Photo by Expect Best from Pexels

Financial Inclusion: The Current State:

While sipping your hot tea at a local tea stall after paying through G-Pay & analyzing yesterday's stock returns on Zerodha, you talk about how Ethereum is moving to Proof of Stake & influence your friend to adjust her crypto holdings accordingly. After tapping your phone at the cafeteria to pay from Samsung Pay, you & your buddy share the tab in Split-wise. You renew car insurance from the Policy bazaar & get the bank to release your next education loan amount through just a one-liner mail. Money is simple right!! Well, nothing could be farther from the truth. You are one of 15% of early adapter Indian who has seamless access to the country's digital financial system.

- In India before 2014, Only 53% of adults had a bank account & only 25% of Indian internet users use Internet banking services.

- When it comes to access to formal credit, only 16% of MSME, a sector that contributes to 8% of GDP, receive traditional credit in India, with a deficit of around $380 B.

- Out of 124 M small & marginal farmers, only 36 M receive formal credit.

- CRISIL Inclusix score, an index to measure the extent of financial inclusion on a scale of 0 to 100, is just in 58.0 India as of 2015.

- India only has 14 bank branches & 17 ATM machines per hundred thousand people against a count of 40 & 174 respectively in the US.

But why is it not the other way around? The economically underprivileged & not the already uplifted population should have first access to adequate & affordable financial services, and why is financial inclusion such an arduous task that India has not been able to achieve in the last 70 years?? Is Sabka Saath, Sabka Vikaas so tough to achieve??

Attempts so far & Key Pain Points:

Awareness, Accessibility & Affordability: Though the term financial inclusion is relatively new, since the launch of the first Indian bank in 1683 & the establishment of RBI in 1935, several initiatives have been taken in a phased manner to include the rural & deprived masses. While Nehru emphasized Cooperatives banks, RBI focused on the spreading of bank branches in rural areas. Indira Gandhi took the initiative of nationalizing banks to have more control over banks & NABARD was set up in 1982 to support agricultural & rural development. Since then, projects such as flow of credit to Small Scale Industry (SSI), Self Help group (SHGs), Microfinance, Jan Dhan Aadhar (JAM) Trinity, Mudra Yojana, Issuance of Kisaan Credit Card (KCC) & increasing number of ATMs have been taken up. Though PMJDY expanded the financial architecture of India & included around 40 Cr account holders, the average deposit per account is just 3000 rupees.

India's Credit Crisis: Who has not heard of NPAs. Well, as of Mar '21, Indian banks have a whopping 8.3 Lakh Crore of bad loans. NPAs as a percentage of the gross bank rose continuously from 2.2% in 2007-08 to peak at 11.2% in 2017-18. Indian banks should maintain capital to risk-weighted asset ratio (CRAR) of 9%. However, when an economic crisis lingers on, such provisioning is usually found inadequate, adversely affecting the demand and supply of credit. Mind you, the total farm loan NPA is just 12.4%, i.e., 1.1 Lakh Crore of total NPAs, yet the farm loan rejection percentage is highest among all.

Though awareness & accessibility has increased substantially in the financial system, Indian banks are still too document-heavy, bureaucratic & complex to handle the financial transactions of a marginally literate society. Still, most of the loans get rejected due to poor credit history & lack of documentation. Alongside, the credit crisis & tight regulations have made the condition worse for the small fishes, while large ones continue to blossom in European ponds! But why Banks are not able to see customer's pain points? If yes, then why are they not able to innovate??

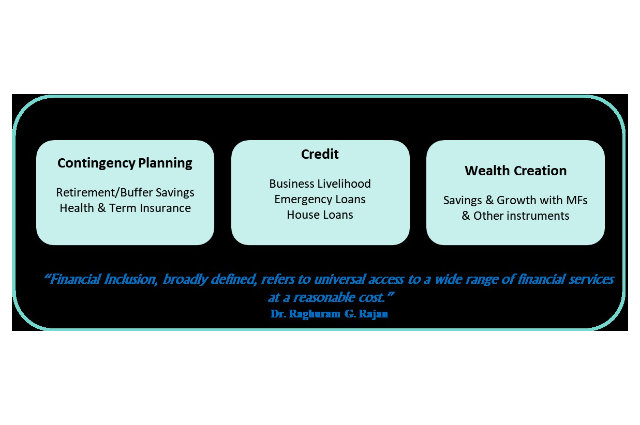

Where Fintech can add value:

When the gatekeepers of the financial system started understanding the customers' pain points, they primarily focused on digitalization & not Digital Transformation. The industry dominated by prominent players started upgrading & digitizing core systems or peripheral changes under the banner of innovation to demonstrate their progress, that too mediocre at best! Can you believe one of the biggest banks in India, HDFC Bank, was barred from launching new digital services in January this year because of multiple prolonged outages in their systems ? Resistance to innovation was endemic & that's where techies of the world, along with entrepreneurs with a master in • Customer value proposition • Profit formula • Essential resources • Key processes, come to the rescue of the dissatisfied consumer. Entrepreneurs & VCs knew that this was a sizeable addressable market which is fuelled by significant shift initiatives such as UPI, Aadhar & GST, and India's large STEM (Science, Technology, Engineering & Mathematics) orientated education, leading to a boom in Fintech Industry as well as its adoption.

- With 2,100+ FinTechs & $10 Bn funding since 2016, India is amongst the fastest growing Fintech markets & is expected to grow to $84B by 2025, at a CAGR of 22%.

- The Indian Fintech ecosystem sees a wide range of subsegments, including Payments, Lending, Wealth Technology (WealthTech), Personal Finance Management, Insurance Technology (InsurTech), Regulation Technology (RegTech), etc.

- As of May 2021, India's United Payments Interface (UPI) has seen the participation of 224 banks and recorded 2.6 billion transactions worth ~$68 Bn, representing a jump of 15x from just three years ago for the same period in 2018.

When Fintech started getting traction a decade ago, the gatekeepers went through what we call the Five Stages of Grief, starting from Denial to Acceptance & finally, a new term was coined.

Fintegration /fɪntɪˈɡreɪʃ(ə)n/ noun: The process whereby traditional financial institutions partner with fintech companies to gain the ability to integrate innovative solutions within their own enterprises.

" Bitcoin is a fraud that will blow up."Jamie Dimon, CEO, JP Morgan (2017)

"Collaboration is the only way to co-exist."

Munish Mittal, CIO of HDFC Bank (2019)

How Fintech are adding value:

As mentioned, One of the key obstacles in accessing formal finance is often the lack of credit scores of the individual. In the absence of credit scores, financial institutions are wary of lending. In the agriculture sector, lack of credit scores or ratings forces the farmer to access funding through informal channels at high rates of interest. One Fintech SERV'D is building an app that helps households and the informal workers they employ (e.g., nannies, drivers, cooks, delivery services) create simple formal work contracts and pay them online, thus capturing their wage history.

FinTech firms have mastered the 5C of Credit: Character, Capacity, Capital, Collateral, and Conditions & are aiming with products and services that are efficient, transparent & more user-friendly to attract customers.

Financing & P2P Lending: WonderLend, Jai Kisan, XtraCap, FinLok, Lendingkart are some of the Fintech offering a credit gateway solution of the rurban and new-to-credit population to enable zero-friction credit assessment through their B2B2C digital lending hub platform. They are helping banks and financial institutions assess the credit of this particular segment by high machine decisions, low underwriting, and low credit operations costs, making it viable at scale.

Asset Management: Today, 40% of urban Indians below the age of 30 say they are unable to save any money, while 60 % say they don't have savings to cover them in case of emergencies. EasyPlan, Amigobulls, CreditMantriFinly are startups that are helping young Indians save money in a smarter, simpler, and more flexible way.

Insurance Coverage: GramCover and SureClaim are working with village-level entrepreneurs and providing them with the right mix of technology, products, and training. They aim to provide simple and affordable insurance products to rural customers.

Conclusion:

Unambiguously, India has significantly improved the financial inclusion of its marginalized sections, and Digital India has turned out to be an essential cornerstone. However, the digital divide is still too broad, and there are many bottlenecks and challenges that can only be solved through FinTech.

The most common barriers to financial inclusion include lack of skills among the stakeholders to use digital services, the non-availability of suitable financial products, teething problems between various systems, infrastructural issues, and low-income consumers.

Though there are the privacy & regulatory concerns, the past five years have introduced a level of disruption in Fintech never experienced before. The ability to emerge these companies to gain traction in the global financial services market quickly is forcing financial institutions to evolve to remain competitive. New competitors (both in the shape of fintech startups and technology giants responding to opportunities to add value), as well as new solutions, are catalysts for change in an industry long defined by tradition. From AI, automation, and augmented reality to the cloud, IoT, and data analytics, Fintech is transforming the financial services status quo, leading to more & more inclusion.