Hundreds of start-ups are initiated by entrepreneurs every day and funded by an affirmative speculator who makes money available for innovative projects. Every start-up has its own story be it a success story or a failure one. Some enter the market with good response but fail to attract users or customers for a longer period of time and some remain on an average scale throughout their life. We have seen several success stories but none of them have the potential to arrogate the five tech giants Facebook, Netflix, Apple, Amazon, and Google in their corresponding markets.

These tech giants have a huge impact on users across the globe. Each of them has observed the corporate world closely and made the act of pursuing to overtake it.

Apple has a market capitalization of $2.235 trillion; Amazon has $1.76 trillion of net worth. On the other side, Facebook has a total worth of $961.30 billion and Netflix with $225.61 billion, and Google with $1.69 trillion. These big techs together have a market capitalization of $4 trillion.

What do you think can be the reason for their success? Is it luck? No, there are several important reasons for the growing market dominance of digital platforms which may result in a highly concentrated market.

This write-up scrutinizes the fundamental five reasons for the concentrated digital market.

1) Two-sided markets and network effects:

Two-sided market means when both vendee and vendor are convinced to interchange commodity or service. These two user groups act together as a platform that benefits both of them. For example; Amazon connects buyers and sellers, Google connects people with a lot of information to gain any kind of knowledge.

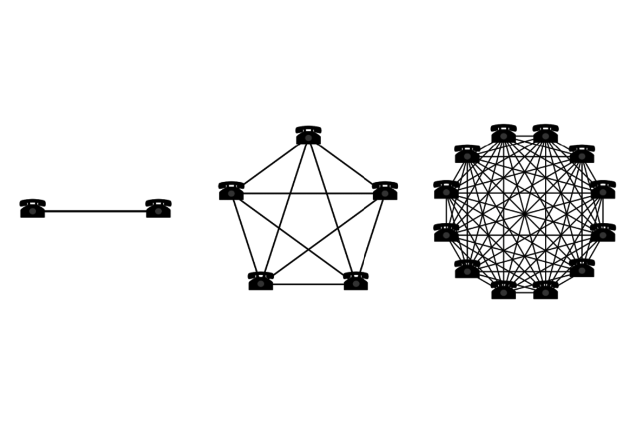

This kind of market is described by network effects. There are two kinds of network effects:

• Direct Network Effect: Direct effect means an increase in the worth of a commodity, service, or platform with the increase in the number of users, resulting in the growth of the network. For example, Social media platforms like Facebook attract more users and increases their value.

• Indirect Network Effect: Indirect effect means an increase in the utilization of a product or service results in an increase in the worth of an anonymous product which successively increases the value of the original one. For example shopping sites like Amazon where both vendor and vendee get benefited by each other.

2) Economies of Scope:

It means the reduction in the cost of one product by increasing the production of the subsequent products. It occurs when a firm produces a huge variety of products one behind the other that becomes more cost-effective than producing each product independently.

Services can cut down prices and raise essential attributes by engaging across the distinct corresponding markets. Intrinsically, services can increase concentration across markets and make an ecosystem.

3) Economies of Scale:

It means a commensurate reduction in prices derived by an increased grade of yield. For example, Mergers may result in economies of scale.

Economies of scale are confined to the physical markets only because there is no such force of control in digital markets. Digital markets are described by high non-value-added costs and the low cost of adding a user to the platform.

Monetary value decreases as the number of buyers increases. This promotes the distribution of a market among the participating companies worldwide.

4) Switching Costs:

It refers to the costs, experience by users on switching brands, vendors, or commodities. Switching costs are economic in nature. It is a matter of competition when users switch amid platforms or use several platforms at a time.

Switching costs and digital markets are circumscribed by several elements like:

• Loss of feedback

• Loss of personal data

• Inertia

These factors show the consequence of restricted switching and increase concentration.

5) Data-driven incumbent advantages:

When tech ventures hold the grip in the market, they compile, examine, and conglomerate customers' data and use it to ameliorate the standard of product or services they render.

This process creates circumstances for the required firms’ concentration and forbids an effortless approach to the marketplace to the novel commodity.

Although these factors are present in physical markets too, the concurrent presence of all these factors in digital markets leads to reduce competition and higher concentration.