“In commodities, when prices go up, demand goes down. In stocks, when prices go up, demand goes up”.

- Rakesh Jhunjhunwala

Introduction:

The year 2020-21 was a rollercoaster, with stock markets soaring more than 80% from their lows in March 2020 through the close of FY21. Considering the pandemic, given the challenges at the bottom of the scale, the upward trend in momentum has proven to be helpful to some and amazement to many. Markets, on the other hand, made money for all those who were invested prior to the outbreak. Profoundly aggressive, stressful, and cyclical – all themes have continued to play out at some point in the past year, but shareholders could perhaps look for stocks that are more adaptable and can withstand difficult times if things start to get worse. With lending rates now at breaking point, investors should look for stocks that are more resourceful and can hold up challenging times if things begin to get worse.

While it's clear that the stock market can help a person grow their wealth, it's also important to remember that it brings its own set of hazards. Many traders feel that there is some type of 'holy grail,' or working approach, that they can use to produce massive amounts of money from the market. Any seasoned trader, on the other hand, will tell you that there is no such thing. The truth is that there are no alternatives and no one-size-fits-all technique that can be used by everybody. If there was one, everyone would be using it by now. Furthermore, there are several things that may be done to improve one's chances of achieving accomplishment and minimizing losses.

Defining Trading:

The exchange of products and services between two entities is referred to as trading. It is the fundamental idea that underlies all economic systems and financial transactions.

Any society's wheels of growth are governed by trade, which allows for the accumulation of riches. A market is a location where any type of transaction can take place. The market is determined based on the type of goods. The stock market, for example, is a location where stock trading takes place. The market is divided into two types: organised and unorganised. An organised market is one that has a set of rules and regulations that every entity functioning in the market must follow, and it usually has a regulatory agency to ensure that they are followed. An unorganised market lacks rigorous regulations, and even if it had, compliance was not required.

The process of buying and selling stocks has become considerably more straightforward thanks to Internet trading and investing, with most markets being recreated on the internet.

Strategies to have a successful stock trading:

- Don't have fake expectations from the market

This might not appear to be significant, yet it is the most crucial. The step is to understand what you're getting yourself into and don't go into the market with unrealistic expectations. There is no such thing as a 100 percent return in a single day. To profit from the market, you must have time and patience. Plan a solid and stable strategy rather than taking large chances and losing your money. Consider this: especially if you only generate 1% per month. Per year, you would have made 12%, which isn't terrible at all.

- Use Backtested strategies - to develop confidence

This one is about automated trading, which is one of the finest methods to buy and sell stocks - notably for beginners. A trading approach is nothing more than a collection of algorithms that help you benefit from the marketplace. However, before putting a strategy into action, ensure confidence it has been backtested. Backtesting is the process of putting a newly devised strategy to the test on past information. If the approach performs well in this environment, it's likely to do well in actual markets as well.

- Position Sizing

The volume a trader buys or sells is referred to as position sizing. Risks, unpredictability, and the amount of capital you're comfortable with are all elements that influence the size of your stake. Your portfolio sizing is ensured by a mix of these criteria, as outlined in your trade plan. Following that, when somebody has made their trade, it's equally important to assess the size and keep a balance throughout the trade. Scaling up and pyramiding are two tactics to use when your trade is trending in the right way.

In simplest terms, increasing volume to stocks when they are heading in the correct direction, removing some shares, and/or raising the stop loss reduces overall risk. Sizing techniques aid in improving returns while lowering risk and fluctuation, resulting in a superior return on risk.

- Develop a trading strategy

Trading is a business model, and no firm can succeed without a strategy. It is not a business plan to read a few books, purchase a charted programme, open an investment portfolio, and begin trading with actual cash. The trade plan is detailed documentation that tries to identify and outline a strategy for allocating capital, regulatory compliance, and, more notably, short and long-term objectives. The degree of volatility as a percentage of the investment, the risk vs reward ratio, and the exit levels are all key aspects to evaluate (both upwards & downwards). A stop loss is essential, but the exit price when the transaction has gone one way is just as crucial.

As a result, specifying your multiple price points (entry, exit, and stop-loss) in combination with the risk tolerance can allow investors to execute deals more efficiently. It's a fictional standard operating practice, and failure to observe it can land someone in big difficulty.

- Have some control over emotions while investing in stocks

Your win size increases overall confidence, but there is a distinction to be made between someone being confident and being overly confident. Stick to the trade plan and follow the established principles to keep one’s emotions in check. A potentially losing purchase should not surprise you, either. The objective, and ultimately any trading plan, should be driven by compounding returns.

To summarise, an effective trade plan ensures that you spend less time looking at charts that aren't relevant to you, that you don't take trades that don't follow your rules, that you don't miss trades and then chase price, that you manage your risk consistently, and that you don't change key indicators or methodologies to find easy solutions.

Top-notch individuals as stock market investors who succeeded in trading and made history

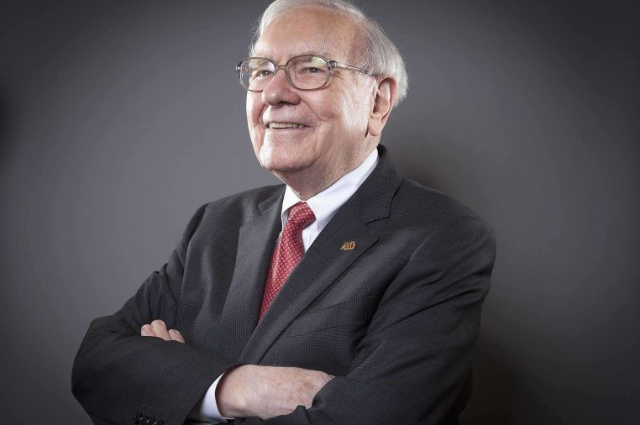

- Warren Buffett

"It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price"

Warren Buffett one of the world's wealthiest, regularly appearing on Forbes' billionaire list. As of October 2020, his net worth was estimated to be $80 billion. Buffett is a philanthropist and a successful businessman. But he's best renowned for being one of the wealthiest investors in the world. As a result, it's no surprise that Warren Buffett's investment strategy has become legendary. Since 1965, Buffett's widely listed Berkshire Hathaway has generated a 19 percent yearly return. That provides him with one of the biggest purchase track records in the account. He is a professional market selector who has made his fortune by adopting Benjamin Graham's value investing concepts.

Although there is no commonly acknowledged method for calculating intrinsic value, it is sometimes approximated by examining a company's fundamentals. The value investor, like bargain hunters, looks for companies that are undervalued by the market or stocks that are valuable but aren't recognised by the majority of purchasers.

Reasons for success in investments:

- Buffett invests in the Benjamin Graham school of value investing, which seeks out stocks with unreasonably cheap costs compared to their underlying value.

- Instead of focusing on the stock market's supply and demand details, Buffett examines businesses as a collective.

- Performance of the company, borrowing, and profitability are some of the issues Buffett examines.

- Other factors for value investing like Buffett includes whether or not a company is publicly traded, how dependent it is on resources, and how cheap it is.

- Rakesh Jhunjhunwala

“Always go against tide. Buy when others are selling and sell when others are buying”.

Rakesh Jhunjhunwala, a Midas-touch trader, is frequently referred to as India's Warren Buffet. He is a chartered accountant as well as a trader. Jhunjhunwala is the 48th richest man in the country, according to Forbes' Rich List. He is the chairman of Hungama Media and Aptech, as well as a board member of Viceroy Hotels, Concord Biotech, Provogue India, and Geojit Financial Services.

Reason for success and background:

While Jhunjhunwala was in college, he began experimenting in the stock market. He joined the Institute of Chartered Accountants of India, but after earning his degree, he opted to jump into the Dalal street wholeheartedly. Jhunjhunwala began with a capital investment of Rs 5,000 in 1985. That capital had grown to Rs 11,000 crore by September 2018. On the advice of his father, Jhunjhunwala would often read newspapers because the headlines carried relevance in terms of driving the stock market in “bull phase or bear phase”.

Risk-taking appetite:

With a net worth of $3 billion, Jhunjhunwala is India's 48th richest man. Being a risk-taker, he gained His first significant profit in 1986, when he purchased 5,000 shares of Tata Tea for Rs 43 and sold them three months later for Rs 143. He made a profit of more than three times his investment. He made between 20 and 25 lakh in three years. Jhunjhunwala has made successful investments in Titan, CRISIL, Sesa Goa, Praj Industries, Aurobindo Pharma, and NCC over the years. His stock prices dropped by 30% following the global financial crisis of 2008, but he returned by 2012.

- George Soros:

From 1969 to 2011, George Soros was a well-known hedge fund entrepreneur who handled client funds in New York. Soros allegedly made a $1 billion profit shorting the British pound in 1992. He was labeled "the Businessman Who Broke the Bank of England." As of 2018, Soros had transferred $18 billion from the family firm to his Open Society Organizations. His fund's holdings are projected to be us$ $8.4 billion. Soros was born in Hungary and left at the age of 17 to work as a railway porter and waiter while attending the London School of Economics.

Reason for his success:

George Soros was an expert at turning wider market patterns into extremely stretched, winning bond and currency trades. Soros was a short-term adventurer when it came to investing, placing large bets in the direction of financial markets. George Soros launched the hedge fund firm Soros Fund Management in 1973, which later would become the very well-known Quantum Fund. He led this aggressive and profitable hedge fund for nearly two decades, reputedly generating annual returns of much higher than 30% and, on two instances, annual growth of greater than 100%.

- Radhakishan Damani

Radhakishan Damani is not only one of India's leading stock market enthusiasts, but also one of the country's top ten wealthiest individuals. He is, in fact, one of the few billionaires whose fortunes expanded throughout the lockdown. Radhakishan Damani, the creator of the grocery chain D-Mart, is known for keeping it secret. In 2002, he launched his first store in Mumbai's Powai neighbourhood, and he hasn't looked back since. Damani scaled the corporate ladder rapidly after his IPO in March 2017 and emerged as India's e-commerce king. Damani now prefers to spend his massive wealth in long-term ventures that will last at least five to ten years. He owns blue-chip equities such as VST Industries, a British American Tobacco subsidiary.

Shares purchased in his portfolio

3M India, Bluedart, India Cements, Sundaram Finance, TV Today, Advani Hotels, Tv18, and other blue-chip firms are included in the portfolio. As of 2020, according to Forbes his correct net worth is ₹1,29,228 crore.

People who went wrong in the stock market and lessons to be learned:

Understanding how previous investor disasters occurred can aid present investors in avoiding them in the future. Here are some of the most notable examples of firms cheating their investors throughout history. Some of these instances are genuinely remarkable. Consider them from the standpoint of a shareholder. Unfortunately, because they were misled into investing, the shareholders concerned had no means of understanding what was really going on.

- Saradha Scam:

Sudipta Sen, the Chairman of the Saradha Group, a chit-fund firm, ran plenty of investment programmes. The operations were known as Ponzi schemes, and they didn't follow any sort of investment plan. Over a million investors are said to have been cheated by this scam. In West Bengal, Assam, Jharkhand, and Odisha, the Saradha Group accumulated vast sums of money from innocent investors. The funds raised were put into real estate, the media sector, Bengali film production houses, and other ventures.

Sudipta Sen fled with an 18-page letter in April 2013, bringing the Saradha scandal to light. The Saradha fraud had an indirect impact on the Indian stock market, despite the fact that it had no direct impact. When they saw such uncontrolled Ponzi schemes getting offered in the market, Foreign Institutional Investors (FII) took a step back.

- Harshad Mehta Scam:

It's been nearly three decades since the 1992 securities fraud was exposed. The ridiculously high fraud featuring infamous stockbroker Harshad Mehta disclosed the banking sector's shortcomings, a situation that continues to result in innumerable bank frauds in India. Harshad Mehta, a stockbroker, began acting as a middleman to facilitate exchanges of fully prepared trades between Indian banks in the early 1990s. In this approach, he would borrow money from banks and then unlawfully spend it in stocks listed on the Bombay Stock Exchange in order to artificially increase stock values.

The sudden uprising and downfall that came in the Indian stock market:

The Sensex rose quickly as a result of this wrongdoing, reaching 4,500 points in no time. With the market's quick increase, individual investors suddenly felt compelled. To earn quick bucks, a large number of people began investing in the stock market.

Harshad Mehta is said to have moved over five thousand crore rupees from the Indian banking sector to the Bombay stock exchange between April 1991 and May 1992. Following the disclosure of the fraud, the Indian stock market collapsed. And, as one might expect, Harshad was unable to return the Indian banks crores of rupees.

- Tyco International (2002):

Tyco executives promised that 2002 would be a memorable year for the stock market. Tyco, a manufacturer of electronic devices, medical services, and protective gear, was seen as a safe blue chip option prior to the incident. Dennis Kozlowski, who was named one of the top 25 corporate executives by BusinessWeek, drained masses of wealth from Tyco through unauthorized loans and fraudulent stock transactions during his tenure as CEO.

Kozlowski obtained $170 million in reduced borrowing without shareholders ’ approval, alongside CFO Mark Swartz and CLO Mark Belnick. For a reported $430 million, Kozlowski and Belnick agreed to sell 7.5 million shares of unregistered Tyco stock.

Reason for fall - extravagant lifestyle

The funds were frequently concealed as bonus payments or perks and smuggled out of the organisation. Kozlowski put the money into his extravagant lifestyle, which included multiple homes, a $6,000 shower curtain, and a $2 million birthday celebration for his wife. The crisis started to unravel in early 2002, and Tyco's stock price plunged over 80% in a six-week span. The executives were initially acquitted owing to a mistrial but were subsequently found guilty and punished to 25 years in prison.

- Ketan Parekh Scam:

Following the Harshad Mehta scam, a chartered accountant called "Ketan Parekh" planned a parallel securities fraud. Ketan had previously worked as a trainee for Harshad Mehta and is hence regarded as the successor to Harshad Mehta's scam approach. Ketan Parekh, on the other hand, did not just obtain funding from banks, as well as from other commercial entities. He, just like Harshad Mehta, resorted to fraudulently boosting stock values. The Calcutta Stock Exchange and the Allahabad Stock Exchange, in addition to the Bombay Stock Exchange, were the additional stock exchanges where Ketan Parekh traded.

Reason for fall:

Parekh used to specialise in a band of ten stocks known as the K-10 stocks. He used the circular trading strategy to inflate their stock prices. One might be astonished to learn that some firms' proponents actually paid him to inflate their stock values in the market. In any case, the Sensex collapsed by 176 points when the Union budget was unveiled in 2001. The Indian government conducted a thorough investigation into this incident. Finally, the Central Bank identified Ketan Parekh as the scheme's creator, and he was restricted from trading on Indian stock exchanges until 2017.

Suggestions for some of the shares in the stock market that might give good returns in future:

- SBI Life Insurance:

Insurance is another topic that has gradually gained traction and offers tremendous development potential due to its underserved nature. SBI Life Insurance, after LIC, is one of the finest private insurance players, with a potentially leading APE rise of 20% or more. Because it offers a wide range of products, the company has a large market share and continues to grow. Players like SBI Life are sure to benefit now that FDI limits in insurance have been increased.

- Larsen & Toubro:

L&T has benefited greatly from the several infrastructure projects revealed in the recent Budget, and the firm has demonstrated not just excellent performance but also financial strength and value creation over the years. Over the last ten years, the company has routinely generated ROEs (return on equity) above 14 percent, with operating margins of over 15 percent. Despite this, it remains to trade at compelling prices, with a PE (price-to-earnings) of less than 15x, making it a compelling value-buy.

- Vinati Organics:

Specialty chemical stocks have lately been heading upwards, in line with increased pharma. Exports in India have increased as a result of China's disadvantage, and Vinati Organics is a strong competitor as a main developer of IBB. Over the previous ten years, it has provided ROCEs of over 35% and earnings that are expanding at a CAGR (compound annual growth rate) of 24%.

- Pidilite Ltd:

Pidilite Ltd, a chemical company, has also been a promising contender. The corporation has a relatively close dominance in both industrial and consumer adhesives as well as associated solutions. It has successfully utilised its position to provide outstanding shareholder returns on a consistent basis, and it could be a nice addition to your portfolio.

- Kotak Mahindra Bank

During the pandemic, the government made efficient measures to guarantee that businesses had access to loans. In reality, in order to provide relief to borrowers, the RBI cut interest rates and declared moratoriums. While this was a great step, many institutions were worried and made adequate arrangements to protect their assets. One such bank, Kotak Mahindra Bank, obtained cash at the outset of the pandemic and has been particularly cautious in its lending. It has routinely delivered a 20 percent + CAGR (compound annual growth rate) increase in profits over the last ten years while enhancing the level of its stock.

- Infosys:

Analysts anticipate a gain in market share as well as a faster pace of digital transformation. Researchers indicate that the business on the stock is due to a healthy pipeline and significant, solid deal wins in Q3, including particularly high wins with the largest ever total contract value (TCV) of $7.13 billion.

Conclusion:

Trading has relatively low entrance barriers and can be a reliable and self-sustaining business if done carefully and meticulously. Every individual's objective should be to reduce the gap between a 'Trader' and a Professional Trader. The three key price points — entry, exit, and stop-loss, as well as your account size — are critical for efficiently planning your trades. Flexibility and the willingness to stick to your trading plan will help you plan your transactions more efficiently and, as a result, handle your account more effectively.

Disclaimer:

Investing in stocks is dangerous, and investors should proceed with caution. Neither reflections.live nor is the author responsible for any losses suffered as a consequence of decisions that are made using the content of this article. While the markets have achieved fresh highs, investors should exercise caution. Before investing huge sums of money, please obtain a professional adviser.

. . .

References:

- www.goodreturns.in/personal-finance

- www.moneycontrol.com/news/business

- www.fool.com/investing/2021

- www.financialexpress.com/money

- www.marketwatch.com/story

- www.upgradingoneself.com/rakesh-jhunjhunwala

- www.investopedia.com/articles

- tradebrains.in/successful-stock-market-investors-in-india

- www.cnbc.com/2021

- www.gqindia.com/get-smart/content

- www.forbes.com/sites/bryanrich

- www.moneycontrol.com/news/business

- www.investopedia.com/world-s-11-greatest-investors

- tradebrains.in/biggest-scams-that-shook-indian-stock-market

- www.business-standard.com

- www.brainyquote.com/quotes/rakesh_jhunjhunwala

- www.livemint.com/money/personal-finance

- www.investopedia.com/articles

- groww.in/p/trading/

- www.financialexpress.com/money/stock-market