INTRODUCTION:

Guyana was founded in 1834 as a British colony and gained independence in 1966. The country now has a GDP of $3.6 billion and is South America's third poorest country. One-third of the country's population is considered impoverished. As a result, Guyana's economy has been in decline and stagnation since its colonial past. Guyana, on the other hand, has been able to replace decline and stagnation with rapid economic growth in recent years. Over the five years ending in 2010, real GDP growth has been strong and positive since 2006. While the Guyanese economy has not been fully spared from the worst global economic downturn since the Great Depression, it has fared better than the rest of the world. In comparison to the deep and widespread economic contractions across Caribbean economies, Guyana’s performance has been stellar. The country’s economy was able to post real growth of 2.0% in 2008 and an even higher growth rate of 3.1% in 2009 and 3.6% in 2010.

Guyana’s experience with foreign investors has been sour. For example, Chinese businesses extracted lumber from the country's forests mined gold and bauxite and worked in the sugar industry, but then left without providing any long-term advantages. However, due to the discovery of vast oil reserves, Guyana is now drawing foreign investors from all over the world. Between 1975 and 2014, roughly 40 exploratory wells–both on and offshore–were drilled in Guyana and Suriname without yielding commercial results. A spate of deep-water discoveries off the coast of Guyana has altered the little South American nation's future. If predictions prove to be precise, oil income could triple the country’s GDP by the end of the next decade.

If Guyana can avoid the "resource curse" that other poor countries have suffered with significant oil finds, it'd be a remarkable chance for its citizens. The government and civil society are on a tight schedule to prepare for the opportunities and issues that will arise as a result of becoming a significant oil producer due to the quick approach of oil revenue and the expected restructuring of the nation's economy.

This article confers the trade-induced growth in Guyana. The first part talks about the growth and degrowth the nation’s economy has seen since 1970 in detail, the second part examines the factors that led to the changes in its economy, the third part discusses its exports, the fourth part talks about its trade policies and the fifth part concludes. A political economy angle has been brought about in every section of this article.

Source: wikimedia.org

- GUYANA’S ECONOMY SINCE 1970:

For much of its post-independence history, Guyana's economic outlook has been a rather tragic one. Guyana's economic landscape has been studded with numerous problems, including chronic output growth instability, which is a particular aspect of the Guyanese economic environment. In 1970, the ruling party declared Guyana a republic and implemented import substitution programs as well as an overtly socialist stance, resulting in extensive government engagement in the economy and widespread nationalization of important sectors. Despite high commodity prices (sugar and bauxite) in the early 1970s, real GDP growth slowed to an annual average of 0.8 percent from 1975 to 1979, compared to 2.6 percent in the previous decade. By 1980, the government-controlled over 80% of the economy (DaCosta, 2007). The economic ramifications of the statist political position were severe. Annual output fell in six of the ten years, with a contraction rate of 2.8 percent on average for the decade. The 1980s are widely regarded as Guyana's "lost decade." In ten of the twenty years leading up to 1989, the Guyanese economy grew. The standard deviation of 4.5 percent and a negative 1.0 percent coefficient of variation indicate that GDP growth throughout the 20-year period was far from smooth. During the 20 years ending in 1989, GDP per capita growth was 0.7 percent on average, with contractions occurring in 11 of the 20 years.

The year 1989 can be considered a turning point moment in Guyana's history. Following a debt default in 1982, prolonged economic contractions averaging 8.3% from 1982 to 1984, and generally weak macroeconomic fundamentals for much of the late 1970s and early 1980s, Guyana entered the International Monetary Fund's Economic Recovery Program (ERP). The ERP emphasized macroeconomic stability, the strengthening and modernizing of institutions to enable economic development, the adoption of outward-looking market-oriented policies, and the elimination of market distortions (World Bank, 1993). The implementation of structural changes, together with the reopening of the economy, aided in the recovery of the economy.

During the 1990s, the Guyanese economy grew at a 4.8 percent annual rate. In the early years of the decade, real economic growth was unusually strong, averaging 5.5 percent from 1990 to 1994, fuelled primarily by increases in sugar and rice production.

- FACTORS LEADING TO GROWTH AND DEGROWTH:

A slew of studies has been published in an attempt to explain Guyana's economic downfall. Some of the arguments provided include (i) a long period of budgetary mismanagement, (ii) socialist economic policies that are inward-looking, (iii) institutional fragilities, (iv) widespread emigration of skilled people, and (v) ingrained political and social fragilities.

Historically, the Guyanese economy's expansions and contractions have always mirrored the agricultural and mining sectors' performance. These industries' outputs are heavily represented in Guyana's export basket, making the local economy vulnerable to external shocks. Unfavorable commodity prices are commonly used to transmit these shocks. The literature on Guyana's economic development provides ample proof of this unpleasant reality. For example, between 1974 and 1976, favourable sugar and bauxite prices are said to have contributed to the economy's expansion. Unfavorable trade arrangements were also blamed for economic contractions between 1997 and 2005, according to certain studies. The impact of unfavourable commodity prices on the agriculture sector was mitigated by preferential markets for rice and sugar. However, given recent changes in global trading arrangements (such as the Economic Partnership Agreement - EPA), the agriculture industry is expected to be more vulnerable to external shocks. These shocks are expected to have a greater impact on the agriculture sector and, as a result, on the economy as a whole.

International pricing for agricultural and mineral goods has been largely advantageous in recent years. From 2005 to 2010, the prices of agricultural and mineral goods (right axis) increased. Regardless, the key export industries' output levels and export volumes were uneven. Over the years 2006-2010, for example, more favourable pricing increased the volume of rice, bauxite, and gold exports. Sugar and timber export volumes, on the other hand, were less sensitive to higher commodity prices. Between 2006 and 2010, poor meteorological conditions, as well as labour issues, contributed to a drop in sugar output and export volume. The implementation of new forestry rules resulted in a decrease in forestry product output and export volume.

- EXPORTS OF GUYANA:

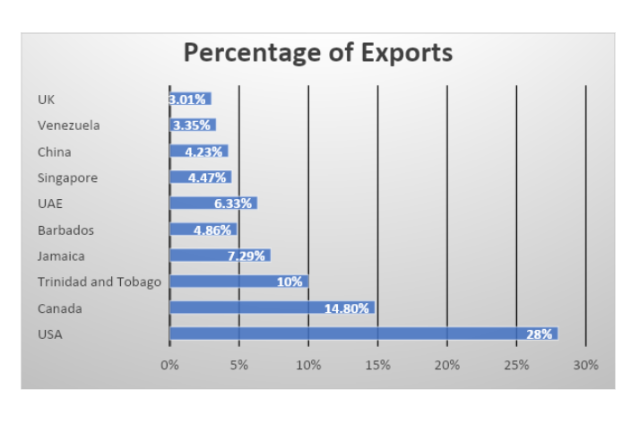

Guyana’s main exports are: sugar, gold, bauxite, aluminium, rice, shrimp and timber. Main export partners are: Canada (28 percent of total exports), United States (17 percent), United Kingdom (11 percent), Netherlands, Trinidad and Tobago and Jamaica.

Previously Guyana’s exports have been impacted by natural causes such as the Covid-19 pandemic. Social and political unrest have always had a negative impact on the economy. Industrial actions coupled with interracial conflicts contributed to the economic decline during the 1970s and 1980s. According to studies, the long-term economic slump from 1998 to 2005 was caused by social and political turmoil. Unusual weather patterns have also hampered the country's exports. For example, the El Nino and La Nina phenomena in 1996 and 1997 caused significant economic losses, particularly in the agriculture sector. The major floods that occurred in 2005 and 2006 had a devastating economic impact. According to the Inter-American Development Bank (2008), the 2005 floods resulted in economic losses amounting to 60% of GDP. It is worth noting that Guyana is less vulnerable to natural disasters than other Caribbean countries. However, given the country’s heavy dependence on the agriculture sector unusual weather conditions is a major source of external vulnerability. This is due in part to a lack of crop insurance, as well as inadequate infrastructure and waste management systems to prevent flooding.

In macroeconomic terms, Guyana’s general exported items constitute 18.2% of its standard Gross Domestic Product for 2020 ($15.five billion valued in Purchasing Power Parity US dollars). That 18.2% for exports to standard GDP in PPP for 2020 compares to 13.1% for 2019. Those metrics endorse a notably lowering reliance on merchandise offered on worldwide markets for Guyana’s general monetary overall performance albeit primarily based totally on a brief timeframe.

Companies that controlled Guyana’s foreign trade post-independence: Because foreign businesses owned the majority of agricultural and mining enterprises, most economic choices were still made outside. The major sugar plantations were controlled by two British businesses, Booker McConnell and Jessel Securities, who had enormous power in the country. The Booker McConnell corporation alone accounted for about one-third of Guyana's gross national product in the early 1970s (GNP). The corporation produced 85% of Guyana's sugar, employed 13% of the workforce, and earned 35% of the country's foreign exchange revenues.

The mining sector was controlled by two additional foreign companies: the Demerara Bauxite Company (Demba), a subsidiary of the Aluminium Company of Canada (Alcan), and the Reynolds Bauxite Company, a subsidiary of the Reynolds Metals Company of the United States. These companies accounted for 45 percent of the country's foreign exchange revenues. The major banks were likewise controlled by foreign firms. The Burnham government, which took office in 1964, considered sustained foreign economic dominance as a barrier to growth. According to economists, foreign ownership is the primary source of local economic troubles.

This position was shared by emerging Caribbean nations, and it was supported by a number of considerations. In the Caribbean, it has been claimed that foreign-owned enterprises use inefficient production technologies. Because they were built for the industrialised world, these technologies were capital intensive rather than labour intensive. As a result, local unemployment has stayed greater than necessary.

Furthermore, local economies were geared toward generating just primary products (in Guyana, sugar, and bauxite) rather than value-added products (processed foods and aluminium parts, for example). Guyana exported its low-cost primary products abroad at world market prices, making local economies exposed to international price fluctuations. At the same time, because most tiny, developing countries lacked a manufacturing base, local economies were forced to import expensive goods such as machinery. In 1970, the government moved quickly to seize control of the economy.

Guyana nationalised the country's largest corporations throughout the 1970s. In 1971, Demba became a state-owned corporation. The government took over the Reynolds Bauxite Company three years later. The Burnham administration then focused on the sugar business. Some analysts believe the latter action was primarily motivated by political considerations; they believe the Burnham administration was attempting to broaden its base of support among Indo-Guyanese sugar labourers. Jessel Securities was nationalised by Guyana in 1975 when the company began laying off staff to minimise costs. The massive Booker McConnell corporation was seized by the government in 1976. By the late 1970s, the government had gained control of more than 80% of the economy.

- TRADE POLICIES OF GUYANA:

Trade policies in the 1970s and 80s: To address the issue of foreign control and dependency, the following steps, among others, were implemented:

- Nationalization of key industries.

- The use of cooperatives to promote small producer access to productive asset ownership in the absence of state control. Agriculture and handicraft were the most likely options for cooperatives.

- In commercial banking, cooperative banking was established with the purpose of minimising the role of foreign banks. Thus, in a relatively short period of time, a national cooperative bank emerged as the dominant player on the commercial banking scene.

- Attempts were made in the mid-1970s to break the back of monoculture agriculture with a national food self-sufficiency policy. This was advocated in order to reduce food import dependency and to encourage agricultural self-sufficiency. To understand the relevance of this statement, consider that agriculture was primarily focused on the external market, hence its capacity to meet demand was largely overlooked.

Guyana's trade policy was centred on developing the economy through import substitution manufacturing from the mid-1970s until 1987. In accordance with that development strategy, the authorities attempted to boost domestic production of imported commodities by

- Imposing heavy levies on imported goods;

- Adopting a highly complex system of import licencing regulations; and

- Imposing, among other things, an all-encompassing system of bans and quantitative restrictions on imports.

However, even with these safeguards in place, the country's output of goods and services has been steadily declining. Guyana's authorities developed an Economic Recovery Program in 1988, which was supported by the international financial community, in order to reverse the country's economic decline. This new programme outlined a new government plan for economic growth. Instead of import substitution industrialisation, the new economic growth strategy was export expansion. To accomplish this plan, the government reduced taxes on globally traded commodities, eliminated prohibitions and quotas on imported items in almost all cases, and liberalised the government's import-licensing system, among other things. In terms of Guyana's exchange rate policy, the reform resulted in a shift away from a fixed exchange rate system. Instead, the authorities instituted a system in which the currency rate was more freely controlled by market forces.

The steady deterioration of the country's balance of payments in the 1970s and 1980s, despite the authorities' adoption of the following measures:

- Devaluation of the Guyana dollar on several occasions;

- Implementation of a comprehensive system of foreign exchange control;

- Application of multiple exchange rates to the country's major exports, among other things.

- Trade policies in the recent times:

The country’s economic progress since 2006 was accompanied by an enhancement in governance and macroeconomic policies. the country enjoyed stable prices during the period 2006-2010. Except for 2006 when the country implemented the Value Added Tax (VAT) and was exposed to high prices for imported commodities, inflation rates were generally low. The rate of inflation as measured by the Consumer Price Index (CPI) declined from 8.2% in 2005 to 4.5% in 2010 due to effective monetary policy and several targeted interventions to control prices. The primary exchange rate - that is, the exchange rate between the Guyanese dollar (G$) and the United States dollar (US$) - exhibited significant stability. The variation in the G$/US$ exchange rate as measured by the standard deviation were extremely low.

CONCLUSION:

Guyana has reached a tipping point in its growth, which might result in considerable gains or little or no change for the bulk of the population. If managed properly, the increase in goldmining and logging, as well as the expected finding of oil, might provide a significant boost to development. However, the ruling class still has a lot of work to do to deal with corruption, illegality, prejudice, and a lack of governmental capacity. If no adjustments are made, the country's great potential will be squandered. This would be especially disappointing given Guyana's expanding spectrum of foreign relations, which is beginning to present significant chances for growth and development. While some long-standing connections, such as those with the EU, are deteriorating, others, such as those with the United States, remain as strong as ever. Relationships with China, India, UNASUR, and, most importantly, Brazil is also becoming increasingly vital. They must, however, be properly developed in order for their full potential to be realised. Meanwhile, relations with Venezuela and Suriname are more difficult, but there are definite benefits and potential.

In conclusion, Guyana has a real opportunity to achieve a significant improvement in its level of development, but significant internal changes and a careful foreign policy balancing act are necessary for these gains to be realised. This article investigated the underlying causes of the recent economic rebound and discovered that a mix of strong policy and good fortune explains much of the current increase. Improved governance, good macroeconomic management, and favourable trade conditions have been major growth drivers. Accelerating and maintaining economic momentum is a major difficulty, but it is also a major need.

. . .

REFERENCES:

- Grenade, Kari and Pasha, Sukrishnalall (2012): Accelerating Guyana’s Growth Momentum.

- U.S. Library of Congress

- Modeste, N. C. (2019). The Impact of Trade Liberalization on Export Supply and Poverty in Guyana: Evidence From Cointegration Analysis. The Review of Black Political Economy, 46(3), 230–249. https://doi.org

- Frank Long (1991) The new international political economy of Guyana, The Round Table: The Commonwealth Journal of International Affairs, 80:317, 73-80, DOI:10.1080/00358539108454024

- Peter Clegg (2014) Guyana, its Foreign Policy, and the Path to Development, The Round Table: The Commonwealth Journal of International Affairs, 103:4, 399-410, DOI:10.1080/00358533.2014.941193