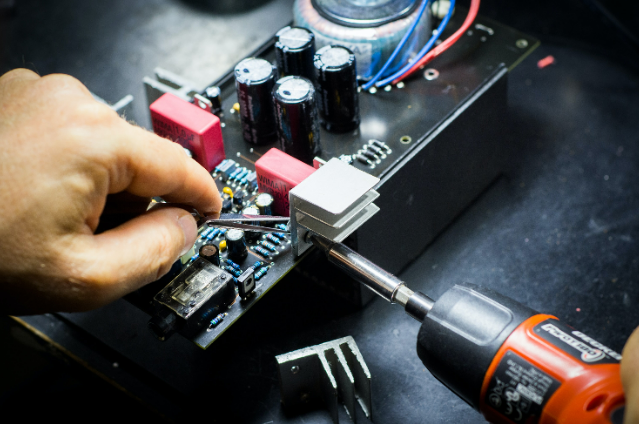

Photo by Blaz Erzetic on Unsplash

India's trade policy has been propelling Vietnam's electronics manufacturing industry, creating a significant advantage for the Southeast Asian nation. Items, like printed circuit board assemblies, camera modules, touch-screen displays, and glass covers, make up a substantial portion of the cost of producing smartphones. Vietnam, known as the world's second-largest handset exporter following China, secures these components and more at zero tariffs through free-trade agreements. However, India, which aims to emulate its neighboring manufacturing powerhouse, lacks comparable trade accords and imposes customs duties as high as 22%. This discrepancy in trade policies has led to a cost disparity of 4% for manufacturing mobile phones in India, according to a recent report by the India Cellular & Electronics Association (ICEA), an industry organization.

Despite India's efforts to offset its existing cost challenges like inadequate infrastructure and bureaucratic hurdles through production-linked incentives (PLI), the country's customs duties still create a competitive disadvantage. The PLI scheme offers incentives to manufacturers by reimbursing them with 4% to 6% of their incremental sales over a five-year period. However, this approach has been critiqued by the ICEA report, which suggests that India is first undermining its own competitiveness and then compensating companies to establish factories within its borders. Alternatively, the incentives are being financed indirectly through increased taxes generated from the same sector. In other parts of Asia, the focus has shifted to semiconductors, critical components in communication, transportation, and artificial intelligence.

Countries like Thailand, Singapore, and Malaysia are vying to become hubs for front-end chip manufacturing. While India is making efforts to enter this space through packaging and testing, these initiatives have yet to yield significant results. However, India is already emerging as a rising contender to Vietnam due to its cost-effective labor force, particularly in low-value-added activities like electronics assembly. The Ministry of External Affairs (MEA) reported that bilateral trade between India and Vietnam reached US$11.12 billion during the fiscal year from April 2020 to March 2021. Indian exports to Vietnam amounted to US$4.99 billion, while imports from Vietnam totaled US$6.12 billion.

India has transitioned from being a net importer of handheld devices to a net exporter. In the larger context of Asia, the competition revolves around semiconductor manufacturing, while India strives to establish itself in the sector through packaging and testing. Although progress in this area is yet to be fully realized, India's cost-efficient labor market has already positioned it as an emerging rival to Vietnam in electronics assembly.

. . .

Reference: