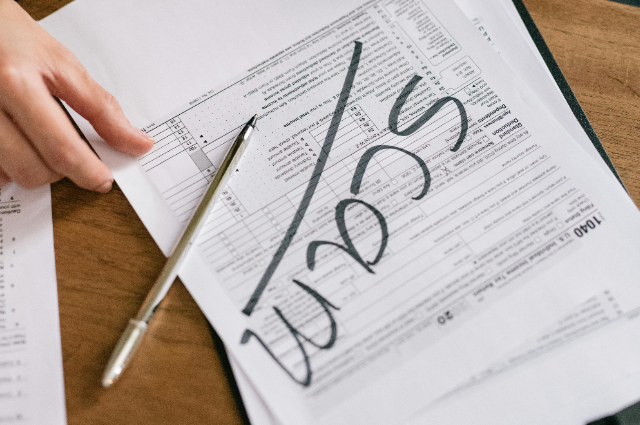

Photo by leeloo the first from pexels

Large sums of money were stolen by the founder and directors of Satyam Computer Services, an outsourcing firm based in India, who also inflated the share price and faked the business's books. A large portion of this was spent on real estate. When the Hyderabad real estate market crashed in late 2008, the scam was uncovered, revealing a connection to Satyam. When chairman Byrraju Ramalinga Raju admitted in 2009 that the company's financial statements had been fabricated, the controversy came to light.

For many years, Satyam records displayed cash at the bank and profits that never existed, inflating the share price. After that, Raju and his pals sold shares. Additionally, the accounts revealed $3 million in "salary payments" to fictitious individuals. In actuality, board members received these. Raju never accessed the fictitious accounts, which were intended to secure low-cost loans in the United States. A large portion of the funds were wasted in Hyderabad real estate transactions. The money disappeared when the real estate market crashed in 2008, and people started to pay attention to whistleblowers. The issue was discovered as a result of Raju's unsuccessful attempt to utilize Satyam to purchase a real estate company.

Byrraju Ramalinga Raju, the chairman of Satyam, resigned on January 7, 2009, after admitting to manipulating the accounting of Rs 7,000 crore in multiple ways. It was said that the international business community was surprised and scandalized. Over the course of the year, the CBI submitted three partial charge sheets (dated 7 April 2009, 24 November 2009, and 7 January 2010) after taking over the case in February 2009. Later, all of the charges from the discovery stage were combined into one charge sheet.

Byrraju Ramalinga Raju was found guilty together with ten other members on April 10, 2015.

Following the revelation of a controversy in Satyam Computer Services' accounting records, PricewaterhouseCoopers affiliates acted as the company's independent auditors. The US Securities and Exchange Commission (SEC) penalized PwC's Indian division $6 million for failing to adhere to auditing standards and the code of conduct while performing its auditing duties for Satyam Computer Services.

Due to Price Waterhouse's involvement with the primary Satyam fraudsters and noncompliance with auditing requirements, the Securities and Exchange Board of India (SEBI) banned the firm from doing any listed business audits in India for two years in 2018. Additionally, SEBI ordered the firm and two partners to disgorge nearly Rs 13 crore in wrongful gains. PwC declared that they intended to obtain a stay order.

"The letter's contents have clearly stunned us. The dedication of Satyam's top executives to its clients, employees, suppliers, and shareholders is unwavering. In view of this shocking discovery, we have convened in Hyderabad to plan our course of action." On January 10, 2009, the Company Law Board made the decision to install ten nominal directors and prohibit the current Satyam board from operating. "The current board has not fulfilled its responsibilities. The IT industry's reputation shouldn't be allowed to deteriorate. remarked Premchand Gupta, Minister of Corporate Affairs. PricewaterhouseCoopers (PwC), Satyam's auditor, received a show-cause notice from the ICAI, the regulation of chartered accountants, regarding the accounts fudging. Ved Jain, the president of the ICAI, stated: "We have asked PwC to reply within 21 days."

The Crime Investigation Department (CID) team also brought up Vadlamani Srinivas, Satyam's former CFO, for interrogation on January 10, 2009. Later, he was taken into jail by the police.

The government named prominent banker Deepak Parekh, former SEBI member C Achuthan, and former NASSCOM chief Kiran Karnik to Satyam's board on January 11, 2009. Indian analysts have compared the Satyam issue to their country's Enron scandal. Some social analysts view it more as a component of a larger issue with the family-owned business environment in India. On January 10, 2009, the Crime Investigation Department (CID) team also summoned up Satyam's former CFO, Vadlamani Srinivas, for questioning. The cops later took him into custody. On January 11, 2009, the government appointed former NASSCOM chief Kiran Karnik, former SEBI member C Achuthan, and well-known banker Deepak Parekh to Satyam's board. The Satyam controversy has been likened by Indian commentators to the Enron scandal in their nation. It is seen by some social analysts as part of a broader problem with India's family-owned business environment.

The National Stock Exchange of India has declared that on January 12, Satyam will be eliminated from the S&P CNX Nifty 50-share index. Two days after confessing to manipulating Satyam's financial statements, the company's founder was taken into custody. Charges against Ramalinga Raju included forgery, criminal conspiracy, and breach of trust.

After peaking at 544 rupees in 2008, Satyam's shares dropped to 11.50 rupees on January 10, 2009, the lowest since March 1998. In 2008, Satyam's stock reached its highest price of US$29.10 on the New York Stock Exchange. They were trading at about US$1.80 by March 2009.According to the Indian government, the corporation may receive short-term direct or indirect liquidity help. It is doubtful, though, if employment will return to pre-crisis levels, especially for new hires. Price Waterhouse, PricewaterhouseCoopers' Indian branch, declared on January 14, 2009, that its audit findings might have been "inaccurate and unreliable" due to its dependence on possibly fraudulent information supplied by Satyam's management.

In court on January 22, 2009, CID stated that there are actually only 40,000 employees, not the 53,000 previously stated, and that Mr. Raju has been reportedly taking out ₹200 million (US$2 million) each month to pay these 13,000 fictitious employees. On February 5, 2009, the Indian government appointed A. S. Murthy as Satyam's new CEO. Additionally, Tata Chemicals' Homi Khusrokhan and chartered accountant T. N. Manoharan were named as special advisors. Ramalinga Raju and two other suspects in the scandal were granted bail by the Supreme Court on November 4, 2011, since the CBI, the investigating agency, had not filed a charge sheet despite having 33 months (from the date of Raju's detention) to do so.

The persons involved were called to appear before the special CBI court hearing the case on September 15, 2014, on October 27. Later that day, the date of judgment was supposed to have been announced. A Hyderabad court sentenced Raju and nine other people to seven years in prison on April 9, 2015, after they were found guilty of conspiring to exaggerate the company's revenue, falsifying accounting and income tax reports, and creating invoices, among other offenses. The court also imposed a fine of 55 million rupees (US$883,960) on Kunjumani and his brother.

As part of its diversification plan, Mahindra & Mahindra-owned Tech Mahindra acquired a 31% share in Satyam on April 13, 2009, through a formal public auction process. Under the new Mahindra administration, Satyam changed the name of its services to "Mahindra Satyam" with effect from July 2009. Following a tax-related delay, Tech Mahindra and Mahindra Satyam announced their merger on March 21, 2012, following approval by the boards of both businesses. Legally, the businesses joined on June 25, 2013.