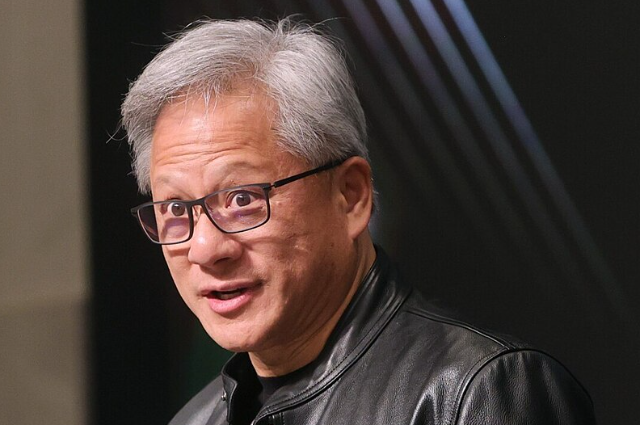

A chronicle of Jensen Huang’s relentless execution, where money chased discipline and adaptation, not mere inspiration.

Shining Like a Golden Crown

Shining like the golden crown, NVIDIA touched the mark of $4.1 trillion in evolution, making it the richest company in the world. Did it happen suddenly, or was it a sequence of visionary ideas, well executed by Jensen Huang and his team, which made their grueling journey from the ashes to the top? Their competition was Microsoft, which had already lured game developers to its models. NVIDIA, meanwhile, had a pact with Saga over their N1 chip, which severely failed. Nearly a quarter of a million units were shipped, but almost all were returned. The idea of a unified graphics chip was still attractive, but investors and customers were fleeing.

Refusing to Be Defined by Failure

What kept NVIDIA alive was not the elegance of the design, but Huang’s refusal to let the collapse define the company. This reflected his intent and dedication—a vision to make his dream a reality. Huang and his colleagues cut costs, canceled extensions of the failed design, and gathered their engineers to start working on a new chip. In 1997, they released the Riva 128, a straightforward but highly compatible graphics processor. It sold a million units in four months and restored solvency. The money arrived only after the team proved they could learn from failure and deliver what buyers actually wanted. Going public in 1999 gave NVIDIA the capital to keep building. They poured resources into research, releasing the GeForce line, steadily outpacing rivals like ATI. But more important than any single chip was the mid-2000s decision to create CUDA, a software platform that allowed programmers to use NVIDIA GPUs for general computing tasks. This was not just an idea—it was years of engineering discipline, developer outreach, and careful execution. CUDA turned NVIDIA hardware into a tool for scientific computing and later for training artificial intelligence models. Capital followed, but NVIDIA built an ecosystem, trained developers, and maintained relentless performance improvements.

Navigating the Volatile Market

By the early 2010s, the company faced a volatile market. Smartphones threatened desktop graphics dominance, competitors seized contracts, and global chip cycles could wipe out profits overnight. NVIDIA’s leadership stayed fixed on execution. They doubled down on data center chips, invested in machine learning hardware, and created software support that locked in customers. Every quarter, investors could see the steady progress and trust the long-term vision.

Prepared for the AI Explosion

When AI began its rapid rise after 2010, NVIDIA’s years of preparation paid off. Their GPUs were the only widely available hardware capable of training the largest neural networks. Demands came from cities, cloud providers, and every major technology company. Later, NVIDIA’s Blackwell architecture became the backbone of AI data centers. Revenues soared, and by 2020, the company’s market capitalization passed $1 trillion. Within two more years, driven by unrelenting AI demand, NVIDIA reached $4 trillion, becoming the largest company in the world. Through every phase, the pattern repeated: the original idea of powerful graphics processors was never enough. Money arrived only after the team addressed manufacturing bottlenecks, rewrote software stacks, and negotiated with partners to trust their roadmap. NVIDIA’s near-bankruptcy after the N1 was not a failure of imagination—it was a failure of product-market fit. The eventual dominance was not a triumph of abstract concepts, but of human adaptability and vision: a vision that transformed a dream into reality.

Lessons in Capital, Persistence, and Discipline

The story underlines the largest truths about capital flows, market rewards, execution, persistence, and discipline. NVIDIA’s success shows that the founder did not merely invent; he listened, cut losses, pursued investors, and kept the engineering team motivated through lean years. Bold moves like creating CUDA were sustained efforts involving training, documentation, and evangelism long before the payoff arrived. By 2025, NVIDIA stands as the most valuable company in the semiconductor industry, but its success is still bound by the same principle: vision and clarity. The seed of innovation matters, but it does not command capital on its own. Money flows only when people demonstrate that they can translate an idea into a product that fits the world as it is. NVIDIA’s story is messy, human, and inspiring. Every failure taught a lesson. Every small victory built trust. The company’s growth is not about sudden brilliance but repeated choices: focus, humility, execution, and persistence. Ideas alone do not create wealth—people turning those ideas into products and ecosystems do.

The Proof Is in Execution

Riva 128 proved that simplicity, compatibility, and reliability could restore faith. GeForce demonstrated that incremental improvements matter. CUDA showed that investing in ecosystems and communities multiplies the power of hardware. Data center chips and AI investments illustrated that long-term vision beats chasing short-term trends. Capital does not reward elegance; it rewards proof. NVIDIA survived near-collapse because it could demonstrate to the world, over and over, that it could deliver. Markets, investors, and developers all followed, but only after results were visible. By the time the company reached $4 trillion, its success was not a surprise—it was the natural outcome of disciplined, persistent human effort.

The story of NVIDIA teaches that money follows people, not ideas. Ideas are potential, but execution transforms potential into reality. Adaptability, learning from failure, and relentless focus on what the market actually values are what turn a fledgling chip company into a global empire. Vision is the spark, but execution is the flame that lights the world.

A Human Empire Built on Ideas

NVIDIA’s journey proves that innovation is a human story. It is about leadership that refuses to be defined by setbacks. It is about engineers who learn, adapt, and persist. It is about a team that transforms abstract ideas into concrete tools that the world cannot ignore. Every quarter, every chip, every line of code, and every interaction with developers contributed to the empire NVIDIA became. The company’s rise is a reminder that money does not chase ideas in isolation—it chases humans who turn ideas into reality.

Vision starts the journey. Execution sustains it. Adaptation ensures survival. And only when those three forces combine does money follow. NVIDIA’s story is proof that the wealth of ideas is unlocked not by imagination alone, but by human persistence, learning, and relentless action.