Post-COVID-19 pandemic, digital dependence in India has increased manifold. The healthcare, real estate, banking, and insurance sectors have witnessed an inevitable surge in digitization. Digitization in the underwriting and distribution of products has catalyzed the growth of embedded insurance in India. Embedded insurance is an upcoming trend in India’s InsurTech industry with long-term growth potential.

What is Embedded Insurance?

Embedded insurance is the bundling and sale of customized micro-insurance products. Embedded insurance coverage is offered to customers while purchasing a product or service. Thus, it is a real-time insurance offer at the point of sale. Embedded insurance gives respite to customers who are either ignorant of or don’t want to explore insurance coverage.

Embedded insurance, a sub-domain of embedded finance, isn’t an entirely new practice. For instance, bancassurance has been around for the last 50 years, starting in France. Bancassurance is a partnership between banks and insurance companies, enabling insurers to sell their services to the banks’ customers through bank agents. The banks’ branch networks are significant in bancassurance. The use of embedded insurance products has seen a spike in India owing to the global pandemic and the consequent lockdown.

Growing Popularity of Embedded Insurance

A broad range of sectors has adopted the model of embedded insurance in their products and services. Some practical examples include:

- Hospitality companies offer host guarantees and protection coverage

- Online or in-store insurance for electrical appliances while checking out

- Travel agencies offering insurance at the time of booking a flight

- Rental companies offer insurance coverage at the point of sale

- Options of extended guarantee on a new handset

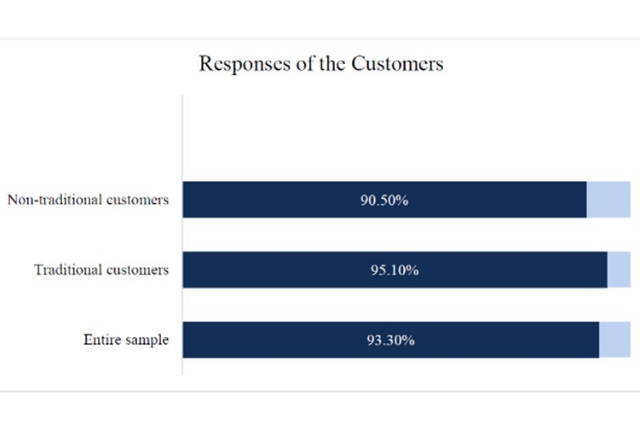

In 2021, Momentive.ai conducted a survey commissioned by Cover Genius, a leading InsurTech company, to gauge the reaction of bank and fintech app customers to embedded insurance offers via real-time transaction data. The report covers the responses of 574 traditional and digital bank customers from India. The survey asked the following question:

“In the future, would you prefer to receive insurance offers from your primary bank, based on your transactions, as opposed to externally sourcing coverage from an insurance carrier, insurance broker, or personal financial advisor?”

The responses to the survey show that 91% of Indian non-traditional or digital insurance customers would be interested in receiving embedded insurance offers, which also includes customers who did not purchase insurance. 95% of traditional customers would also opt for real-time embedded insurance offers based on their transaction data.

The survey also asked the reason for allowing banks to make these offers. To this, about 63% of the respondents stated that ‘Convenience’ is the chief driver of their interest. Another key finding of the survey is that 95% of the Indians opting for a traditional insurer in the last 12 months would prefer embedded insurance offers in the future.

The embedded finance industry also has high growth prospects. As per the February 2022 report by Research and Markets, India’s embedded finance business may grow 46% annually. The revenues from the industry will increase from INR 36,694.50 crores in 2022 to INR 1,61,442 crores by 2029.

Digitization of Insurance Industry in India

Over the years, the insurance industry in India predominantly functioned through manual effort and paperwork for offering policies and claim settlements. The global pandemic brought disruptions to the traditional insurance industry in India. Not only did the customers face issues in getting their claims settled, but it was also challenging for the insurance companies to manage customers’ grievances. The setback has called for the intervention of technology in the insurance market. The distribution of insurance policies has mostly turned digital in the post-pandemic scenario. Digitalization in insurance has been possible via InsurTech, which includes AI and machine learning, IoT, data analytics, and automation.

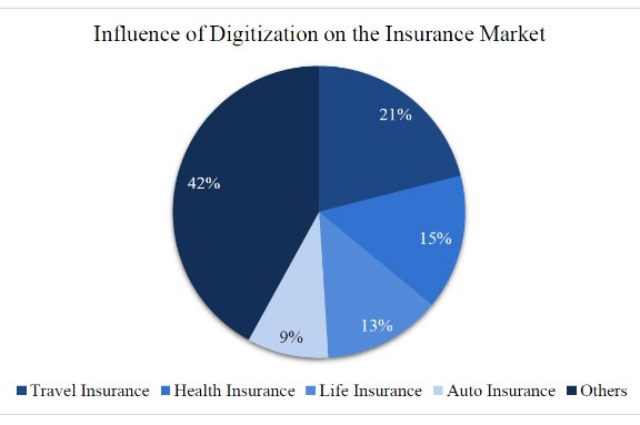

According to a report by Mordor Intelligence, the influence of digitization on Indian policyholders is:

- Travel insurance (21%)

- Health insurance (15%)

- Life insurance (13%)

- Auto insurance (9%)

The report also states that new insurance sales, amounting to approximately INR 80 billion, are digitally influenced. Also, it projects that the online insurance market in India will reach around INR 220 billion by 2024.

Impact of Embedded Insurance on the Insurance Market

Embedded insurance is a significant tool for insurance companies and tech players to promote the penetration of the insurance industry in the unexploited Indian market. The underserved areas, particularly the rural ones, have been foreign to the entire concept of insurance.

With the growth of the InsurTech industry, embedded insurance has a role to play in digitalizing the insurance sector. Embedded insurance makes the process of buying and selling insurance coverage simple. It endeavors to bridge the trust gap between digital services and insurance policies. Besides, the tech-savvy generation finds digital insurance more accessible.

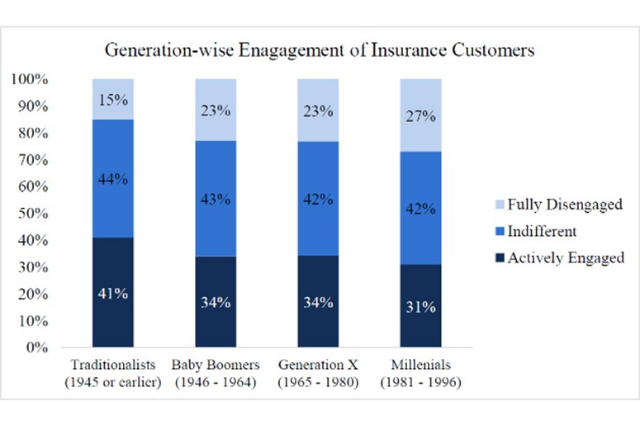

As per Gallup, millennials are the least contented with the existing digital insurance options. However, millennials are twice more likely as other generations to buy online insurance. In other words, millennials are least likely to be engaged with their primary insurers.

Some of the facets that have driven the popularity of embedded insurance in the Indian insurance sector include the following –

- Customized Plans: Underwriters track customers’ data to create personalized, relevant, and reasonably-priced insurance coverage plans. Product managers can also adjust the features and pricing of the plans if they are not feasible. Thus, there is a greater sense of flexibility, creativity, and innovation linked to embedded insurance.

- Minimal Cost of Customer Acquisition: The effective customer acquisition cost is low as embedded insurance goes with an already existing product. The minimal cost ultimately lowers the premium paid by policyholders, thereby attracting more customers.

- Approach to the Rural Market: Embedded insurance provides access to the rural and underprivileged markets leading to greater penetration of the insurance industry as a whole. The inaccessible segments were previously not penetrable by traditional insurers.

- Efficient Claim Settlement Process: Policyholders’ claims are less likely to be rejected as the data collected from them is verifiable and precise. The settlement also becomes hassle-free as the insurer can evaluate the available information.

- A Win-win for all Stakeholders: Embedded insurance benefits insurers, customers, and tech intermediaries. It provides a way more effective channel of distribution, thereby obviating commission payments and customer acquisition costs. Insurance companies offer coverage for customers at the time of making a purchase. Serving an offer exactly when it is most relevant to customers increases conversion rates. Digital players get greater access to the risk data, which helps them create more customer-centric products.

The Road Ahead

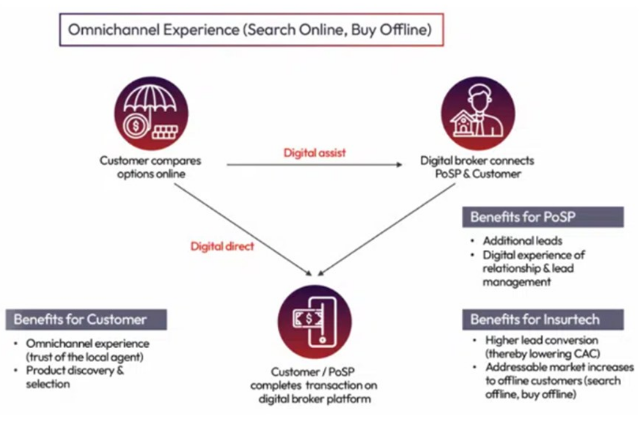

According to Redseer, about 43% of the premium underwritten in India in FY21 is attributable to InsurTech. Omni-channels and technological interventions will be the cornerstone for the penetration of the InsurTech industry in India. Companies like Ola, IRCTC, Amazon, and MakeMyTrip have already adopted the insurance-in-a-box model in their core businesses. Over the coming years, the InsurTech industry will focus on collecting data via gadgets and wearables to frame efficient embedded insurance policies. Above all, embedded insurance is a fundamental instrument for insurers and intermediaries to stimulate the penetration of the insurance industry in the untapped Indian market.

. . .

References:

- https://www.investopedia.com/terms/b/bancassurance.asp

- https://campaigns.covergenius.com/embedded-insurance-india

- https://www.researchandmarkets.com/reports/5547708/india-embedded-finance-business-and-investment

- https://www.mordorintelligence.com/industry-reports/online-insurance-market-in-india

- https://news.gallup.com/businessjournal/181829/insurance-companies-big-problem-millennials.aspx

- https://redseer.com/newsletters/key-trends-that-are-shaping-insurtech-in-india/