Introduction

Gold is a metal that, alongside silver, has been used for many purposes all around the world including economic barter. It is the most ductile and malleable metal as it can be woven into wires and can be beaten down to sheet which can be most slender of all metals (Kumar, 2017). The quality of gold and its sustenance over a long period has made it valuable enough since an impressive timeframe. India, in the ancient times used to export the finished goods in the exchange for gold which has accumulated gold in India. (Vanitha & Saravanakumar, 2019). However, the British colonialism in India had, through its exchange and trade policies, sent a considerable amount of gold from India to Britain. This article talks about the degree of relevance of gold in India as against the fact that the highest volume of gold has been vaulted into India and what India must do to yield more value out of it.

History

Before the Bretton Woods Conference after the World War 2, gold was the reserve currency for majority of the nations as there was a lack of any internationally approved currency. Thus countries made huge reserves of gold against a hedge of the collapse of their currency in case of hyperinflation (Reddy, 1996). When the dollar was approved as a reserve currency, countries started to accumulate dollars instead of gold as price fluctuations were a continuous possibility in the world due to fluctuation in demand, and gold was less safe than USD (Mishra, 2010).

The Gold Economy in India

Traditionally gold has been looked at by Indians as important and auspicious occasions demand gold buying in different forms in India. It is used in weddings, deities, for any other festive occasion, thus the demand base of gold in India is solid and consequently is relied upon to make a minimum demand level over the coming decades. Indian people hold more gold than any other country in the world, in terms of value, as India sees gold as a part of the culture (D’souza, 2015). This gold reserve with the people had been seen by the government and served many a times as an opportunity to the economy and thus the government started approval of gold loans and higher interest on gold deposits in the decade of 2000 so that the gold economy could run across the businesses and increase the investment and manufacturing to produce more even without printing more money (Mishra et al., 2010).

The current developments are related more with the demand and supply and price movements in accordance with the international events and fiscal policies in India-

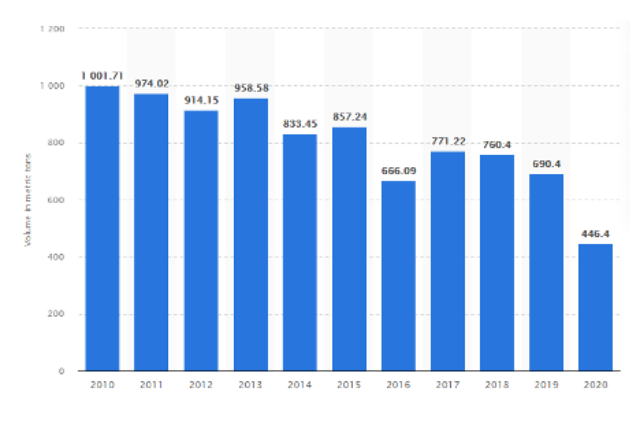

On the demand side, though they are no authentic estimates, most of the gold, which is about 80 % of the gold, is used for jeweler fabrication, 15% for the demand of the investors, and 5% for the industrial usage (Abraham & Ramanathan, 2020). The demand for gold has been rooted in the minds of the Indians as culture, religious preferences, and hedge against inflation. It can be concluded that the combined effect of treating gold is a major part of treating it as a hedge or value instrument and also that the investments in gold is out of black money in India, at least till recently (Vanitha & Saravanakumar, 2019). The annual consumption of gold may fluctuate but decade-wise consumption is only increasing as the population is expanding. Shortly likewise, the demand for gold in India will continue to be around 600 to 700 tonnes. Even in the month of March of 2021, which has seen a surge in gold imports, the demand was 160 tonnes (Mukherjee, 2020).

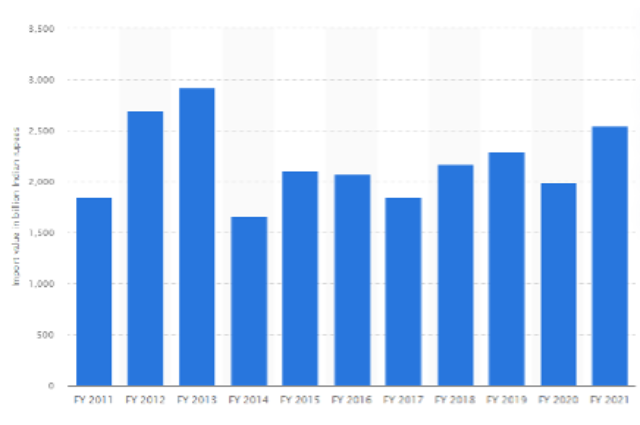

Gold imports in India (by value) (Mukherjee & Mukherjee, 2020)

Gold imports in India (by volume) (Mukherjee & Mukherjee, 2020)

As the domestic production of gold is limited, around 2 tonnes per year, and some supply from fabricated gold scraps which is around 80 tonnes, the insatiable thirst for gold reaches out to imports of gold which is a huge reason for India’s current account deficit, importing gold and sending currency out of India, thus devaluing the Indian currency. Even the government's decision to decrease this CAD had restricted the imports, which then began gold purchase in the form of illegal imports (Singh, 2013).

Thirdly, the strong demand for gold and restrictive policy stances has always resulted in increased prices of gold in the domestic market as against the international market. The value of gold is increasing each year. It must also be mentioned that the management of gold demand and supply has an important policy implication for the monetary and fiscal policy and also in the exchange rate management. In the recent times, as mentioned before, usage of gold as a financial instrument against loans, and mobilisation within the financial funnel has also attracted attention for gold (Narayanan et al., 2020).

The decline in the value of gold in the recent past was so rapid that the recession in Greece could also be attributed to gold as one of the reasons. Similarly, the gold rush in India has also reached the point when the nation’s economy and currency are being sacrificed in the bargain as the metal has fallen for three consecutive years.

It’s about time that gold be used through the help of governmental and fiscal policies for the benefit of the Indian economy, for instance, providing gold loans (Mukherjee, 2020). In addition to that, the government must also discover newer ways of gold use to extract gold from the personal vaults and to use them for circulation in the economy so that it creates value. Presently, gold is the most valuable non-value-creating asset. Gold rush mining must be on priority for the government, as gold imports can be a pit in essential imports.

Conclusion

Gold imports have emerged, in terms of the importance of trade, only second to the crude oil. It must be remembered that the Indian government has been, to some extent, successful in limiting the imports of gold, but it should be recalled that the 2008 crisis was survived by India because of Indians having gold in their vaults and that money was not in circulation. Thus, in place of limiting gold demand, the government must look for newer aspects of gold usage for economic prosperity and growth.

References:

D'souza, E. R. R. O. L. (2015). Gold monetisation scheme for India. Economic and Political Weekly, 23-27.

Kumar, A. (2017). The black economy in India. Penguin Books India.

Abraham, S., & Ramanathan, H. N. (2020). Asset Price Interrelationship: Real Estate, Gold, and Stocks. SCMS Journal of Indian Management, 17(3), 64-81.

Mukherjee, P., & Mukherjee, V. (2020). Assessing the scope of gold refineries in India: Evidence from survey data. Resources Policy, 69, 101810.

Narayanan, P., Gopalakrishnan, B., & Sahay, A. (2020). Understanding the government's attempt to transform attitudes towards a critical resource: Gold monetization in India. Resources Policy, 66, 101600.

Reddy, Y. V. (1996). Gold in the Indian Economic System. World Gold Council, New Delhi.

Singh, P. (2013). Gold Prices in India: Study of Trends and Patterns. International Journal of Innovations in Engineering and Technology (IJIET), 2(4), 332.

Srinivasan, P. (2014). Gold Price, Stock Price and Exchange rate Nexus: The Case of India. Romanian Economic Journal, 17(52).

Vanitha, S., & Saravanakumar, K. (2019). The usage of gold and the investment analysis based on gold rate in India. International Journal of Electrical and Computer Engineering, 9(5), 4296.