The price difference in Razors – Example of Pink tax

This generation has come far its way from fighting for equal rights of women to supporting all the genders and their well-deserved rights. A lot of changes have been observed in the recent years. Once upon a time when body-shaming was ignored and people sealed their lips and did not raise their voices to this absurd behaviour, today people take a stand against body-shaming and are no more ashamed to raise their words for the same. Have you ever heard of the terms – gender pay gap, gender discrimination, inequality etc.? What comes into your mind when you hear these terms? Gender pay gap as in not getting equal pay from the companies for the same position and the same work you benefit them with? Gender discrimination as in preferring women in the queues to get their work done first? Now, what If I tell you there is gender discrimination even in the consumer products? Specifically, dry cleaning, personal care products, hair cut services, children toys etc. Have you ever noticed that the same pack of disposable razors for men cost less compared to the same pack of disposable razors for women? What is the difference? The colour? Why do you think blue or black disposable razors with same function, same blade, same design cost less when compared to the pink or purple razors with same function, same blade, same design?

This extra invisible tax charged for products designed for women is called pink tax. Pink tax refers to the invisible cost of products that women are liable to pay for the products designed and marketed specifically for them. According to a study, products for women cost 7 per cent more than the same products for men. Well this is a hidden marketing strategy used by companies to make their own profit. A tampon, pad, menstrual cup etc. are the utmost necessities of women which they are helpless about i.e. no matter what comes they just need it. Not only these, but also the urge to buy razors and shave their body hair is the insecurity which hits them from within. The sellers take advantage of this and use this as their marketing strategy to increase their profits.

When Was the Pink Tax Started?

Many may wonder as to when the pink tax was introduced? The pink tax has existed since at least the early 1990s — and this is when California started its study about the problem. The U.S. formed the sales tax system between the 1930s and the 1960s. “It was a different world at that point of time when the legislators were trying to understand the products which need to be taxed and the products which need to be exempted,” states Laura Strausfeld, co-founder of an organization dedicated to fighting for menstrual equity. Its development into a “gendered colour” can be attributed to several factors, most notably: (1) the extensive use of propaganda that sought to return women to their pre-war limitations in the domestic sphere of the home, and (2) cloth manufacturers, who aimed to increase the profitability and predictability of consumer trends and to inhibit the passing down of children’s clothes. Encouraged by a diverse set of cultural influences - from the trademarked “Barbie Pink” to the rise of pink taxis and pink parking spaces - the association of pink with femininity came to be deeply rooted in societies across the world, and has since birthed the unmistakably misogynistic marketing mantra: “Shrink it, pink it, and women will buy it at a higher price.” An earlier version of the term “Pink Tax” was first coined in October 2014 by Georgette Sand - a women’s rights group based in France - when it launched an online petition titled:

“Monoprix: Stop aux Produits plus chers pour les femmes!

#Womantax” (Monoprix: Stop Aux Produits plus chers Pour Les Femmes! #Womantax, 2014). Rapidly popularized in the coming months by social media platforms, “Woman Tax” evolved into “Taxe Rose”, lending to the usage of its direct English translation.

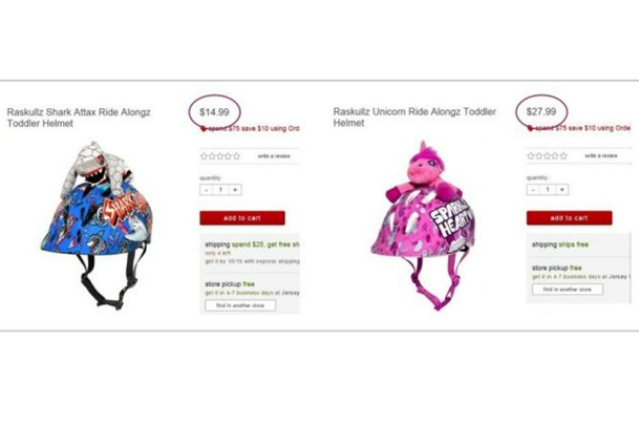

The clothing companies in response to pink tax stated that due to the different build-up body structures of men and women, different fabrics and different cutting preparatory methods are used. Hence, when the making process costs more, the selling price would automatically increase. Coming to the personal care products, I’ve already stated an example of a pack of razors being charged differently just because of the colour difference. The other example includes shampoos, conditioners, deodorants, soaps etc. This doesn’t stop here. Even when you observe the toys section in a shop, you’ll notice the same toy bike marketed for boy’s costs lesser compared to the same material, same featured, same functioning toy bike marketed for girls. Pink tax isn’t a literal, exposed tax. Instead, it’s a hidden amount charged for personal care products, toys, clothes etc. marketed for the female gender.

You all are familiar with social media. Well, on Instagram I saw a post by a man who went to a professional hair salon with his wife. The man pays around 40$ and his wife (a woman) pays around 66$. They both had same inches of hair cut by the professionals but as you can see that the woman has paid 26$ more than the man. Now, the same scissor was used to cut the same inch of hair for both the genders but why is that the woman is charged more? This post had enlightened me about the hair service gender discrimination. This is another example of pink tax.

Dry cleaning is typically a service where women pay more for the same service. Men’s shirts typically cost $2.86 for dry cleaning, and women’s shirts cost almost $4.95. However, a woman’s dress or shirt doesn’t require any different dry-cleaning method.

Now, what if I tell you that a food outlet had used different packaging just to charge more amount for a woman? In July 2018, several period Burger King outlets in Miami, New York, Chicago and other cities in the US sold a different variant of their regular chicken fries to the female customers. The quantity offered was the same as the regular box of chicken fries, except that it was sold in pink packaging and was labelled ‘Chick Fries’. These ‘Chick Fries’ were priced at $3.09 whereas the regular box was priced at $1.69. A video was shared on Burger King’s official account on Twitter, in which the women appeared perplexed at the absurdity of the situation and demanded to be charged the same amount as the male customers.

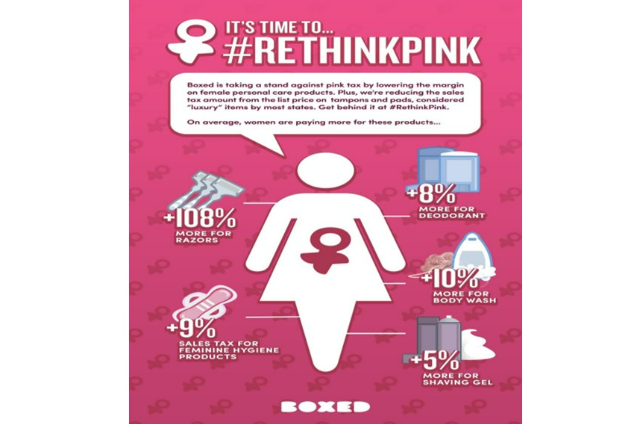

#RethinkPink - Started by a U.S. based company – Boxed.

Boxed – American company

Boxed is an American online wholesale retailer platform. In 2016, Boxed became one of the first US retailers to reduce the pricing on their products to ensure equal prices in men’s and women’s products. This step was taken due to the initiative of Nitasha Mehta, Director of Vendor Marketing in the company.

What if I tell you that a company charged the same shirt with same colour, same material, same print, same size differently for different genders. A shirt with the quote “The Future is Equal” printed on it was priced at £12.95 in the Boys section and £14.95 in the Girls section, for the same XS size. This was in 2019 by the Gap Inc, the popular American clothing brand.

Menstrual hygiene products were charged luxury product tax rate. I bet no woman would say bleeding every month felt like a luxury to them. India is one of the countries which has abolished taxes on menstrual hygiene products. The important developments in the elimination of tampon tax worldwide are mentioned below:

2004: Kenya removed the value-added tax on menstrual products. By doing so, it became the first country to repeal the tampon tax.

2015: Canada eliminated its national goods and services tax on menstrual products 2018: The Australian Government passed a law to remove the 10% goods and services tax on feminine hygiene products. (Cook, 2018)

Columbia abolished its 5% tax on menstrual products.

The Indian Government scrapped the 12% goods and services tax on menstrual products. 2020: The UK announced that from January 2021, the 5% value-added tax on menstrual products will be abolished. (Collinson, 2020)

Germany reduced the tax on sanitary items from 19% to 7%, reclassifying them as “normal goods” from “luxury goods.”

What Is The Impact of Pink Tax?

Another example of the pink tax where children's products are not even spared

According to the International Labour Organisation (ILO), women work more and are paid less. The gender divide is already prevalent in workplaces with a limited number of women participating in leadership roles across sectors. The international organisation mentioned that the gender gap exists in all the countries worldwide, and globally it has narrowed only by a bit in the past decade. On one hand, we are not remunerating women enough for their work, and secondly are charging them more for almost the similar products than men.

Now, there have been various campaigns being held who have fought to abolish pink tax. If a product says made for women with the same colour, same size, same material, same usage etc. as that of the male products, the companies shouldn’t charge woman more just because it says made for women. There have been laws initiated which defines the following statement above. But, are we seeing the laws being implemented?

Now, don’t come at me saying why don’t you buy male razors then? Well, if a man has got cheaper pricing on the same product marketed for a woman then why can’t the companies charge woman equally? There should be same pricing for the same products. Let’s make gender neutral products a thing.

The 5th Sustainable Development Goal, as enshrined by the United Nations resolution “2030 Agenda” (THE 17 GOALS | Sustainable Development, n.d.), emphasises the need for gender equality and women empowerment. Whether intentional or not, the price discrimination represented by the “Pink Tax” exacerbates the financial burden faced by women, epitomizing social disparities and gender-stereotypical norms.

WHAT CAN YOU DO ABOUT PINK TAX?

- Well, make yourself and the people around you aware about it. An essential aspect of the awareness campaign about the pink tax revolves around publicly bringing to attention to examples of products and services of companies that charge pink tax. When consumers of such companies learn about the gender-based price discrimination that they themselves fell prey to, they feel more inclined to demand justice and support the pink tax revolution.

- Do your research on product pricing, packaging and purchase your products carefully.

- Support gender-neutral organizations.

- Buy gender-neutral products.

There is a need for companies to adopt transparent pricing policies and to take accountability for their actions. Elimination of pink tax will be a step forward towards gender equality.

. . .

References: