The Unified Payments Interface (UPI) is a payment system developed in India. It is also known as a Virtual Payment Address (VPA). The UPI IDs have revolutionized the method of transactions, making them fully digital without the need to visit banks as was traditionally required.

In June 2025, the UPI system facilitated around 18.39 billion transactions. It connects 675 banks serving 65 million merchants and 491 million people. With these huge numbers, the system has now been recognized globally as a leading digital payment platform in various countries.

The UPI ecosystem has a wide range of applications, being part of 77 applications, including Google Pay, Paytm, Amazon Pay, WhatsApp, and BHIM.

In 2016, UPI was launched by the National Payments Corporation of India (NPCI) as a groundbreaking payment system. Since its launch, it has continuously expanded, providing a user-friendly experience. What makes the UPI system so loved by people is its empowering nature. It includes the most marginalized communities and sections of society. Small businesses, shops, vendors, and rural areas have all received beautiful benefits. The UPI system has acted as a catalyst for the economic growth of the country. It has promoted cashless transactions, increased digital payments, and expanded financial bandwidth.

What Makes UPI Unique?

- Instant: The UPI system offers instant, real-time digital payments. It is open 24/7 virtually. For consumers, the biggest value addition is that their time is being respected.

- Simplified Transactions: For merchants, the UPI system has simplified transactions. In India, even small shops and vendors use UPI. It has empowered them with their finances. The comfort they have gained through this is incredible.

- Digitalization: The UPI ecosystem is a huge leap in the world of digitalization, including people nationwide from small towns to big cities. UPI aims to provide easy, fast, and secure payment experiences, which can make India a 'less cash' society.

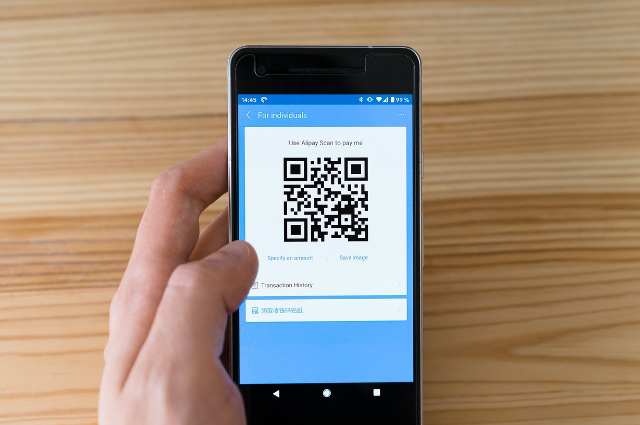

- Payment Through QR Codes: The use of QR codes has completely changed the way transactions are conducted in India, whether you enjoyed a chai at a nukkad on the streets or are enjoying dinner at a restaurant. You can find the payment QR code, making payment convenient for you.

- Cashless Payments: No hustle, no running to the ATMs. The UPI system offers cashless payments at your fingertips.

- Connection: The UPI payments form a unique connection between banks, customers, and merchants. It has become convenient for all three of them. There is no credential sharing due to the virtual ID. It is safe, secure, and innovative.

- Reduces Burden: This system has reduced the burden of carrying cards and cash, making shopping and traveling far easier.

- Social and Cultural Impact: The mindset of people has changed from cash payments to cashless payments. It has reduced dependency on wallets and cards. The older generation is also participating in this, which is the most wholesome thing to witness. They are learning to make payments using their phones.

Challenges: While UPI has a number of advantages, it also has some challenges.

- Technical Glitches: Technical glitches sometimes create problems for consumers and merchants.

- Cybersecurity Threats and Fraud: The UPI system is prone to fraud and scams. It is disheartening to see that something so useful could also be misused by people to scam others. We need more alertness and awareness regarding scams and fraud. We should avoid payments to unknown QR codes and visiting unsecured websites for payments.

- Digital Illiteracy: Digital literacy is a significant challenge in this highly populated country. The statistics indicate a very small percentage of the population is digitally literate. Urban areas show higher literacy compared to the rural areas of India.

- Poverty: Poverty is also a dominating challenge on the path of digital payments. Most people do not have access to smartphones, an internet connection, and connectivity. This creates a gap in the economy.

Government Initiatives:

The various initiatives by the government to push India further in the area of education and digital literacy have helped in the promotion of digital platforms for payments. Programs like the National Digital Literacy Mission and Pradhan Mantri Gramin Digital Saksharta Abhiyan have been launched to offer digital literacy and skills in rural areas. This will make the UPI ecosystem stronger, building a foundation for a global phenomenon.

The continuous expansion of UPI in India has pushed it beyond the boundaries of the country, allowing it to enter the horizons of the global market. Slowly, it is reaching both the rural areas of the nation and cities across the globe. To leap further, which has already started with the use of UPI in countries like Nepal, Singapore, Mauritius, Bhutan, Sri Lanka, and the UAE, we need to further strengthen the security of payments. We also need to expand through education, awareness, and digital literacy. We need to bridge the gaps and the divisions on the road to digital payments.

“Technology is best when it brings people together.” – Matt Mullenweg, Founder of WordPress.

UPI in India is an innovative revolution, a boon for the people, and an impactful social change. It has demonstrated India's potential to leap into the world of digitalization on a global platform. India has seen a journey from cash to QR codes. The true purpose that UPI serves is in connecting the nation, empowering the individual, shifting the financial mindset, and putting the hard-earned money of rural workers into their hands.