The Title and its metaphorical significance:

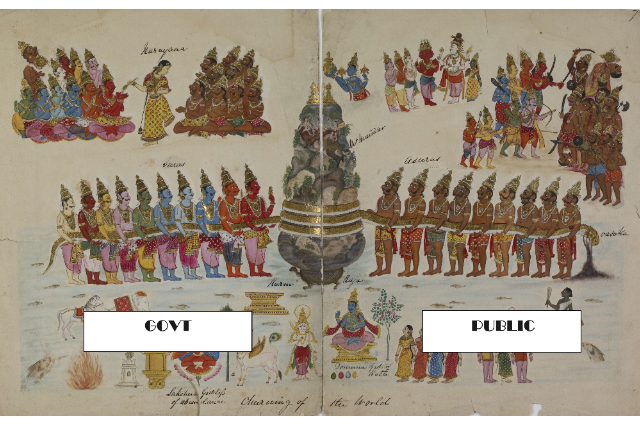

How does “THE SAMUDRA MANTHAN BETWEEN GODS AND ASURAS” conflict relatable assurance to our new era of living?

In the realm of governance and public administration, taxation stands as one of the most enduring and contentious subjects. The title "The Samudra Manthan of Taxes between Govt. and Public" evokes a vivid metaphor from Hindu mythology, drawing parallels between the churning of the ocean (Samudra Manthan) by gods (devas) and demons (asuras) in their quest for the nectar of immortality, and the ongoing struggle between governments and the public over taxation. This metaphor underscores the complex and often adversarial nature of this relationship, marked by both conflict and cooperation.

In Hindu mythology, the Samudra Manthan was a monumental effort requiring immense labour and cooperation between two opposing forces. Similarly, the process of taxation involves a multifaceted interplay between the government, which levies taxes to fund public services and infrastructure, and the public, which is required to contribute a portion of their earnings. The government, like the devas, views taxation as a necessary tool to ensure the collective well-being and progress of society. These funds are essential for building roads, maintaining public safety, providing education and healthcare, and supporting numerous other public goods and services.

However, from the public’s perspective, the experience of being taxed can often feel more akin to the asuras’ perception—an extraction of resources that can be burdensome and sometimes perceived as unfair. The reaction to taxation can range from acceptance and compliance to resistance and evasion, influenced by factors such as perceived fairness, transparency in the use of tax revenues, and the overall economic context.

Historically, taxation has been a catalyst for significant social and political change. Examples abound, from the peasant revolts in medieval Europe to the more recent anti-tax movements around the world. These events underscore the critical importance of how taxes are imposed and managed. Public acceptance of taxation is closely tied to the perceived legitimacy of the government and its policies, as well as the tangible benefits that citizens receive in return.

This article embarks on a comprehensive exploration of this intricate relationship, delving into the historical context of taxation, examining the perspectives of both the government and the public, and analyzing the economic, social, and psychological implications. We will explore how taxation systems have evolved, the justifications for various forms of taxes, and the myriad ways in which they impact everyday life. Additionally, we will consider the mechanisms through which governments seek to balance the need for revenue with the imperative of fairness and transparency, and how technological advancements are shaping the future of taxation.

Through this exploration, we aim to unravel the complexities of the taxation process, shedding light on the underlying tensions and cooperative efforts that define the dynamic interplay between government and the public. By understanding these dynamics, we can better appreciate the delicate balance required to maintain a fair and effective tax system that supports societal growth and development.

So first let me remind you of the Hindu Mythology, what is Samudra Manthan, and how does it occur?

The Samudra Manthan, or the Churning of the Ocean of Milk, is a pivotal episode from Hindu mythology, illustrating a cosmic struggle between good and evil, embodied by the devas (gods) and asuras (demons). This event is described in several ancient texts, including the Bhagavata Purana, Vishnu Purana, and the Mahabharata.

According to the legend, the devas, weakened by a curse, sought the nectar of immortality (amrita) to regain their strength and ensure their dominance over the Asuras. Lord Vishnu suggested that the only way to obtain the amrita was to churn the primordial ocean of milk, a task requiring the combined efforts of both devas and asuras.

The churning process was monumental and required ingenious tools. Mount Mandara was used as the churning rod, and the serpent king Vasuki served as the rope. The devas and asuras took opposing sides, pulling Vasuki back and forth, causing Mount Mandara to rotate and churn the ocean.

The churning released numerous treasures and beings from the ocean, including the deadly poison Halāhala (Sanskrit हलाहल) or Kālakūṭa (Sanskrit कालकूट, lit. 'poison of death'), which Lord Shiva consumed to protect the world. Finally, after much toil, the amrita emerged, and Vishnu, in the form of the enchantress Mohini, ensured that the nectar was distributed to the devas, securing their victory over the asuras.

The Samudra Manthan symbolizes the necessity of cooperation and effort, even among adversaries, to achieve a common goal, illustrating profound themes of struggle, sacrifice, and ultimate reward.

What If the Asuras Had Obtained the Amrita?

The Samudra Manthan, or the Churning of the Ocean of Milk, is a profound allegory of cosmic balance, illustrating the eternal struggle between good and evil. The story is steeped in rich symbolism, depicting the devas (gods) and asuras (demons) working together to obtain the nectar of immortality (amrita). Traditionally, the devas secure the amrita, ensuring their supremacy. However, contemplating a scenario where the asuras obtain the amrita invites intriguing speculation about the cosmic order.

If the Asuras had successfully consumed the amrita, the balance of power in the cosmos would have dramatically shifted. The asuras, traditionally portrayed as embodiments of chaos, ambition, and self-interest, would have gained unprecedented strength and immortality. This newfound power could lead to several hypothetical outcomes:

- Dominion Over the Devas: Immortality would render the Asuras invincible, enabling them to overpower the Devas. This could lead to a prolonged period of turmoil and conflict, as the devas, despite their inherent immortality, might struggle to counterbalance the empowered asuras.

- Disruption of Cosmic Balance: The devas and asuras represent the dual forces of order and chaos, respectively. The immortality of the asuras could disrupt this delicate equilibrium, potentially plunging the cosmos into a state of perpetual conflict and instability. The harmonious cycles of creation, preservation, and destruction, essential to maintaining cosmic order, might be severely affected.

- Evolution of Devas’ Strategies: In response to the asuras’ newfound immortality, the devas might need to evolve their strategies. This could involve seeking new forms of power, forging alliances, or even appealing to higher cosmic entities like Brahma, Vishnu, or Shiva for intervention. The devas’ inherent wisdom and adherence to dharma (cosmic law) might lead to innovative solutions to counter the asuras’ dominance.

- Potential for Reconciliation: On a more optimistic note, the asuras' immortality might eventually lead to a reconsideration of their values. Immortality could provide them with the time and perspective to understand the importance of balance and harmony. This scenario could pave the way for a more integrated and cooperative cosmic order, where devas and asuras work together to maintain equilibrium.

- Mythological and Cultural Implications: Such a shift would profoundly impact Hindu mythology and cultural narratives. The stories and teachings, which often emphasize the ultimate victory of good over evil, might evolve to reflect more complex moral and philosophical lessons about power, responsibility, and the interdependence of opposing forces.

In essence, the asuras obtaining the amrita would introduce a new dynamic to the cosmic narrative, challenging the traditional roles and relationships between devas and asuras. While the devas’ inherent immortality might provide a counterbalance, the ensuing struggles and potential for growth and transformation would underscore the intricate and evolving nature of the cosmic order.

Relating Samudra Manthan to Taxation: The Consequences of Public Non-Compliance:-

The Samudra Manthan, with its intricate dynamics between the devas and asuras, serves as a powerful metaphor for the interplay between governments and the public in the context of taxation. Just as the churning of the ocean was essential for extracting the nectar of immortality, the process of tax collection is crucial for sustaining public services and the overall functioning of society. The devas (government) and the asuras (public) must both participate in this churning process to achieve a stable and prosperous society. But what if the public, akin to the Asuras, decided not to pay taxes? Here’s what might happen:

- Collapse of Public Services:

Taxes are the primary source of revenue for governments. If the public stops paying taxes, the government would face a significant shortfall in funds. This would directly impact the ability to maintain essential services such as healthcare, education, public safety, and infrastructure. Hospitals might shut down, schools could be unable to operate, and public transportation systems might fail, leading to widespread societal disruption. - Economic Instability:

Taxes play a vital role in regulating the economy. They are used to fund social welfare programs, stimulate economic growth through investments, and manage inflation. Without tax revenue, the government would struggle to implement economic policies effectively, potentially leading to increased poverty, unemployment, and economic stagnation. - Increased Inequality:

Publicly funded programs aimed at reducing inequality, such as social security, unemployment benefits, and subsidized housing, rely on tax revenue. Without these funds, the gap between the rich and the poor would likely widen, exacerbating social tensions and leading to greater societal instability. - Infrastructure Decay

Infrastructure projects such as roads, bridges, public transportation, and utilities are funded by tax revenue. Non-payment of taxes would result in the deterioration of these critical infrastructures, affecting daily life, economic activities, and overall quality of life. Businesses would find it harder to operate efficiently, and the general public would face increasing inconvenience and safety risks. - Increased Borrowing and Debt:

To compensate for the loss of tax revenue, governments might resort to borrowing, leading to higher national debt. This would result in increased interest payments, which could further strain public finances and reduce funds available for public services. Over time, excessive borrowing could lead to a debt crisis, undermining the country’s economic stability and creditworthiness. - Erosion of Public Trust and Governance:

Tax compliance is a cornerstone of the social contract between the government and the public. If people stop paying taxes, it could signal a breakdown in trust and the perceived legitimacy of the government. This erosion of trust could lead to increased civil unrest, protests, and a general sense of lawlessness, further destabilizing the society. - Negative Global Implications:

On a global scale, countries with failing tax systems might struggle to engage in international trade and diplomacy effectively. Investors could lose confidence, leading to reduced foreign investment and economic isolation. This could compound the country’s economic problems and hamper its growth and development prospects.

So, just as the Samudra Manthan required the combined efforts of devas and asuras to achieve a beneficial outcome, the effective functioning of a society requires the active participation of both the government and the public in the tax system. Non-compliance by the public would not only undermine the government’s ability to provide essential services and maintain economic stability but also threaten the very fabric of society, leading to widespread chaos and decline.

Now let’s take a brief Overview of the Tax System and Its Importance:

What is a Tax System?

A tax system is a structured framework through which governments impose financial charges or levies on individuals, businesses, and other entities. The primary purpose of taxation is to generate revenue needed to fund public services and infrastructure. Taxes can be categorized into various types, including income taxes, sales taxes, property taxes, and excise taxes, each serving specific functions within the economy.

Key Components of the Tax System

1. Income Tax:

- Personal Income Tax: Levied on individual earnings such as wages, salaries, and investments. Progressive in nature, meaning the rate increases as income increases, which helps in redistributing wealth and reducing income inequality.

- Corporate Income Tax: Applied to the profits of businesses. It ensures that companies contribute to the public revenue, reflecting their economic activities and profits.

2. Sales Tax:

A consumption tax is imposed on the sale of goods and services. It is usually a fixed percentage added to the sale price, collected by retailers and passed on to the government. Sales taxes are regressive, impacting lower-income individuals more heavily as they spend a larger portion of their income on taxed goods.

3. Property Tax:

Charged on the ownership of property, including land and buildings. Property taxes are typically used to fund local services such as schools, police, and fire departments. The amount is usually based on the assessed value of the property.

4. Excise Tax:

Applied to specific goods, such as gasoline, alcohol, and tobacco. Excise taxes are often used to discourage the consumption of harmful products and to generate additional revenue from goods that can bear a higher tax burden.

5. Value-Added Tax (VAT):

A type of sales tax is collected at each stage of production and distribution based on the value added at each stage. It is common in many countries outside the United States and helps reduce tax evasion.

Importance of the Tax System

1. Revenue Generation:

The most fundamental role of taxes is to provide the government with the necessary funds to operate. This revenue supports public services such as healthcare, education, defence, infrastructure development, and social welfare programs. Without tax revenue, governments would be unable to maintain these essential services, leading to societal and economic instability.

2. Economic Stabilization:

Taxes are vital tools for economic stabilization. Through fiscal policy, governments can influence economic activity by adjusting tax rates and government spending. During economic downturns, reducing taxes and increasing public spending can stimulate growth, while increasing taxes and reducing spending can help cool down an overheating economy.

3. Redistribution of Wealth:

Progressive tax systems, where higher income levels are taxed at higher rates, help reduce income inequality by redistributing wealth from the richer segments of society to the poorer ones. This redistribution funds social programs that support low-income individuals and families, promoting social equity and cohesion.

4. Behavioral Influence:

Taxes can be used to influence behaviour and achieve policy goals. For example, higher taxes on tobacco and alcohol aim to reduce the consumption of these harmful products. Similarly, tax incentives for renewable energy investments encourage environmentally friendly practices and innovation.

5. Funding Public Goods:

Public goods, such as national defence, public parks, and street lighting, are non-excludable and non-rivalrous, meaning they benefit all members of society regardless of whether they contribute to their funding. Taxes are essential to finance these goods, as the free market would not adequately provide them due to the free-rider problem.

6. Promoting Social Justice:

A well-designed tax system promotes social justice by ensuring that everyone contributes their fair share based on their ability to pay. This principle helps maintain public trust in the government and the tax system itself, fostering a sense of civic duty and collective responsibility.

In conclusion, the tax system is the backbone of any functioning government, enabling it to provide essential services, maintain economic stability, and promote social equity. Understanding its components and significance helps us appreciate the intricate balance required to sustain a fair and effective tax system that benefits society as a whole.

What happened within 24 hours in India, Date- 23rd July 2024, in terms of Taxes?

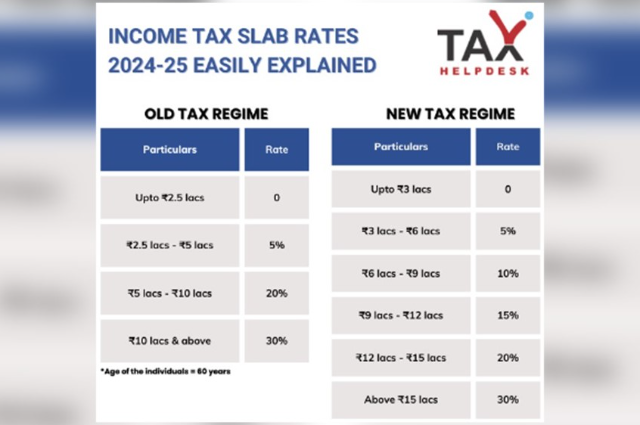

Finance Minister Nirmala Sitharaman presented Budget 2024 on July 23. The FM announced a marginal income tax relief for the middle class. She raised the standard deduction -- a flat deduction from the total salary earned by an employee in a year before calculating the applicable income tax rate -- by 50 per cent to ₹75,000 and tweaked tax slabs for taxpayers opting for the new income tax regime. Commenting on the budget, Prime Minister Narendra Modi said it "will act as a catalyst in making India the third-largest economy in the world (from fifth largest today) and will lay a solid foundation for a developed India".

Impacts After the New Tax Slab Shared

"Middle-Class Faces Tax Burden with No Relief, While Rich Benefit"

The recent changes in the tax slab have sparked significant debate and concern, particularly regarding their impact on different socio-economic groups. Here’s a detailed look at these impacts:

1. Increased Tax Burden on the Middle Class:

- Higher Effective Tax Rates: The new tax slab often increases the effective tax rate for middle-income earners, reducing their disposable income. Middle-class households, which typically rely on salaries and wages, find themselves with less money to save or spend, leading to a tightening of household budgets.

- Limited Deductions and Exemptions: The revised tax framework might reduce or eliminate various deductions and exemptions that the middle class traditionally used to lower their tax liabilities, such as deductions for home loans, education expenses, and medical costs. This change further exacerbates their tax burden.

- Inflationary Pressures: With increased taxes and reduced disposable income, middle-class families might struggle to keep up with rising living costs. This situation can lead to a decrease in their standard of living and financial insecurity.

2. Benefits for the Rich:

- Lower Marginal Tax Rates: The new tax slab may lower the marginal tax rates for high-income earners, significantly reducing their tax liabilities. This reduction can lead to substantial tax savings for the wealthy, increasing their disposable income.

- Investment Opportunities: The rich can benefit from tax provisions that encourage investments, such as lower capital gains taxes and favourable treatment of investment income. This advantage allows them to grow their wealth further through strategic investments.

- Wealth Accumulation: With more disposable income and investment opportunities, the wealthy can accumulate even more wealth. This scenario exacerbates income inequality, as the rich become richer while the middle class and poor face increasing financial pressures.

"Government Infrastructure Projects Raise Concerns About Sustainability"

The government's announcement of ambitious infrastructure projects, funded by the new tax revenue, has also raised several concerns:

1. Environmental Sustainability:

- Resource Depletion: Large-scale infrastructure projects often require significant natural resources, such as water, minerals, and timber. The extraction and use of these resources can lead to environmental degradation, deforestation, and depletion of water sources.

- Pollution: Construction activities can result in increased air and water pollution. Dust, emissions from construction equipment, and runoff from construction sites can negatively impact local ecosystems and public health.

- Climate Impact: Infrastructure projects that rely on fossil fuels or promote increased vehicle use can contribute to higher greenhouse gas emissions, exacerbating climate change. Sustainable alternatives and green technologies are essential to mitigate these impacts.

2. Economic Sustainability:

- Debt Financing: Many infrastructure projects are financed through government borrowing, increasing national debt. High levels of debt can strain public finances and lead to higher interest payments, reducing funds available for other essential services.

- Maintenance Costs: Large infrastructure projects require ongoing maintenance and operational costs. Without proper planning and funding, these projects can become financial burdens, leading to deteriorating infrastructure and increased costs for future generations.

3. Social Sustainability:

- Displacement: Infrastructure development can result in the displacement of communities and disruption of local livelihoods. Ensuring fair compensation and rehabilitation for affected communities is crucial to maintaining social equity.

- Access and Equity: There is a risk that infrastructure projects may primarily benefit urban and affluent areas, neglecting rural and underserved regions. This imbalance can exacerbate social and economic disparities, leading to uneven development.

So basically, the new tax slab and subsequent government actions have created a mixed bag of outcomes. The middle class faces increased financial strain, while the rich benefit from reduced taxes and investment opportunities. Additionally, the sustainability of government infrastructure projects is a significant concern, with potential environmental, economic, and social impacts that must be carefully managed to ensure long-term benefits for all segments of society.

As for now, the Budget estimates the government's spending and income sources, what do you mean by budget here?

Understanding the Budget: A budget is a financial plan that outlines a government's projected income and expenditures for a specific period, typically a fiscal year. It includes revenue sources such as taxes, fees, and loans, and details how this income will be allocated to various sectors and ministries to meet the country's needs. Budgets can be classified as balanced, surplus, or deficit:

- Balanced Budget: When the government's income equals its expenditures.

- Surplus Budget: When income exceeds expenditures, leading to savings.

- Deficit Budget: When expenditures surpass income, necessitating borrowing or using reserves.

Explanation in Indian History: Historical Context: India's Budgets.

1950-51: Surplus Budget of Rs 71 Lakh

In 1950-51, India experienced a rare surplus budget, with a surplus of Rs 71 lakh. This period marked the early years of independent India's economic planning. The surplus was a result of conservative fiscal policies aimed at stabilizing the economy post-independence and managing limited resources efficiently.

Deficit Budgets: Common Scenario

Throughout much of its history, India has encountered deficit budgets. Deficits have been driven by the need to fund extensive developmental projects, social welfare programs, defence, and infrastructure development. This trend reflects the challenges of balancing growth and fiscal prudence in a developing economy.

So, what are the Current budget highlights including the top five ministries' expenditures and revenue details? like the Ministry of Finance, Ministry of Defence, Ministry of Road Transport and highways, Ministry of Railways and Ministry of Consumer Affairs, food and Public Distribution.

Current Budget Highlights: The latest budget highlights the government's spending priorities and revenue projections. Key ministries and their expenditures play crucial roles in shaping the nation's development.

Top Five Ministries' Expenditures and Revenue Details

1. Ministry of Finance

- Expenditure: The Ministry of Finance oversees the overall economic policy, including tax collection, budget preparation, and financial regulations. Significant allocations are made for debt servicing, subsidies, and financial sector reforms.

- Revenue: Major sources include direct taxes (income tax, corporate tax) and indirect taxes (GST, customs duties). The ministry aims to enhance tax compliance and expand the tax base to increase revenue.

2. Ministry of Defence

- Expenditure: A significant portion of the budget is allocated to defence, reflecting the importance of national security. Funds are used for salaries, pensions, modernization of armed forces, procurement of weapons, and infrastructure development.

- Revenue: While the defence ministry does not generate revenue directly, it benefits from the overall revenue collected by the government to ensure adequate funding for defence needs.

3. Ministry of Road Transport and Highways

- Expenditure: This ministry focuses on developing and maintaining national highways, and road infrastructure, and promoting sustainable transport. Investments are aimed at enhancing connectivity and reducing transportation costs.

- Revenue: Revenue is primarily generated through toll collections, cess on petrol and diesel, and budgetary support from the central government.

4. Ministry of Railways

- Expenditure: The Indian Railways is one of the largest employers and the backbone of India’s transport network. The budget allocates funds for modernization, safety, infrastructure development, and operational costs.

- Revenue: Revenue sources include passenger fares, freight charges, and leasing of railway properties. The ministry also receives budgetary support for capital projects.

5. Ministry of Consumer Affairs, Food and Public Distribution

- Expenditure: This ministry is responsible for ensuring food security and consumer rights. Major expenditures include subsidies for food distribution under the Public Distribution System (PDS), procurement of food grains, and price stabilization measures.

- Revenue: Revenue is limited as the ministry’s primary role is distributive rather than revenue-generating. It relies on central government allocations and subsidies to fund its activities.

Key Points and Summary

- Balanced Budget: Achieved when expenditures match revenues, rare in developing economies like India.

- Deficit Budget: Common in India, driven by developmental needs and social welfare programs. Managed through borrowing and fiscal measures.

- Surplus Budget in 1950-51: An early achievement reflecting conservative fiscal management with a surplus of Rs 71 lakh.

- Current Budget Priorities: Highlight the critical role of major ministries in national development, with significant allocations to finance, defence, transport, railways, and food distribution.

- Revenue and Expenditures: Reflect the government's efforts to balance growth with fiscal responsibility, ensuring adequate funding for essential services and infrastructure while striving to increase revenue through efficient tax policies.

Understanding these dynamics provides insight into India's fiscal policies and priorities, illustrating the challenges and strategies in managing the nation's finances.

How are the next 5 years going to be? Will India catch the fast train of development, or will it waste all its money on useless projects? If the answer to all these things is found anywhere, then it is India's budget. The poor get something, the rich get a lot, and the middle class just gets the middle finger. The middle class quietly pays their taxes, and their money goes to make UPSC scammers rich or to build bridges that could collapse at any time. You can live as usual. After finishing your income, the government will keep an eye on your savings. It seems that after paying so much tax, you should definitely visit Bihar and Andhra to see how our money is being wasted.

The Future of India: Development Prospects and Budgetary Implications

The next five years will be pivotal for India’s trajectory towards economic development and social progress. The Indian budget plays a critical role in shaping this future, influencing how resources are allocated and managed. The effectiveness of these allocations will determine whether India can capitalize on its development potential or face challenges related to inefficiencies and mismanagement. Here's a detailed look at the potential outcomes based on current budgetary trends and historical patterns:

Development Prospects: Riding the Fast Train or Facing Challenges?

1. Opportunities for Rapid Development

India has the potential to experience significant development over the next five years if it effectively leverages its resources and focuses on strategic priorities:

- Infrastructure Development: Investing in robust infrastructure, including transportation networks, energy, and digital connectivity, can drive economic growth and improve quality of life. Efficiently managed projects have the potential to enhance productivity, attract investment, and create jobs.

- Technological Advancements: Embracing innovation and technology can boost sectors such as IT, manufacturing, and services. Initiatives like the Digital India program and investments in research and development can position India as a global technology hub.

- Economic Reforms: Continuing with reforms aimed at simplifying the business environment, improving ease of doing business, and enhancing regulatory frameworks can attract both domestic and foreign investments, fostering economic growth.

- Social Welfare Programs: Targeted social programs can improve living standards, reduce poverty, and promote inclusive development. Investments in healthcare, education, and social safety nets can build a more equitable society.

2. Risks of Inefficiency and Mismanagement

However, India also faces risks that could impede its development if not addressed effectively:

- Project Mismanagement: Inefficient execution of infrastructure projects, such as poorly planned bridges or roads, can lead to the wastage of resources and undermine public trust. Ensuring transparency and accountability in project management is crucial.

- Corruption and Misuse of Funds: Issues like corruption and misuse of funds can divert resources from their intended purposes, affecting the effectiveness of government initiatives. Strengthening governance and anti-corruption measures is essential to prevent these issues.

- Economic Disparities: If budgetary allocations disproportionately favour certain sectors or regions, it can exacerbate economic disparities. Ensuring balanced development and equitable distribution of resources is important for sustainable growth.

Budgetary Allocation and Social Impact

1. Middle-Class Strain

The perception that the middle class bears a disproportionate tax burden while seeing limited benefits can contribute to frustration:

- Tax Contributions: The middle class often contributes significantly to tax revenues, funding various public services and infrastructure projects. However, if the perceived benefits do not align with their contributions, it can lead to dissatisfaction.

- Limited Relief: If tax policies and budget allocations do not adequately address the needs of the middle class, it can result in a sense of neglect. Ensuring that tax policies are fair and provide tangible benefits to all income groups is vital.

2. Allocation to Various Sectors

Balancing expenditures across different sectors and ensuring that investments are effective is crucial:

- Public Sector Spending: Allocation to sectors like education, healthcare, and infrastructure should be managed effectively to avoid waste and ensure that funds are used to achieve meaningful outcomes.

- Monitoring and Evaluation: Implementing robust monitoring and evaluation mechanisms can help track the progress and impact of budgetary allocations, ensuring that resources are used efficiently and achieve the desired results.

Conclusion

The next five years hold significant potential for India to accelerate its development, provided that the budget is managed effectively, and resources are allocated judiciously. Addressing issues of inefficiency, corruption, and imbalanced allocations will be key to harnessing this potential and ensuring that the benefits of development are widely shared. The middle class, which plays a crucial role in funding public services, should see equitable returns on their contributions, fostering a sense of fairness and trust in the governance system. Effective management of the budget, transparency in project execution, and balanced development will be essential to navigating these challenges and achieving sustainable progress.

In the context of the Samudra Manthan metaphor applied to modern issues such as taxation and government spending, determining the "winner" involves evaluating who benefits most from the current system and its outcomes.

Winners and Losers in the Modern Samudra Manthan:

1. Government (Devas)

- Benefits: The government benefits from increased revenue and enhanced control over resources and policies. The ability to manage and direct substantial funds towards infrastructure, social programs, and development projects can potentially drive economic growth and national development.

- Challenges: The effectiveness of this control depends on transparent and efficient management. Misallocation of resources or corruption can undermine the government's ability to achieve its goals, leading to disillusionment among the public.

2. Wealthy Individuals (Asuras)

- Benefits: The wealthy often benefit from favorable tax provisions, investment opportunities, and economic policies that allow them to preserve and grow their wealth. Reduced tax rates and incentives for investment can enhance their financial position and opportunities.

- Challenges: This can exacerbate income inequality if not balanced with measures that support broader economic and social equity.

3. Middle Class (Common People)

- Benefits: The middle class, through their taxes, contribute significantly to public revenue. Ideally, they should benefit from government services and infrastructure funded by their taxes.

- Challenges: If the middle class feels disproportionately burdened by taxes with limited visible returns or benefits, it can lead to dissatisfaction and a sense of being undervalued. This demographic often bears a significant tax load while perceiving less direct benefit compared to the wealthy or the lower-income groups.

4. Poor and Underserved Communities

- Benefits: Ideally, social welfare programs and public services funded by taxes should benefit lower-income groups. Investments in healthcare, education, and social safety nets aim to improve their quality of life and reduce poverty.

- Challenges: Effective targeting of resources is crucial. Inefficiencies or mismanagement can prevent these communities from receiving the intended benefits, perpetuating cycles of poverty and inequality.

Conclusion

In the modern context of the Samudra Manthan metaphor, there is no clear-cut "winner" in the traditional sense. The success of the churning process—whether it benefits the government, the wealthy, the middle class, or the underserved—depends on how effectively and fairly resources are managed and distributed.

- Government’s Role: The government must ensure that the benefits of economic policies and public spending are equitably distributed to prevent disparities and foster overall prosperity.

- Wealth Distribution: Effective policies should address income inequality and ensure that both wealthy individuals and middle-class taxpayers see tangible benefits from their contributions.

- Social Equity: Ensuring that the most vulnerable populations receive the support they need is crucial for achieving balanced and inclusive development.

Ultimately, the "winner" in this metaphorical Samudra Manthan is determined by the overall effectiveness of governance, transparency, and the equitable distribution of resources, ensuring that the benefits of economic policies reach all segments of society.