Introduction

Quantum theory is yet to find a human being who wants to live in a world where there is no hint of peace, equality and justice. The stressed importance of these virtues may appear exorbitant to everyone today but these were rare commodities in the past. Martin Luther King Junior is credited with the following words: “Injustice everywhere is a threat to justice everywhere”. At present, the global population has access to impartial justice irrespective of a plethora of differences like caste, race, gender. However little importance is given to the fact that it comes with a price tag. The availability of funds to summon the scales of justice is still a major barrier in the judicial and legal system. It is a characteristic of every modern economy that every problem can be successfully converted into a scalable business. Thus, to bridge the lack of funds with the required justice litigation finance came into being.

Litigation financing, at its core, is actually third-party financing to transfer the risks of court proceedings of the claimant to an organization. In this non-recourse type of finance, the funding entity is responsible to dispense monetary assistance to the party for litigation. The entity also expects a monetary incentive if the litigation is successive. Litigation financing covers all costs pertaining to commercial contracts, insolvency proceedings, court proceedings, arbitrage and anti-trust proceedings.

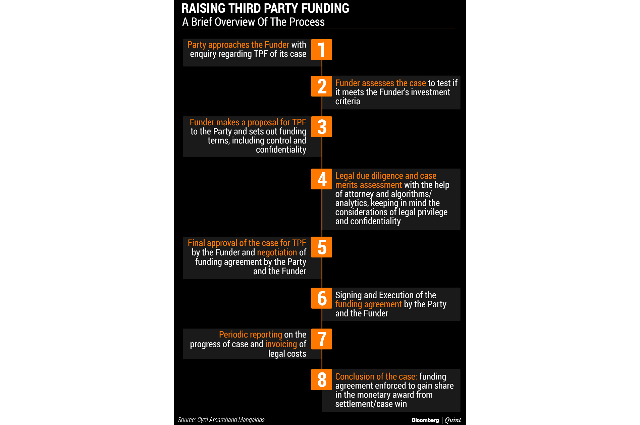

How the Gears Turn—The Process of Litigation Finance

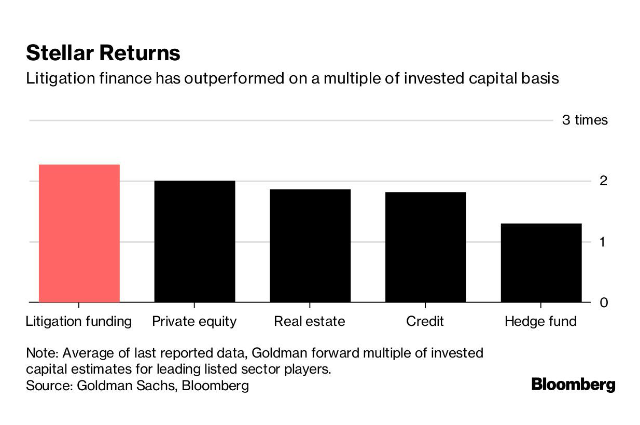

Contrary to the sophisticated terminology, litigation finance works on a very simple concept. The claimant who is not capable of funding his/ her litigation is helped by a third-party financer. They can include hedge funds, investment banks, insurances and so on. If the litigation succeeds, the financer charges a fee for its service and recovers the initial costs incurred. However, if the litigation is unsuccessful, the third-party financer walks away with no monetary benefits, thus indicating the risks in this sector. This is a game of probabilities and statistical tools are employed to determine the risks leverage in each litigation. On an average litigation financing can be a pretty profitable source for revenue generation. The return on investment is close to 4-5 times of the initial investments, often making it more profitable than stocks and hedge funds. Furthermore, they are not affected by external factors such as market trends and economic growths. Several key players in this segment include IMF Bentham, Burdford Capital LLC, Longford Capital Management, of which Burdford has the highest market capitalization of about USD 4 billion.

While it may be true that the concept of third person litigation finance is relatively young, its history goes back to at least a few decades in the world. For lawyers, jurists, litigators and investors this concept can provide a valuable insight with regards to the rising legal fees over the decades. Like any other market the litigation finance market has also expanded marking its global footprints in almost all countries including India. Their range of expertise have also expanded from single case financing and non-recourse funding to a plethora of portfolio like defense side financing, copyright claim financing, monetization of claims, etc.

Juxtaposing Returns from Litigation Financing and Other Financial Instruments

The returns on litigation finance mainly depends on the choice of cases the claimants deal with. In defense side financing the defendant is usually involved in disputes for breach of business contracts and agreements, real estate issues and liquid assets. A part of the revenue obtained from the recovery of assets that the defendants was sued initially for serves as a source of profit for the litigation financers. Portfolio financing is another productive undertaking favored by most litigation financers. A list of claims is enlisted by the fund provider which is litigated by a law firm or an individual law practitioner. The risk is significantly lowered in portfolio financing in contrast to single claim financing because the risks are distributed over a list of claims in the portfolio. Claim monetization is another form of litigation financing. This is employed in onerous cases where the financer disburses funds to cover the claimant’s debts, R&D, operating expenses and so on. This is particularly beneficial for the claim holder to keep running his/her business in spite of the lack of funds due to the ongoing litigation.

Unique Challenges Pertaining to India

Every investor seeks to get a quick return on his/her investments, which is exactly why litigation finance has a major drawback in India. The Indian legal system is slow and litigations take an undue amount of time to pass. The huge time lapse that jeopardizes the benefits of investing in the litigation. Several proceedings like arbitrations which ideally should be completed in a short time takes exponentially longer time to pass because of the sheer amount of paperwork involved, and the claimant who has to approach the court several times and somersault over bureaucratic red tapes before the final execution. Ideally it is sound to have the lawyer involved also have a stake in the reward as it boosts the efforts needed to win the case. However, the Indian law prohibits lawyers to act on a contingency basis for monetary rewards. Owing to all these challenges the scenario of litigation finance in India is still a blurry image.

The Silver Lining—Future Prospects

As witnessed from the past data, litigation finance has emerged as a very profitable source of investment for the past decade. a significant number of entities are present who possess the knowledge of litigation finance, but does not utilize it to the fullest extend yet. However, the future of litigation financing looks promising due to the constantly changing market in the legal world. The instance of huge capital entering the market will synthesize newer opportunities to successfully invest in litigation portfolios and undertake more complex cases with higher returns. The COVID-19 pandemic has also affected the economies of several countries severely, which is expected to be a prime reason to propel the growth of litigation finance through the coming years. Hong Kong and Singapore have already expanded relaxed their rules to invite investors for expanding their chain of operation in litigation finance. The alleviation of ethical and moral constraints on the basis of trust has been able to mitigate much of the concerns and fears for litigation financing, thus beckoning a sign of hope for players involved in this trade.