Introduction

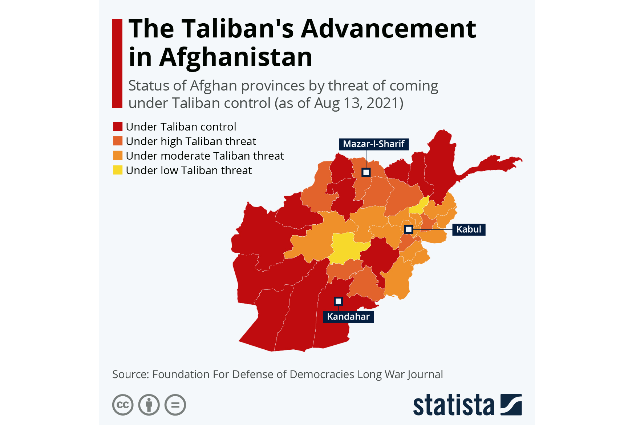

The swift return of Taliban in Afghanistan after nearly two decades has already send ripples in the world economy, jinxing trade and commerce in its immediate neighbors, including India. Although the far-reaching cascading effects of this shocking political development cannot be predicted by mere extrapolation of available data into the future, its economic effects on the world economy can be summed up in one word— uncertainty. While immediately disposing off all positive predictions, it has introduced several volatile variables in the equation, enough to upset the delicate balance of commerce. Prosperity may have been promised in Kabul by the rebelling Taliban, but the unfeigned substance of such proclamations only catalyzes the amplification of the economic problems that plague the developing countries.

Economic Impact on Afghanistan

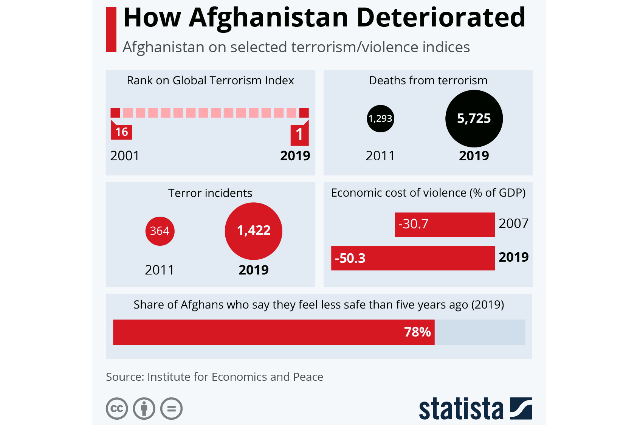

With the advent of clouds of uncertainty looming over the future of the country, its economic prospects look bleak. It is still one of the poorest countries in the world with a GDP of about $20 billion in 2020, with the country’s 90 % of the population surviving on a bare minimum of less than $2 per day! With Taliban returning to the helm of political power again, it is debatable whether the nation would find ways to thrive economically. The current economy of the country is on the verge of collapse, which further threaten to alleviate an already existing humanitarian crisis. A shortage of cash and money was caused on 15th August 2021 when the militant powers forced the banks to freeze their operations completely. A country is considered aid-dependent when foreign aid constitutes more than 10 % of its GDP. In Afghanistan’s case it is an overwhelming 40 %. When the Taliban seized control of the country, the western powers including Germany and the US, cut-off all financial aids to the country, thus knocking off a large chunk of the nations GDP overnight. One of the largest banks in Afghanistan, Da Afghanistan Bank (DAB) has its foreign reserves of $9 billion frozen by the US. According to Ajmal Ahmadi, the governor of DAB, most of these reserves are help in liquid assets like bonds, gold offshore in the US. This has further brought the economy to a standstill.

Economic Impact on India

Although India has been engaged in trade with Afghanistan, the total cumulative value of such exports only amounted to approximately $1.5 billion. India exports tea, cotton and pepper while importing dried fruits and nuts from Afghanistan. Ever since the Taliban has wrest control over the country’s government, the volume of exports from Afghanistan has reduced. In this scenario where trade isn’t exactly thriving off, a slight, inconsequential rise in the sale of dried fruits, dates and nuts can be observed in the future.

What concerns India more is the long-term implications of Taliban takeover. In the recent UN Security Council meeting, India announced to have extended $3 billion to Afghanistan for economic development of the Afghani people in the present predicament. Union Minister, Nitin Gandhari also declared the government’s will to continue India’s infrastructural investments in Afghanistan. Two options are available: to either maintain all supply chains open or slowly wean-off all interdependencies altogether. The last option, although unlikely to materialize, but the argument that anything is plausible seems to suit particularly well for the current socio-economic relations between India and Afghanistan.

A Silver Lining Perhaps

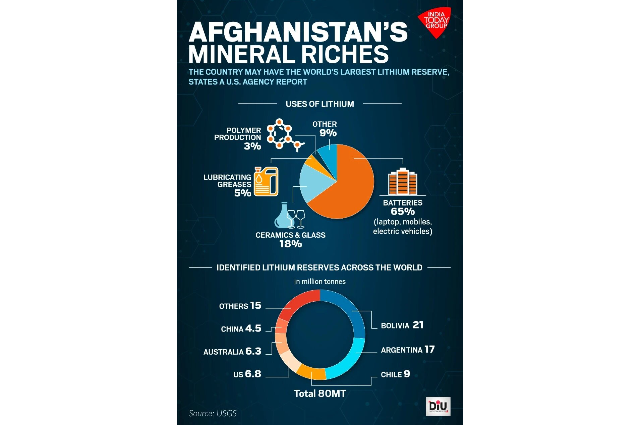

However, the economic impediments do not mean its curtains for the country yet. The now Taliban occupied Afghanistan is sitting on vast mineral reserves, which could be worth trillions of dollars. According to one report published by The Diplomat, Afghanistan holds 2.2 billion tons of iron ore, 60 million metric tons of copper, veins of aluminum, silver, mercury and gold and about 1.4 million metric tons of rare earth elements such as lanthanum, neodymium and cerium. The combined worth of such vast mineral reserves was estimated to be about $3 trillion, which may be an understatement, as the mineral reserves also include rare earth elements (REE), which can fetch higher prices. Global powers are also eyeing Afghanistan’s vast Lithium (Li) reserves, particularly because of its increasing importance in the global green and sustainable agenda. For the uninitiated, Lithium is the principal component in Li-ion batteries, which power almost all portable electronic devices including smartphones and electric vehicles. China has already mandated in 2020 that electric vehicles would constitute more than 40 % of all car sales in 2030, with the US and European markets indicating a keen disposition towards a transition in favor of electric vehicles. According to one internal memo in the Pentagon US, Afghanistan may have the potential to become the “Saudi Arabia of Lithium” if its Lithium deposits are exploited.

However, such potentials can translate to economically favorable outcomes only when the country’s administrators are willing to invest. Perhaps China’s amicable relationship with the Taliban can propel the industrial development in these aspects. Constant political turbulence juxtaposed with difficult terrain and harsh climate has become major roadblocks in tapping the latent potential of the country. Even if the administrators find a way to construct a trade based on the mineral wealth, the inherent uncertainty of whether the wealth generated would indeed tickle down to the general public of Afghanistan with Taliban at the top still remains an unanswered question.

Conclusion

While things could have been worse from an economic and humanitarian standpoint, what is going to unfold in the future will not only depend on the Taliban disposition, but also on the joint response of the United Nations and the international community in general. The complete loss of aids and overseas assets has already ushered a fiscal collapse as well as an enhanced food shortage which is likely to plunge Afghanistan in an economic catastrophe and mass exodus of its citizens to the neighboring countries. The real pinch of the economic turmoil may have been numbed by the intense political unrest, but is sure to become an historic economic crisis similar to Yemen, Syria or even Venezuela if not aptly controlled.