Image by Markéta Klimešová from Pixabay

Abstract

This paper will deal with the topic of white collar crimes. The white collar crimes are known as the nonviolent crimes committed by those of upper class due to greed.

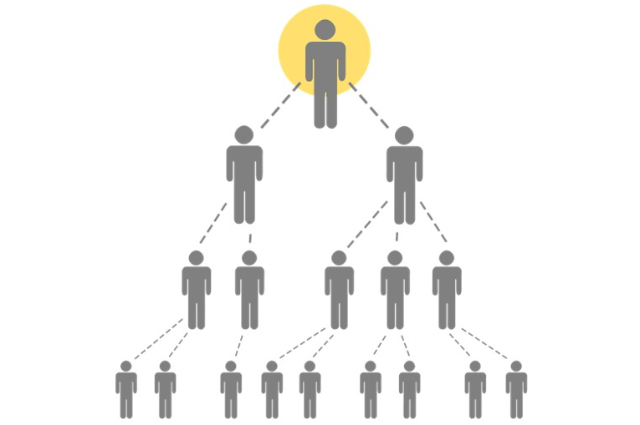

The white collar crime that I would like to focus on in this paper is the pyramid schemes or the Ponzi schemes that have caused an uproar in the whole world. The meaning or the basic definition of pyramid schemes is that there is a business that requires an entrance fee or buying of products by the employees only rather than a customer and then the same money is used to pay the salary of the superior. The first person or the person at the top of the said pyramid is the one who actually rakes in all the profits by just taking bit by bit from the others. These schemes can be recognized from the factors that the recruitment of new members is more important than the actual selling of products or doing the business the company is made for. The pyramid schemes require the actual buying of products every month of a certain amount to make profits and recruit as many people as possible. This is one of the telltale signs that indicate it is a pyramid scheme and not a multi-level marketing company (MLM). The other difference is that a pyramid scheme is that the company does buy back the unsold inventory which an MLM does. The recent increase of this crime has been seen not only in India but all over the globe. Claims of defamation and forgery to reason damage through on-line structures are filed beneath torts as a civil match via way of means of the aggrieved party. There has been a boom within side the range of fraudsters and frauds nowadays, which is likewise the subsequent subject matter of attention in this report. And there are numerous kinds of frauds:

- Telecommunication

- Debt elimination

- Nigerian fraud

- Identity Theft

- Phishing, etc;

The cyber branch of Delhi police additionally produced a few recommendations to comply with precautions or protection measures. Recently, a brand new criminal device of ODR (Online Dispute Resolution) frame has been made as a web or virtual extension of ADR (Alternate Dispute Resolution). The 3 foremost features of ODR middle are arbitration, mediation, and conciliation. And that is a faster, extra-green gadget that saves money and time and pointless rounds of the courthouse. This, I will address the subject of white collar crime and the diverse pyramid and ponzi schemes under its ambit.

Introduction

To introduce the topic of white collar crimes first we need to understand what it is and how it has evolved over time to this point. This term was initially used for the first time in around 1949 by the famous sociologist Edwin Sutherland in respect to crimes committed by respectable high-status people and with time it has evolved to become a term that can be used as a synonym of the types of crimes committed by organizations at large. These crimes are often times committed without the involvement of any actual or physical injury or action but it is a crime that has more victims than a physical crime at times. It is a crime that uses non-violent methods such as deception and trickery to wrongfully gain the property of another as the definition of wrongful gain states under section 22 of the Indian penal code, 1860. This term was coined as the high-status employees wore a white shirt with white collars and lower-level workers wore a blue shirt. The crime thus committed involves the acts of:

- Defrauding people: This is the act of using deceitful means to defraud people into believing a wrong fact and robbing them if their property.

- Money laundering: Money laundering is the unlawful system of creating huge quantities of cash generated via way of means of crook interest, together with drug trafficking or terrorist funding, which seem to have come from a valid supply. The cash from the crook interest is taken into consideration as dirty, and the procedure “launders” it to make it appear clean. Criminals regularly clear out cash from crimes together with human and narcotics trafficking, public corruption, and terrorism in a three-step system:

1. Placement is the preliminary access of a crook’s monetary proceeds into the economic system.

2. Layering separates the crook’s economic proceeds from their supply and creates an intentionally complicated audit path through a chain of monetary transactions.

3. Integration takes place while the crook’s economic proceeds are back to the crook after “laundering” from what looks like valid sources. - Embezzlement: The act of misplacing funds of the company and the clients and actually filling their own pockets by creation of offshore accounts, etc;.

- Corporate fraud: This is the practice of committing illegal acts as a part of the corporation they work for these are quite intricate in nature and thus difficult to identify.

- Security fraud: This is a fraud committed in relation to the stock market and it creates a deceptive image that the buyer or seller of the stock suffers a loss due to the misrepresentation leads to loss.

- Nigerian scam: This is a typical advance payment scam. This scam involves them telling the victim to pay a small registration or subscription fee in return of which they will give back a huge amount of cash. This is done by sending an email asking the same.

- Ponzi scheme: This is one of the most elaborate schemes and is also known as a pyramid scheme. It is known as a pyramid because it forms that shape as it goes on. It uses the money of new investors to give to the old ones the old ones are asked a minimal fee to buy a product or to tell others about the said product and then the more people they add the more money they get. But the top of the pyramid does not add money but just keeps taking it in small amounts which are not noticeable to a common man as out of ordinary.

- Phishing: This scheme involves an e-mail that contains a link that takes all the data and account information of the person upon being clicked.

- Smishing: It is done through mobile phones and people are fooled into calling the wrong numbers or downloading apps.

Thus, there are many different types of white-collar crimes of which we discussed a few above.

According to an article published by The Business Standard on November 22, 2016, there has been a significant increase in white collar crime in India. Over the past decade, the Central Bureau of Investigation (CBI) has identified a total of 6,533 corruption cases, with 517 of these cases being registered in recent years. Laws Against White Collar Crime In India:

In India, there are several laws in place to detect and address white-collar crimes. These legislations include:

- Indian penal code, 1860

- Companies Act, 1961

- Customs Act, 1962

- Prevention of Corruption Act,1988

- Income tax Act, 1961

- Commodities Act, 1955

- Imports and Exports Control Act, 1950

- IT Act, 2005

- Prevention of Money Laundering Act, 2002

- Lokpal Act, 2014

Main part

“Crime”, a word that was in existence side by side the very human existence. Crime is an act that is harmful physically, mentally or socially to the well-being of the society at large. The definition of crime has changed over time but the basis remains the same. Even the theories of crime have evolved. The basis for a crime are:

- The mens rea or the guilty mind of the accused to commit the act which is present in case of white collar crimes as well.

- Then the actus reus or the guilty act that is not necessarily a violent act but an illegal or criminal act which is done when they deceive others.

- And the injury which is present in white collar crime in the form of the many victims that are a part of the society that fall into their trap.

The history of white collar crimes can be traced back to the criminologist and sociologist E.H. Sutherland who stated the term fir the first time and brought it to light. Before that in 1907 sin and society E. A. Ross used the term. Morris drew had mentioned this in 1934 which was finally realized after Sutherland’s observations. White-collar crimes are dedicated through folks of popularity, now no longer for want but for greed ~ sir Walter Reckless Sutherland desired to outline white-collar crime as “crime dedicated through someone of respectability and excessive social reputation within side the path of his occupation.”, at the same time as Marshall Clinard described white-collar crime as “a contravention of the regulation devoted broadly speaking through corporations consisting of businessmen. Professional men, and politicians in reference to their occupations”. Paul Tappan described it as “White collar crime Is a unique kind of solitary expert criminality. It includes actual violation of crook regulation systematically or repeated through enterprise. Professional and clerical employees further to their occupation”. Moreover. Sir Walter Reckless said “White collar crime represents the offences of businessmen who’re in role to decide the regulations and sports of enterprise”. According to Frank Hartung, white-collar crime is defined as the violation of regulations related to business that is committed by a company or its representatives in the course of conducting their business. In a typical pyramid scheme, individuals are enticed to pay high membership fees in order to participate in money-making opportunities. The only way to recoup any money is by convincing others to join and invest as well. Often, people are persuaded to join by friends or family members. However, there is no guarantee of recovering the initial investment.

The white collar crimes can be classified into four categories:

- Ad-hoc: This category deals with those types of crime that involve the person never actually meeting the victims and there is no actual confrontation between them. These involve online frauds and schemes.

- Then there is one of the fiduciary relationships where the trust is breached due to the act committed by them this usually involves crimes such as the embezzlement of funds and misuse of information, etc.

- Then there are individuals in high positions who commit it to gain access to quick cash and they involve the fake bills and educational institution scams, etc.

- At times the business itself commits crimes through infringement of trademarks, copying, domain name, etc.

The Santhanam committee report elaborates on the topic and the rise of this crime in India.

White collar crime in different fields:

Engineering:- Underhand dealings

- Passing of below-average work

- Corrupt records maintained

- Average or below-average material used

Medical:

- Illegal abortion

- Illegal drugs trials

- Fake certificate

- Sex determination

- High cost charged

- Fake witness

- Fake testimony

- Unethical practices

Education:

- Fake details

- Fake students

- Charging donations

- Fake high-marks students used to pass exams and were given money in return.

The white collar crime that I would like to focus on in this paper is the pyramid schemes or the Ponzi schemes that have caused an uproar in the whole world. The meaning or the basic definition of pyramid schemes is that there is a business that requires an entrance fee or buying of products by the employees only rather than a customer and then the same money is used to pay the salary of the superior. The first person or the person at the top of the said pyramid is the one who actually rakes in all the profits by just taking bit by bit from the others. These schemes can be recognized from the factors that the recruitment of new members is more important than the actual selling of product or doing the business the company is made for. The pyramid schemes require the actual buying of products every month of a certain amount to make profits and recruit as many people as possible. This is one of the telltale sign that indicates it is a pyramid scheme and not a multi level marketing company (MLM). The other differences are that a pyramid scheme is that the company does buy back the unsold inventory which an MLM does. The other signs of Ponzi schemes are:

- Difficulty in getting payment.

- The promise of a lot of money is being returned for a small amount.

- Unregistered and unlicensed sellers and investors.

- One should do a background check and get reviews.

- One should keep an eye on the prices of the product.

- Not publicly listed

- Not listed for revenue as well.

- Little or no effort is made to sell the product.

- No refunds are allowed.

Pyramid schemes and unlawful Ponzi schemes percentage sure of similarities, however right here are the massive differences. In most cases, orchestrators of a Ponzi scheme simplest ask for a single “investment,” with huge returns promised at a later date. Pyramid schemes operate by victims generating income through the recruitment of more individuals into the fraudulent scheme. A few of the most famous pyramid schemes were as follows:

- Mary Kay consulting firm: The company was never upfront about it’s acceptance or denial of the fact as to whether it was under the radar and investigated by the Security and Exchange Commission. But the company's policies were a telltale sign as they stated that buying products was not enforced but beneficial and most of the company transactions were made by employees only.

- United sciences of America: This was yet another company that took advantage of the fear of disease and said that whoever took their product would not have HIV and cancerous diseases. This false advertisement and the fake advisory board who were paid a high fee were bought to light by many and in 1987 finally three states told the company to take back such claims to which the board owners fled with the money closing the company itself due to it.

- Business in Motion was yet another Ponzi scheme in which Alex Klippax the mastermind behind it told people to sell a holiday package. The entry to this job had 3200$ fee and the payment for selling the product was $5000 which led to suspicion of the investigators. The person was caught and deported.

- Burn Lounge Inc.: Thus company promised the people to give them an option to sell their music albums on the website and at a store in return for a small joining fee for new members. And on selling songs or recruiting new members they got points that could be used in the website only. They could turn it into money but with a fee. This was another pyramid scheme that took money from many innocent individuals.

- USANA: This company was under investigation from 2007-2008 but the suit was settled out of court and the company is still running.

- Fortune hi-tech marketing: In the year 2013 this company started selling products of daily use or gadgets, etc. The company employees earned more money from recruiting rather than actually doing sales.

- VEMMA: This was another scheme that affected a huge population of the U.S.

- Nu Skin Enterprises: They were never proven as they settled most of the suits through out-of-court method.

- Herbalife

- Amway: This was one of the most important precedent cases in which the court gave the basic structure of a pyramid scheme and the factors are a part of it. The court also asked the company to change some of its policies.

- Koscot Interplanetary Inc.: This American organization that was based in Florida was under investigation and was ceased in 1971. They had oil-based makeup products available and the main aim was to increase recruitment. And a person just had to pay a certain amount to be an executive or director.

- Holiday Magic: This company was a pyramid scheme as well that was investigated after it was closed due to the death of the owner on 1974. And a compensation of 2.6 million was decided by the court.

- Michael Ferreira: The person had committed a rupees 425 crore scam and was caught by the police.

- Equinox International: Ceased business in 2001. When several states filed it as an illegal scheme the a $40 million suit was settled and the company dissolved.

- Sharda group chit fund scam: The scam caused a loss of up to 300 billion rupees and the involved people were arrested.

- Speak Asia: This was an online scam that involved the process of people registering on the website for rupees 11000 and getting more than double the return by answering simple surveys. The scammers made more than 2000 crore rupees.

- City limousine scam: The person scammed people into giving money for shares and paid the initial investors through the new recruits that he encouraged and by the time it was caught the person had scammed rupees 1000 crores.

These were some of the many examples of the various Ponzi and pyramid schemes that have looted many innocent people. The various measures that can be adopted to curb the white collar crime practices include:-

- The act of or the process of screening of an interview candidate should be made more strict to check whether the documents are fake by any chance.

- Multiple levels of verifications should be made before the person is finalized.

- Audits should be done regularly.

- Awareness should be spread

- Tribunals with fast track systems should be set for such cases.

Famous white-collar crime cases:

- SEBI vs. Burman plantation and ors.: The accused was held liable.

- Abhay Singh Chautala v. C.B.I.: Since the office provided by the appellant was not the same as the given one the claim has no merit.

- Binod Kumar v. State of Jharkhand & Others.

- Harshad Mehta scam

- Punjab National Bank fraud.

Conclusion

White collar crimes are the United States of America’s fundamental supply of worldwide issues considering they’re non-violent crimes that undermine the United States’s economy. Various research have proven that white collar crimes do some distance greater monetary damage to the United States than traditional crimes. While it’s miles real that absolutely removing white collar crime is unachievable, the authorities and applicable government ought to make each attempt to lessen those crimes with the aid of using taking the essential steps. White-collar crime is a main social problem. It inflicts trillions in dollars in economic damage, and it extracts a major psychological and social toll. A wide range of individuals, organizations, and segments of society bear the prize of white-collar crime. The growth in the rate of white collar crime has been tremendous all over the world and India is a developing nation thus the toll on our economy is far greater and worse than other nations.

With the advancement of technology the crime over cyberspace is also increasing at an alarming rate and it is time to join hands to curb this evil. The government needs to amend better schemes and policies, the official and investigating officers need special and specific training to deal with this issue, the media and people alike need to spread awareness and need to take this economic black hole seriously. In India, implementing monetary legal guidelines and pursuing financial crime are the duties of the Enforcement Directorate (ED), a regulation enforcement organization. The cyber branch of Delhi police additionally produced a few recommendations to comply with precautions or protection measures. Recently, a brand new criminal device of ODR (Online Dispute Resolution) frame has been made as a web or virtual extension of ADR (Alternate Dispute Resolution). The 3 foremost features of ODR middle are arbitration, mediation and conciliation. And that is a faster, extra-green gadget that saves money and time and pointless rounds of the courthouse. This, I will address the subject of white collar crime and the diverse pyramid and ponzi schemes under its ambit.

The concept of crime has evolved with time and now online crime is something that is of common occurrence and with this the law needs to evolve in order to prevent it and punish the wrongdoers. The very essence of law is change and the time has come for it to change once again to entail in its provisions the various new aspects that are affecting the society at large.

So, to conclude the above-discussed topic all I would like to say is that the white collar crimes are as real a threat as any other type of crime. Even though the stigma attached to them begs to differ, the true reality is that these non-violent crimes end up taking more lives than the violent ones. All over the world the governments have been trying to implement strict punishment for them as well. And since India is a developing nation so it is very important for us to implement laws. India’s future is in disarray and ambiguity which need to be dealt with. And that can only be done by finding new solutions and spreading awareness.

. . .

References:

- https://www.investopedia.com/terms

- https://www.fbi.gov/investigate

- Edwin H. Sutherland. “White Collar Crime,” Page 9. Dryden Press, 1949

- https://www.investopedia.com/terms

- https://www.investopedia.com/terms

- https://corporatefinanceinstitute.com

- https://en.wikipedia.org/wiki/Securities_fraud

- www.yrp.ca/en/crime-prevention

- https://www.investor.gov/protect-your-investments

- https://www.legalserviceindia.com

- https://www.google.com/amp/s/blog

- https://www.britannica.com/topic/crime-law

- https://finance.yahoo.com/news

- www.yrp.ca/en/crime-prevention/resources

- https://amp.scroll.in/article/603226

- https://www.investor.gov/protect-your-investments

- https://www.forbes.com/advisor/investing

- https://www.gradschools.com/get-informed

- https://indiankanoon.org/doc/78238799/

- https://www.indianbarassociation.org

- https://indiankanoon.org/doc/1342360/

- https://indiankanoon.org/doc/1930072/

- https://www.legalserviceindia.com/legal

- https://blog.ipleaders.in/white-collar-crimes

- https://vakilsearch.com/blog

- https://lexforti.com/legal-news/

- https://law.jrank.org/pages/2314/

- https://doi.org/10.7591/9781501732966-008

- https://ls.com/wp-content/uploads

- https://ised-isde.canada.ca/site/competition

- https://www.scribd.com/document/633563688/

- https://www.rcmp-grc.gc.ca/en/seniors-guidebook

- https://www.wowessays.com/free-samples

- https://www.sbhambriadvocates.com

- https://static1.squarespace.com/static