial success.

Advanced Concepts in the Stock Market

In addition to the fundamental principles of the stock market, there exist several advanced concepts that are crucial for investors seeking to deepen their understanding of the market dynamics. These concepts, while complex, are essential for navigating the stock market landscape and making informed investment decisions.

Market Microstructure:

Market microstructure refers to the study of how markets operate and how trading occurs at a micro level. It involves understanding the mechanics of order flow, price formation, and market liquidity. Market microstructure examines how trading venues, such as exchanges and electronic communication networks, function and how they impact market efficiency and price discovery.

One key concept in market microstructure is the order book, which is a real-time record of buy and sell orders for a particular security. The order book displays the current market depth, showing the number of shares available at various price levels. Understanding the order book can help investors gauge market sentiment and anticipate price movements.

Another important concept in market microstructure is market impact, which refers to the effect of a large trade on the price of a security. Large trades can cause temporary price distortions due to the imbalance between supply and demand. Market impact is influenced by factors such as market liquidity, trading volume, and the speed of order execution.

Algorithmic Trading:

Algorithmic trading, also known as algo trading or black-box trading, refers to the use of computer algorithms to execute trades at high speeds and frequencies. Algorithmic trading algorithms are designed to analyze market data, identify trading opportunities, and execute trades automatically based on predefined parameters.

One key concept in algorithmic trading is high-frequency trading (HFT), which involves executing a large number of trades in fractions of a second. HFT algorithms are designed to exploit small price discrepancies and market inefficiencies, often using complex mathematical models and statistical arbitrage strategies.

Another important concept in algorithmic trading is algorithmic execution, which involves splitting large orders into smaller orders and executing them over time to minimize market impact. Algorithmic execution algorithms are designed to balance the need for speed with the goal of achieving the best possible execution price.

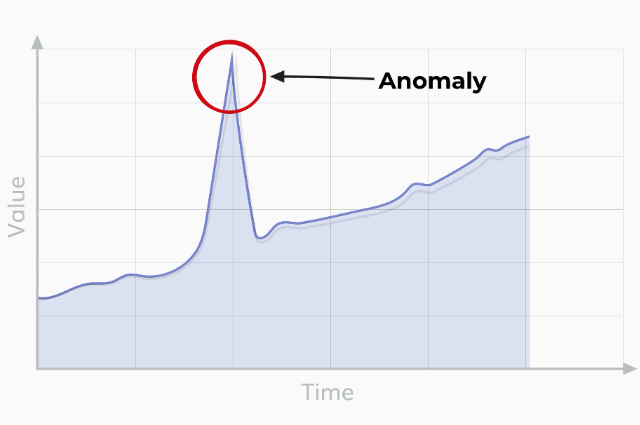

Market Anomalies:

Market anomalies are deviations from the efficient market hypothesis (EMH), which posits that asset prices reflect all available information. Market anomalies suggest that certain market patterns or trends exist that cannot be explained by traditional economic theory.

One example of a market anomaly is the January effect (commonly observed in overseas markets), which refers to the tendency of stock prices to rise in the month of January. The January effect is believed to be driven by factors such as tax-loss harvesting and year-end bonuses, which lead to increased buying pressure on stocks.

Another example of a market anomaly is the momentum effect, which refers to the tendency of stocks that have performed well in the past to continue to perform well in the future. The momentum effect contradicts the EMH, which suggests that past performance should not predict future returns.

Behavioural Finance:

Behavioral finance is a field of study that combines psychology and finance to understand how psychological factors influence investor behavior and market outcomes. Behavioral finance challenges the traditional assumption of rationality in financial decision-making and explores the impact of emotions, cognitive biases, and heuristics on investment decisions.

One key concept in behavioral finance is loss aversion, which refers to the tendency of investors to prefer avoiding losses over acquiring equivalent gains. Loss aversion can lead to risk-averse behavior, such as selling winning investments too early or holding onto losing investments for too long.

Another important concept in behavioral finance is herd behavior, which refers to the tendency of individuals to follow the actions of the majority. Herd behavior can lead to market bubbles and crashes, as investors tend to buy when prices are rising and sell when prices are falling, amplifying market movements.

Free float shares:

Free float shares refer to the portion of a company's outstanding shares that are freely available for trading on the open market. These shares are not held by insiders, such as company executives, directors, or controlling shareholders, and are not subject to any restrictions on their sale. Free float shares are important because they determine the liquidity of a stock and can have an impact on its price.

Investors often pay close attention to the free float of a stock because it can affect the stock's volatility and trading volume. Stocks with a small free float are generally more volatile because a relatively small number of shares are available for trading, which can lead to larger price swings. On the other hand, stocks with a large free float are typically less volatile because there are more shares available, making it easier for buyers and sellers to transact without significantly affecting the stock's price.

Companies may increase or decrease their free float through actions such as share buybacks, secondary offerings, or the issuance of new shares. Changes in a stock's free float can impact its liquidity and attractiveness to investors.

Options and Derivatives:

Options and derivatives are financial instruments that derive their value from an underlying asset, such as a stock or a bond. Options give the holder the right, but not the obligation, to buy or sell an asset at a specified price on or before a specified date. Derivatives are contracts between two parties that derive their value from the performance of an underlying asset.

One key concept in options trading is option pricing models, such as the Black-Scholes model, which are used to determine the fair value of an option. Option pricing models take into account factors such as the current price of the underlying asset, the option's strike price, and the time remaining until expiration.

Another important concept in derivatives trading is hedging, which involves using derivatives to offset the risk of adverse price movements in an underlying asset. Hedging strategies can help investors protect their portfolios from market volatility and reduce the impact of unexpected events.

Warrants:

Warrants are financial instruments that give the holder the right, but not the obligation, to buy a specific amount of a company's stock at a predetermined price within a specified period. Warrants are often issued by companies as a way to raise capital or as an incentive for investors to participate in a financing round. Warrants are similar to stock options, but there are some key differences.

One key difference between warrants and stock options is that warrants are issued directly by the company, while stock options are typically issued by exchanges or other third parties. Additionally, warrants often have a longer lifespan than stock options, with expiration periods ranging from several months to several years. Warrants can be traded on the open market, allowing investors to buy and sell them like stocks. The price of a warrant is influenced by a variety of factors, including the price of the underlying stock, the exercise price of the warrant, and the time remaining until expiration.

Warrants can be classified into two main types: call warrants and put warrants. Call warrants give the holder the right to buy the underlying stock at a specified price, while put warrants give the holder the right to sell the underlying stock at a specified price.

Apart from these concepts, traders employ several strategies to maximise their profits.

Short selling is an investment strategy that allows traders to profit from the decline in the price of a security or asset. The process involves borrowing a security from a broker (subject to margin calls) and selling it on the open market with the expectation that the price will fall. The trader then buys back the security at a lower price, returns it to the broker, and pockets the difference as profit. This strategy is based on the belief that the price of the security will decrease, allowing the trader to buy it back at a lower price than they sold it for. However, if the stock price rises, it results in a significant loss.

Arbitrage is a sophisticated trading strategy that aims to profit from price inefficiencies in financial markets. It involves simultaneously buying and selling the same asset in different markets to exploit price differences. Arbitrageurs leverage these price differentials to generate risk-free profits, capitalizing on market inefficiencies that are typically short-lived and self-correcting. This strategy requires a keen understanding of market dynamics, rapid execution, and access to real-time market data and trading platforms.

Pairs trading is a market-neutral trading strategy that involves simultaneously buying and selling two related securities to profit from the relative price movements between them. This strategy relies on the assumption that the prices of two related securities will move in tandem over time. Pairs traders aim to capitalize on temporary divergences in the prices of these securities, which they believe will eventually converge. This strategy requires careful selection of securities and a thorough understanding of their relationship.

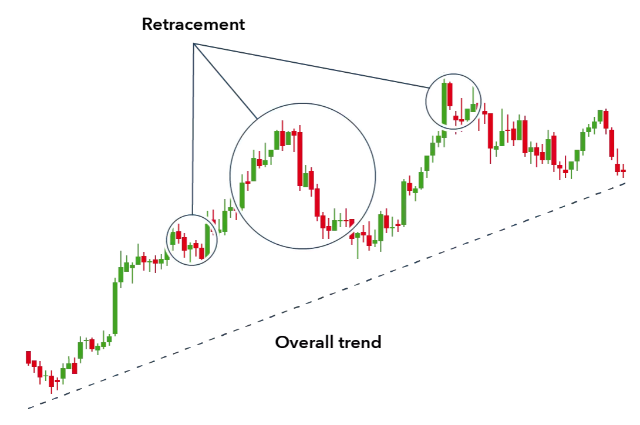

Trend following is a strategy that seeks to profit from the directional movements of financial markets. Trend followers identify and ride trends in asset prices, buying securities that are trending upwards and selling those that are trending downwards. This strategy relies on the assumption that trends will continue in the same direction over time. Trend followers use technical analysis and trend-following indicators to identify and confirm trends.

Mean reversion is a trading strategy that is based on the concept that prices tend to revert to their historical averages over time. Mean reversion traders buy securities that are trading below their historical averages and sell those that are trading above their historical averages, expecting prices to return to their mean. This strategy requires a deep understanding of market dynamics and the ability to identify securities that are mispriced relative to their historical averages.

Convertible arbitrage is a trading strategy that involves buying convertible securities, such as convertible bonds or convertible preferred stock, and simultaneously selling short the underlying equity securities. Convertible arbitrageurs aim to profit from the price discrepancies between the convertible security and the underlying equity. This strategy requires a deep understanding of convertible securities and options pricing.

Merger arbitrage is a strategy that involves buying shares of a target company in a merger or acquisition and simultaneously selling short the shares of the acquiring company. Merger arbitrageurs seek to profit from the price differential between the target company's share price and the agreed-upon acquisition price. This strategy requires a thorough understanding of merger and acquisition dynamics and the ability to assess the likelihood of a successful deal.

Overall, these market strategies are complex and require a deep understanding of financial markets, as well as sophisticated analytical tools and trading techniques. Traders and investors who employ these strategies must be prepared to manage risks effectively and adapt to changing market conditions.

Historical roots: BSE and NSE

The BSE, established in 1875 as the "Native Share & Stock Brokers' Association," is Asia's first stock exchange. Initially, it operated under a banyan tree in Mumbai before moving to its current location at Dalal Street.

The BSE faced several challenges, including outdated trading practices, inefficient settlement mechanisms, and a lack of transparency. These issues led to concerns about market manipulation, delays in trading, and inadequate investor protection. The NSE was conceived as a solution to these problems, offering a more technologically advanced and regulated platform for trading securities.

One of the key innovations introduced by the NSE was the use of electronic trading, which significantly increased the speed and efficiency of transactions. This move away from the traditional open outcry system used at the BSE helped reduce trading errors and manipulation while improving market liquidity.

Additionally, the NSE introduced the concept of an index, the Nifty 50, which provided investors with a benchmark to track the performance of the Indian stock market. The Nifty 50 became a widely recognized and followed index, further enhancing the credibility of the NSE.

In conclusion, stock markets across the globe offer an opportunity for wealth creation for individuals as well as institutions, with a corresponding risk of wealth erosion, too. Investing in stocks is a risky affair; and the urge to engage in trading, despite most people possessing inherent laziness, has led to the proliferation of mutual funds in India. Stock markets are an indispensable part of modern economics, and a basic understanding of such a manifestation of macro-economics is now a part of our ‘average’ life.