Finance Minister of India Nirmala Sitharaman presented the Union Budget 2021-22 in the Parliament with significant changes in taxation process, manufacturing activities and other crucial aspects. The COVID-19 pandemic has forged chaos in the nation and it is proceeding to assert lives and finances and hence the government is ensuring that the losses are minimized and future strategies are arranged according to the fast-changing global dynamics. However, this global pandemic includes the possibility to formulate India's much-perceived direction into the manufacturing sector, because it is one of the worst impacted sectors in India. With Budget 2021, the government would cover incentives and additional new schemes to instill modern life and to facilitate overseas funding in this sector which can support in generating employment. In past, the force of the government to advertise manufacturing and exports has been on Special Economic Zones (SEZs), Export Oriented Units (EOUs), Export Promotion Capital Goods (EPCG), and many others schemes. Additionally, some previous schemes of government had been challenged by the United States before the World Trade Organization (WTO). Now, the primary focus of the government has presently shifted to manufacturing in Customs Bonded Warehouses (CBWs).

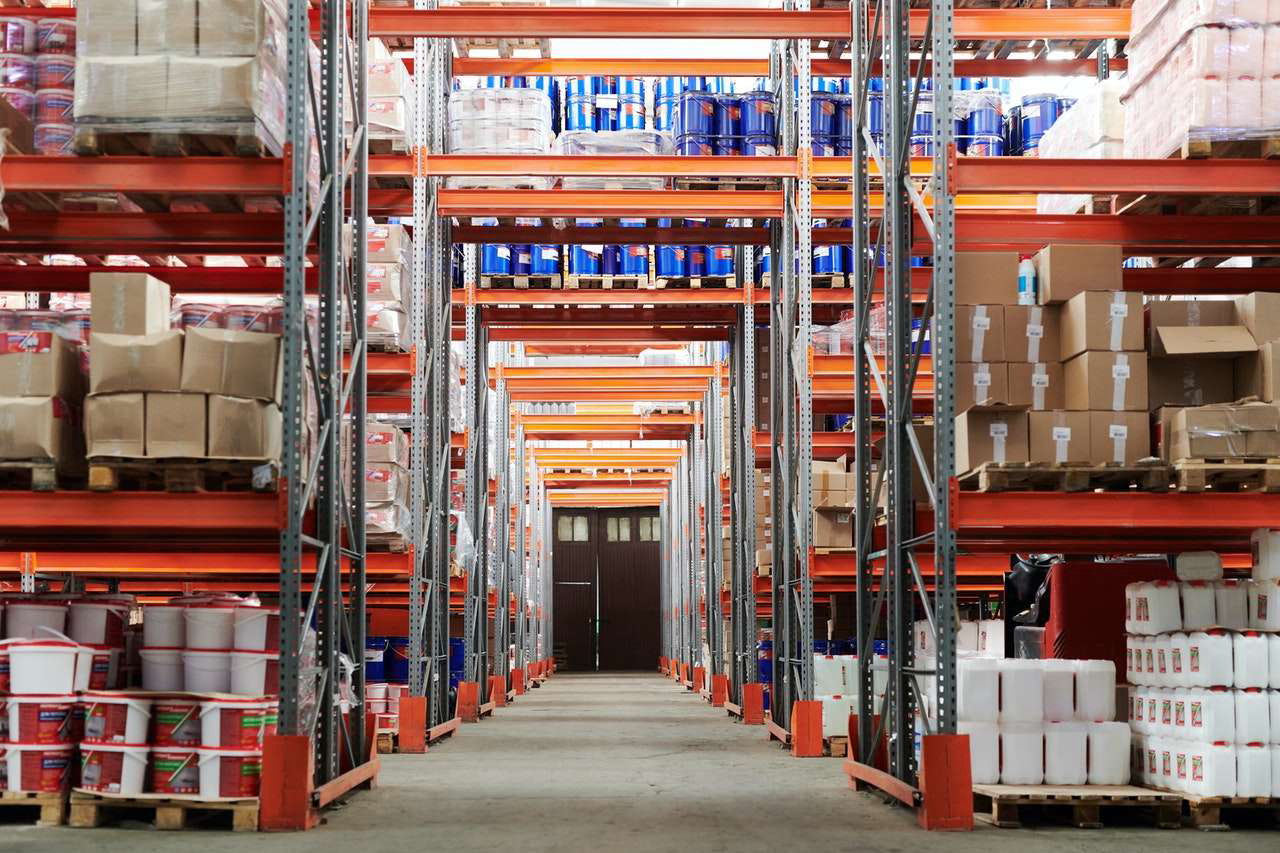

A Customs Bonded Warehouse is a steady setting at which you can stock, export and import goods. Imported cargo must be scanned and authorized by Customs agents before they can be transmitted to its destination. The major difference goes down to the warehouse's relation with Custom's, and under the CBWs scheme, manufactures are permitted to import duty-free goods for undertaking manufacturing in CBWs. But when the imported cargo is stocked in a non-bonded warehouse, the importer must instantly pay taxes on the goods and have them examined no matter where they are taking off next. According to the Economic Times, the in-bond manufacturing course of CBW was virtually productive when undertaken under a scheme of Foreign Trade Policy (FTP). And accordingly, moving to the demand of trade, the Central Board of Indirect Taxes and Customs (CBIC) specified to free up manufacturing under bond from the regulatory framework of FTP in 2018. To make the employment of Customs agents a little easier, they work with certified, Customs bonded transportation and warehousing services that can receive and hold the goods until duties and assessments are dealt with.

A Customs bonded warehouse is periodically administered by Customs officials, which authorizes exporters to hold off their payments until goods are paid for. Accordingly, manufacturing under Customs bond has presently grown to be a separate scheme, entirely different from other schemes of FTP, and it can open distinct doors of modern possibilities in the Indian economy. Custom Bonded Warehouses are responsible for payment on imported items rooted in completed product and GST payable on providing finished goods, with duty implications on exports. According to Deloitte Touche Tohmatsu India LLP, the CBIC has issued new regulations and circulars, and one of the most receptive circulars was the one issued in October 2020, in which it was clarified that a Customs bonded manufacturing unit can carry out job work for different models. Moreover, the CBIC has also clarified via its Frequently Asked Questions (FAQs) that a unit holding 100% home gross sales can be eligible for this scheme, no bodily management of Customs on everyday operations and in-bond manufacturing models can be eligible to export advantages under FTP.

These benefits would assist in offering the required force to the mentioned scheme and would assist the government in reaching its goal of constructing India as a producing hub and appeal to new funding into manufacturing. However, one of many aspects that needs an overview to make sure that producers or buyers can undertake the scheme with confidence, is for reasonable modifications to be prepared to the Customs Act to present impact to the current circulars and FAQs. A related manufacturing facility can be utilized for home provide in addition to exports in CBW. Trade expects that appropriate relaxations or clarifications are provided to permit the promising thing about depreciation on capital items at the time of elimination, single invoice of entry for all consignments opened from unit throughout the day and whether or not pure service models can be eligible for the scheme. Deloitte Touche speculates that if any statement to existing impact to the aspects captured above will help allocate trade uncertainties and point out the CBW scheme amongst producers and exporters. Presently when the global dynamics are adapting the schemes like CBW, conditions are favorable and if the Indian government takes the right advantage of this opportunity then it can drastically shift its monetary objectives.

______________________________

Reference -

- www.taxathand.com

- www.m.economictimes.com