Image by Tumisu from Pixabay

In its most basic sense, the rise in the price of products over a given period is called Inflation. It is a term that resonates with every living individual, be it from the urban or rural areas, from the most financially stable to the daily wage workers; inflation affects everyone. It is not just limited to fuel prices that have been soaring in recent years, but when we are talking about inflation, we consider a basket of products like groceries, houses, transportation, healthcare, and more. As a concerned citizen of India, I believe it necessary to understand inflation, not just for the sake of economics but as a pathway to a better future.

The Need To Understand Inflation

In the contemporary national economic discourse, understanding inflation is paramount, considering the fact that the prices of basic livelihood are surging higher by the day. Inflation, like an insidious vicious villain, is an ambidextrous phenomenon impacting both consumers and businesses. Its deleterious impact pervades both micro and macroeconomic domains.

At the microeconomic level, it takes a toll on the individuals by diminishing the actual worth of their earnings and savings, forcing them to spend extremely carefully.

On the other hand, at the macroeconomic level, it causes disturbance in supply and demand, causing chaos in the businesses and resulting in long-term instability.

In the midst of a relentless ascent in prices, the sagacious grasp of inflation nuances becomes essential for informed decision-making and sustainable development.

The State of Inflation in India

Our economic landscape is evolving at a rapid pace, and we have to keep up with the rate of inflation in order to keep our money from losing its value, causing our purchasing power to decline. To fathom the gravity of the scenario, we must first understand the numbers, the historical trends, and the factors that affect Indian inflation. But before we dive into the trends of inflation in India, we have to understand the Consumer Price Index (CPI).

CONSUMER PRICE INDEX (CPI)

Consumer Price Index, CPI, is the key indicator of India’s inflation. It measures the average change in the price of a basket of goods and services that fall under essentials and are consumed on a daily basis. CPI also reflects the cost of living and is directly related to inflation. The value of CPI is obtained by comparing the current price of a basket of goods to the price at the time of interest. By getting insights into CPI, the government, businesses, and individuals get an idea of the inflation trends. A higher CPI implies rising prices and eroding purchasing power, while a lower CPI indicates a relatively stable price. The CPI also helps the people at the top of the market hierarchy in adjusting the wages and pensions for coherent market growth.

Inflation Trends

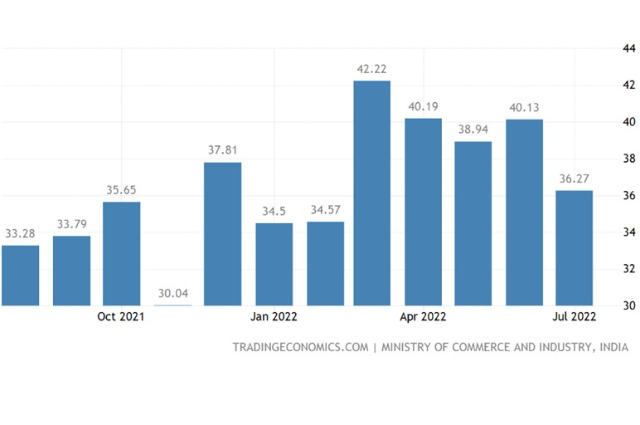

In 2020, India witnessed relatively lower inflation due to economic disruption caused by COVID-19 pandemic. However, as the country began to recover, inflation started to rise. In 2021, there was a significant increase in inflation, mainly due to a restrained increase in fuel prices, consumables, houses, and raw materials, and supply chain disruptions. Thus, the inflation graph showed an upward trajectory.

In 2022, the annual inflation rate remained between 5.7% to 7.4%, which was higher compared to 2021, and the main reason behind the surge was the increase in the prices of crude oil and natural gas owing to the fact that a war broke out between Ukraine and Russia causing a turmoil in the global supply chain. However, the government managed to take care of it by Q1FY23 and brought it down to 4.9% by the end of the quarter.

By analyzing the above matter about the inflation trend, it is safe to say that India is a country with fluctuating inflation while the policymakers keep trying to maintain it between the bracket of 2% to 6%.

Factors Contributing to Inflation in India

Multiple factors drive inflation in India, and the most important factors are broadly classified as:

- Demand-Pull Inflation

- Cost-Push Inflation

- Wage Inflation

- Monetary Inflation

Demand-Pull Inflation

When the country's economy increases, and the citizens have a good capital, thus a good purchasing power, the potential of expenditure increases, increasing the demand for products and goods. When this demand overpowers the supply or production, the producers raise the prices of their products, thereby contributing to inflation. Let us take the example of the city of Mumbai, which has a thriving business atmosphere that attracts a lot of families in order to grow. Now, the interest of people in residing in Mumbai has increased, but the residential space in Mumbai is still the same. What happened here? The demand in the housing sector has grown more than the supply. What is bound to happen now? A surge in the price of houses, right? Yes, that’s what we call Demand-Pull Inflation.

Cost-Push Inflation

When an increase in the production cost of raw materials or services drives the rise in prices, it contributes to inflation, and this type of inflation is referred to as Cost-Push Inflation. This type of inflation occurs when factors outside the consumer demand influence the price rise. If we take the same example of the housing sector, let us say that the government increases the tax on iron imports. As iron is one of the most used underlying assets in the construction of a house, the builder or the contractor of the house must increase the price tag to make profits on the sale. This rise in price due to the increase in underlying cost contributes to the Cost-Push Inflation.

To give another example to make it easier for you, if the labour union negotiates for higher wages and the wage laws advocate in their favour, the price of the house/building increases because of the increase in the underlying services, and that is inevitable as the businesses have to make a profit.

Wage Inflation

Have you ever wondered if a hike in your salary can actually contribute to inflation? If not, this might blow your mind. When you are promoted to a higher position in your company and your salary increases, the company has to find a way to make profits, right? In order to maintain the ROI (return on investment), the company raises the prices of its products and services, which again contributes to inflation. This type of inflation occurring due to an increase in wages is called Wage Inflation.

Monetary Inflation

Now, this is a dual-edged sword for the country. Monetary Inflation refers to the inflation caused by the increase in the supply of money or the liquidity in the Indian economy. The Central Bank of any country is responsible for making decisions on monetary policy, and the Central Bank of India, Reserve Bank of India (RBI) reviews the monetary policy every two months.

The RBI circulates money in the market, increasing the liquidity, which increases the purchasing power, hence resuming the vicious cycle of Inflation. RBI does that by various means:

- Decreasing Repo Rate

The Repo Rate is the interest rate RBI sets while providing bank loans. By decreasing the repo rate, RBI attracts the banks, indirectly attracting the end consumers to issue loans and spend it to circulate money. The bright side is that this expenditure adds to the economic growth of businesses and, hence, the country. But the downside is that it pushes inflation to higher levels. This is the reason I refer to it as a dual-edged sword.

To give you one of the most popular examples of Monetary Inflation, let me take you back to the condition of Zimbabwe in 2008 when the Reserve Bank of Zimbabwe had print notes of 1 million dollars, 1 billion dollars, and even up to a whopping 100 trillion dollars. In fact, the value of the Zimbabwean Dollar hit so low that 1 USD was equal to a Quadrillion Zimbabwean dollar. This was the time of hyperinflation in Zimbabwe.

- Open Market Operations (OMOs)

When there’s a requirement for cash in the market, RBI buys the government securities, injecting cash into the market, thereby increasing liquidity. This directly affects stocks, bonds, real estate, and other financial instruments, lowering the interest rates and increasing the demand, resulting in Inflation.

After reading about the factors contributing to inflation, you must have understood that one factor is linked to another, right? Let us take an example to understand it better.

Picture a scenario of urbanization when the housing sector is experiencing a market boom. People are interested in building new houses, leading to a spike in the prices of the raw materials used in building the house (Demand-Pull Inflation). This, in turn, results in an increase in the cost of production of the raw materials as the company will have to work more hours and work faster in order to keep up with the demand. The machinery involved in manufacturing will have to be increased, thereby increasing the production cost of the raw material (Cost-Push Inflation). The employees working for the company will demand higher pay as they will have to work more hours (Wage Inflation). When the collective inflation soars higher than expected, the government will increase the repo rate to curb the inflation (Monetary Inflation). Higher interest rates will result in fewer loans being issued to the public, pacifying the growth in the housing market.

Challenges in Controlling Inflation

Despite the trials and tribulations of RBI and the government, curbing inflation in a large and diverse country like India is not an easy task. There are innumerable hurdles to controlling inflation, and that is why RBI has set the target goal of inflation to be within a bracket of 2-6%, with 4% as the most desirable on an annual basis. That figure, according to RBI, would result in sustainable growth of the country’s economy.

Let us now look at some of the hurdles that India faces in overcoming Inflation:

- Global Factors

India is a part of the global economy, and the fluctuations in the global resources and their prices directly impact their availability in India. For example, if the prices of crude oil rise in Saudi Arabia, and as India imports crude oil from Saudi Arabia, the price of oil is bound to increase in our country as well, contributing to inflation.

- Inelastic Demand

Few of the major sectors in India have inelastic demand, like healthcare, food, fuel, and housing, regardless of the price that the consumer has to pay. The government might try imposing the tax, but when it comes down to a life-or-death scenario, you will issue a loan no matter how much interest you have to pay in order to get your kin treated in the hospital, right?

- Fiscal Policy

Fiscal Policy mainly focuses on the changes in the tax rates and the expenditures by the government. Fiscal policy can be a boon as well as a curse to the country’s economy. Working on a new mega project while under an already high inflationary pressure can cause panic among the country's citizens, which may have adverse effects on the economy. This is the reason fiscal policy has to be managed extremely carefully because it has the potential to make or break the spine of a country.

- Monetary Policy

Overall, tightening the spending capacity of individuals and businesses by increasing the interest rate can be a matter of distress for the citizens, eventually causing turmoil in the economy. This gives rise to the demand to create a balance between curbing inflation and supporting the economic growth of the country.

Solutions and My Recommendations for Controlling Inflation

This is the part where people have various opinions. As individuals, we might think controlling inflation is like controlling housing expenses; just make a list of miscellaneous expenses and cut them down one by one. That is what most people think when they hear the news that inflation has risen yet again or RBI has increased the repo rate for the 3rd time in a year. But we cannot ignore the fact that we are talking about the world’s most populated country and not a mere house. It is not about the 10 family members; it is about 1.42 billion people, and thus it is not so easy. If it were so easy, RBI wouldn’t be reviewing monetary policy every two months. Yes, it is a democratic country, and everyone has the right to express their views, but it would be wrong if we only blame the rule-makers of the country.

By this time, I hope you all have understood that handling Inflation in even a small country, let alone India, is a pretty difficult endeavor. Addressing inflation requires collective efforts of the government, RBI, and the citizens, emphasizing a comprehensive strategy that incorporates monetary, fiscal, and structural measures. In this section, we will outline potential solutions and my recommendations for navigating the intricate valley of inflation management and achieving economic growth.

- Financial Literacy Programs

We call the youth the nation's future but never focus on what we feed their brains. If financial literacy is taught and emphasized in schools, kids will learn how to manage their money better and how not to spend it on the stuff used for boasting. Lately, our country’s youth has mostly been disappointing as they are more involved in spending on luxuries than necessities. Financial education, like budgeting, saving, and investing, will provide them with the upper edge, which will act as a shield when they grow up in the midst of rising inflation. Not only will it spark responsible financial behaviour, but it will also equip them with the knowledge to make informed financial decisions in the omnipresent threat of ever-rising inflation.

- Digital Data Forecasting System

A blockchain transparency system that would give real-time data on the supply and demand by tracking the daily record of production and consumption would be highly beneficial for consumers and businesses as it will forecast the price of goods based on the trends and availability of the product. By anticipating fluctuations in the market, these forecasting systems would act as an alarm for individuals to control their expenditures as a prevention to inflation.

- Smart Taxation Laws

Implementation of taxes on luxury items will discourage speculation and excessive consumption, and it will promote frugality. This innovative method of taxation will help further reduce the taxes on essentials and will help the lower-class people leverage the reduced taxes. For example, the government can set a higher tax on luxury cars while still maintaining the same tax rates for regular cars, which will make affording a regular car easier for people with low income and discourage buying extravagant cars for higher class people. Now, even if people buy those supercars, they will pay higher taxes, which will add up to the government fund, which can be used for people’s benefit. Hence, the money is being circulated to support people. This can be a great initiative in the aspects of equity as opposed to equality, as equity is much more needed than equality in our country.

These creative solutions aim to balance the need to curb inflation with a focus on alleviating poverty and creating social balance. They empower the vulnerable majority by providing them access to resources for daily needs, promoting economic resilience among the people at a higher risk of being affected by inflation. These solutions not only promote responsible consumer choices but also address broader policy goals related to revenue generation and economic sustainability.

In the end, I would like to say that India’s battle with inflation is far from over, but it is a battle worth fighting. We must remember that conquering inflation is not elusive but totally within our reach. It just requires the collective efforts of the ruling bodies and the citizens of India.

TOGETHER, WE CAN BRING A CHANGE.