After Life Pay, a franchise of widely ridiculed extreme branding, stunt marketing, and provocative advertising, is the most audacious action to date by Hell Pizza of New Zealand. The campaign promised its selected customers that they could enjoy the pizza and pay not only weeks and months later, but also after their death. On the one hand, the concept is dark and intense; on the other hand, it was a direct and acute commentary on the growing trend of the so-called BNPL market and consumer debt. Opposite to shock advertising, AfterLife Pay employed both legal means and real statistics to create a broader discourse regarding credit culture, debt, and financial responsibility in modern markets.

Overview and Mechanics of the Campaign

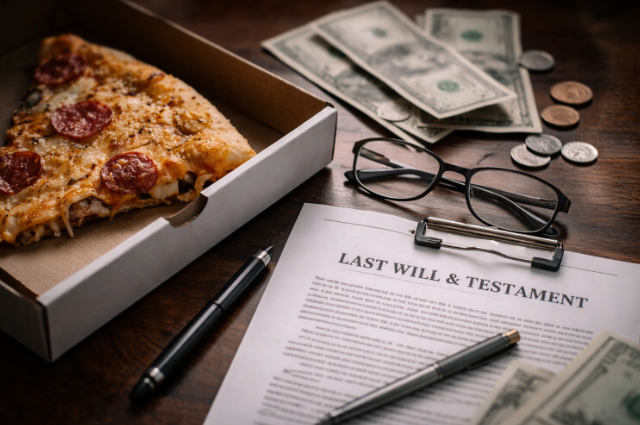

AfterLife Pay by Hell Pizza was introduced at the end of May 2023. The business enticed 666 clients in New Zealand and 666 in Australia to participate in the pilot, which aimed to ridicule the reasoning behind BNPL services. The participants were chosen and asked to sign a duly amended codicil to their wills. They signed an agreement in which they consented to be charged for their purchase of pizza by their estate even after their demise, as opposed to while they were alive.

The price was the normal Hell Pizza product price, with no interest, fees, or penalties charged. The contract, the company claimed, was a legal contract but one based on the certainty of an inevitable occurrence—death.

The Chief Executive of Hell Pizza, Ben Cumming, stated that the concept arose after a range of inquiries from BNPL companies seeking to have their products offered under buy-now-pay-later programs. AfterLife Pay, Cumming asserted, was both a form of criticism of BNPL and a means of publicity to demonstrate the absurdity of deferred payment when pushed to its extreme.

The cultural and emotional resonance of the idea was depicted through anecdotal responses to the campaign. In one cited instance, Sydney resident Terina Josling claimed she sought the scheme because adding such a clause to a future will would make her family smile, recalling her experience of handling her deceased father’s estate.

BNPL Trends and Risks

To understand the rationale behind such an initiative by a pizza chain, one must analyze the rapid expansion and rising concerns surrounding BNPL services in New Zealand and beyond. Afterpay, Klarna, Zip, and Laybuy are examples of BNPL services that allow customers to divide total costs into interest-free installments. Although this appears convenient, financial campaigners have reported rising arrears and accumulating debt, particularly among financially strained households.

Credit bureau Centrix reports that BNPL arrears have increased in recent years, with approximately 9–9.7 percent of BNPL accounts in arrears as of mid-2023. Consumer advocacy groups further note that vulnerable and lower-income households increasingly rely on BNPL systems and are more prone to late fees and financial instability.

One analysis indicated that 50 percent of households earning less than NZ$50,000 used BNPL to purchase necessities, compared to only 29 percent of higher-income households. These statistics place the Hell Pizza campaign in context as a commentary on the economic realities pressuring many consumers.

By reframing deferred payment to an absurd extreme, AfterLife Pay challenged audiences to reconsider BNPL in a way that headlines and surveys alone often fail to achieve.

Controlled Creativity Case Study: Legal Underpinnings

Marketing case studies often celebrate innovation rooted in cutting-edge technology or novel consumer behavior insights. Hell Pizza, however, demonstrates that creativity grounded in legal frameworks and cultural critique can generate significant attention without violating regulations or consumer trust.

Rather than simply offering free pizza, Hell Pizza established a legal relationship requiring participants to amend their wills through codicils. Such legally binding promotional campaigns are rare, yet this stunt operated without regulatory penalties due to its voluntary, transparent nature and compliance with estate laws.

Storytelling and experiential marketing were also integral to the campaign. Instead of trivializing debt, AfterLife Pay rendered it emotionally resonant by connecting it to mortality and legacy. Marketing analysts suggest that campaigns engaging universal themes such as mortality and financial burden tend to generate higher earned media value than conventional paid advertising. This was reflected in the extensive international media coverage the campaign received.

Public Response and Market Reaction

Statistics released by Hell Pizza indicated that the campaign received thousands of applications within days, far exceeding the 1,332 available slots across New Zealand and Australia. The campaign trended on social media and prompted widespread commentary from mainstream news outlets and financial analysts.

Online discussions suggested deeper engagement beyond novelty. Many respondents noted that the campaign prompted reflection on personal spending habits and the seductive appeal of BNPL services. Others appreciated the dark humor, which aligned with Hell Pizza’s established brand identity.

As a result of the campaign, Hell Pizza experienced a surge in website traffic and brand recognition—an important outcome in a competitive quick-service restaurant market.

Greater Marketing Strategy Implications

The success of AfterLife Pay extends beyond Hell Pizza itself. It illustrates how brands can leverage controversy and social issues to spark meaningful conversation without crossing ethical or legal boundaries, particularly in saturated markets where differentiation is essential.

Key lessons from the campaign include:

Brand alignment: Hell Pizza’s dark, transgressive image made AfterLife Pay feel authentic rather than gimmicky.

- Factual grounding: The legal framework added credibility and media interest.

- Cultural relevance: Tying the campaign to BNPL debates positioned it within broader consumer concerns.

- Ethical execution: Voluntary participation and transparency prevented exploitation.

These insights suggest that controversial marketing succeeds when it engages cultural discourse rather than relying solely on shock value.

The AfterLife Pay campaign by Hell Pizza stands out as one of the most vivid marketing initiatives in recent years—not because it offered free pizza, but because it addressed systemic issues in consumer credit culture through legal mechanisms and strategic provocation. By combining creative risk, legal compliance, and cultural critique, the campaign captured global attention while maintaining transparency and ethical integrity.

In an era saturated with marketing noise, AfterLife Pay reminds brands that meaningful disruption lies not in exaggerating existing practices like deferred payment, but in thoughtfully reimagining them.

. . .

References:

- Consumer NZ. (2023). Buy now, pay later preys on the poorest consumers. https://www.consumer.org.nz

- Consumer NZ. (2023). Know the risks before you ‘Buy Now, Pay Later’.: https://www.lifetimeworkplace.co.nz

- NDTV. (2023). Wait, what? You can pay for pizza after you die at this New Zealand outlet.: https://food.ndtv.com

- UPI. (2023). Pizzeria offers to delay payments until after customers die.: https://www.upi.com

- The New Daily. (2023). Buy now, pay when you die: Pizza chain’s cheeky marketing gig. https://www.thenewdaily.com.au

- Daily Jagran. (2023). New Zealand pizza chain launches ‘pay after you die’ scheme.: https://www.thedailyjagran.com