Introduction

Founded in 2015 by co-founders Abhay Hanjura and Vivek Gupta, Licious is a meat and seafood e-commerce company tapping into the $30 billion Indian meat market. This Mayfield Capital-backed start-up has witnessed a 300 % rise in revenue and a six-fold increase in customers over the course of 6 years and has projected a sound growth trajectory for the years to come. According to an analysis by IndiaSpend and FactChecker 70 % of Indian women and 80 % of Indian men consume non-vegetarian food. However, despite the huge market demands the meat and seafood industry in India lacked a reliable brand and was a highly decentralized, unorganized industry, usually associated with lack of hygiene and sanitary practices. Meat being a highly commodified item, the founders focused on modelling an actual brand, rather than an online e-marketplace. The result was Licious.

Business Model And Supply Chain

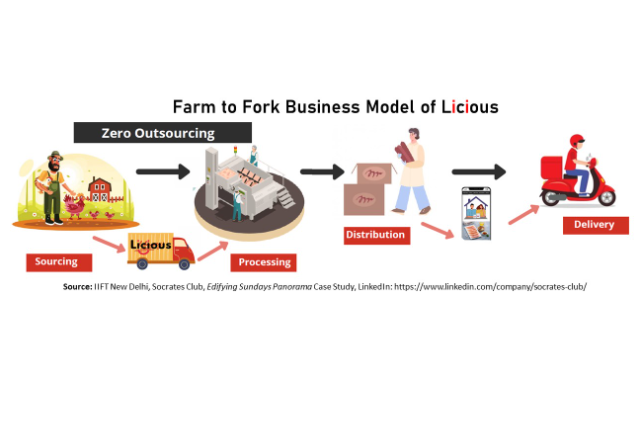

When it comes to business, it is often the simpler models that outshines the others in terms of success. Licious follows the farm-to-fork business model with end-to-end services which includes procuring fresh meat directly from the farmers, its processing, storage and delivery to the consumers. It works directly with the farmers on a contract basis and lays down strict protocols with respect to caring for the livestock, feed rations and breeding. They own the entire back-end supply chain and cold storage facilities with no third parties involved, thus enabling better quality control. The products are processed in currently 5 processing centers across the country: Hyderabad, Mumbai, Gurugram and two of them in Bangalore. They have 90+ delivery centers (DCs) with cold storage facilities catering to 12 cities across India.

Licious follows a D2C (Direct to Customer) model which ensures that the company has a 20-40% profit margin. This has ensured Licious to gain complete ownership of customer data, thus gearing innovations towards better customer satisfaction and customer retention.

Zero outsourcing was the secret sauce for this delicious company. In its initial stages the company outsourced most of its customer care operations. However, it emerged as a flawed decision as they couldn’t respond to the customer’s queries due to lack of knowledge of the products. Now it has an entire team dedicated for this purpose who are specifically trained in all aspects related to meat and seafood. Objectively speaking, the major efforts undertaken to own the entire supply chain with zero outsourcing has ushered a better customer response and increased customer loyalty to the company. Meat is a highly perishable commodity that stays fresh for only 24-36 hours. The company has stressed on the freshness factor and has ensured a temperature of 0-4℃ for its entire cold chain logistics. For the cities like Jaipur, Coimbatore, Vijayawada, Visakhapatnam and Kochi where there are no processing centers, the company relies on AI-based demand supply algorithm to forecast the quality that needs to be shipped to these cities. Zero outsourcing also means that the 90+ delivery centers are operated by trained employees who know appropriate handling procedures for the products.

Funding, Revenue and Finances

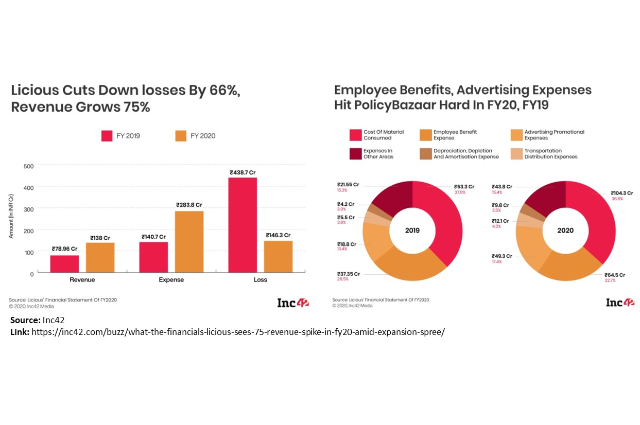

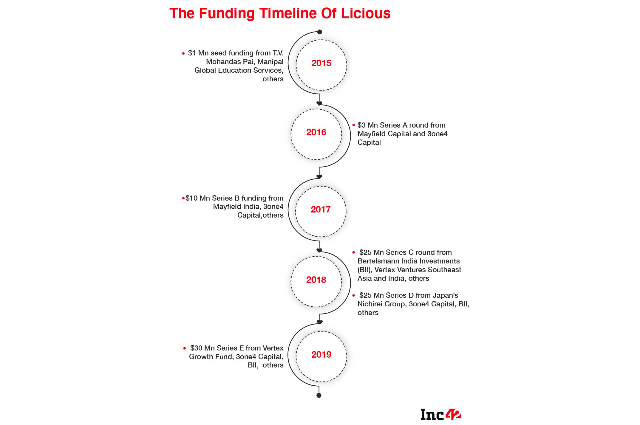

Since its inception in the year 2015, Licious has clocked a 300% YoY growth with its annual revenue increasing almost by 75 % from INR 78.96 Cr in FY2019 to INR 138 Cr in FY2020. According to the annual financial statement released in 2020, its revenue grew by six times from May to December 2020. According to the statement, an average customer orders about 2-3 times from them in a single month. Another significant achievement of Licious is they were successful in reducing their losses from INR 438.7 Cr by 66% to INR 146.3 Cr in FY2019-20.

Revenue: About 91 % of revenue or INR 125.3 Cr of the total earnings came from direct sale of meat and meat products, seafood, marinades and eggs. The rest of the revenue was contributed by the companies returns on investments and other financial instruments. The company earned a return on investment of 76 % or a total of INR 3 Cr from an investment of INR 1.7 Cr in the FY2019.

Expenses: Expenses geared towards infrastructure maintenance was low for the FY2020. The transportation and distribution expenses increased from INR 5.5 Cr in FY2019 by 120 % to INR 12.1 Cr in FY 2020. Power and fuel costs saw an increment of 76 % to INR 3.9 Cr, machinery repairs increased by 109 % to 2.3 Cr and information technology spending increased by almost 200% during this period to about INR 5.1 Cr. The company spent the most on material consumption which was 36.8% (INR 104.3 Cr). Since it has hired more 1500 employees, the employee incentives clocked to 22.7% (INR 37.35 Cr). It also ramped up their expenses by 162 % in advertisement and marketing campaigns which accounted to INR 49.3 Cr. This was the entire detailed expense statement for the company for the FY2020.

Conclusion

The company has come a long way but is still a lot to achieve yet. The company is set to expand to all tier I and tier II cities in India by 2025. The company is working to reach to more customers who have not even heard the name of the company. It has achieved a completely visible and transparent supply chain by not outsourcing anything, thus optimizing better customer services and delivery timings. It has also solved the problems of last-mile delivery and back-haul problems with suitable use of AI-based forecasting systems, thus better bridging the gap between supply and demand. Overall, Licious was successful in finding its own niche of business. It introduced a new concept in the Indian Meat Industry for other startups to follow and has become a classical example for case studies on recent agri-business startups.