Image by Gerd Altmann from Pixabay

“You don’t buy Life Insurance because you are going to die, but because those you love are going to live”

Insurance is a means of protection from financial loss. It is a form of risk management that immunes an individual against any uncertain loss. It is not a new concept in the world and on the other hand, is as old as human existence. In ancient times, there were friendly societies organized for purpose of extending aid to their unfortunate members from a funds made up of contributions from all. The studies show that insurance as a concept was well known to Romans, and Rhodians although it was not highly developed. Let us discuss a little about Indian Insurance history.

The Earliest traces of insurance in Indian History was in form of Trade loans in the marine sector or carrier’s contract which can be found in Kautilya’s Arthashastra, Manu Smriti’s, etc. In the 19th Century, Insurance without regulations started in India during the British period but it was discriminatory in nature and somewhat unaffordable too. Bombay mutual life insurance society indicated the birth of 1st life insurance in India in the 1870s and was pocket friendly. In 1912, Life Insurance Companies Act and the Provident Fund Act were passed to regulate the insurance businesses which were later nationalized in 1956 and thus LIC (Life Insurance Corporation) came into existence.

Talking about the present scenario, the principal legislation regulating insurance sector in India is the Insurance act of 1938. Some other include the LIC Act, 1956, the Marine Insurance Act, 1963, and Insurance Regulatory and Development Authority Act, 1999 (IRDA), etc. The Indian Contract Act, 1872 and Companies Act, 2013 are also applicable to the Insurance Industry. After the LPG reforms of 1991, the Insurance sector was introduced with many changes as the economy became liberative and free from governmental control although not completely. But this also meant many new challenges as this would have resulted in a huge competition. To prevent misuse by insurers of shareholders and policyholders funds and to ensure accountability, it was imperative to have in place an effective regulatory regime. Insurers being repositories of public trust, efficient regulation of their business became necessary to ensure that they remained worthy custodians of their trust.

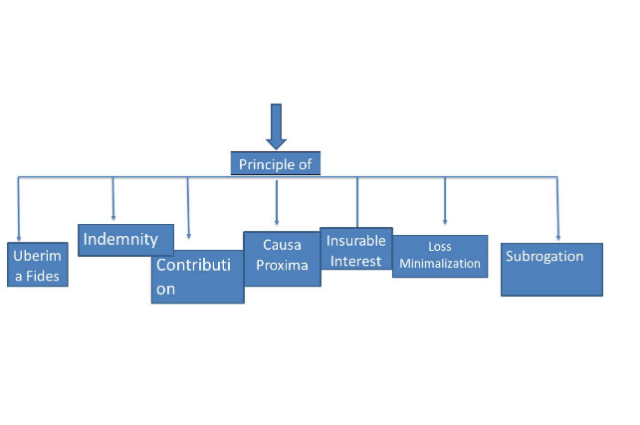

Insurance works on some essential principles. These are:-

Any law which comes into existence has its challenges which are very important to be discussed and looked upon. There is a huge insurance gap in India and this leads to low insurance density in comparison with Global Levels which indicates the huge uninsured population. The Insurance sector has transitioned from being a state monopoly to a competitive market but public-sector insurers hold a greater share of the insurance market. Life insurance dominates the market and another general (Non-life) insurance is neglected. The rural-Urban divide is also a mounting challenge in the insurance industry. Usually, life insurers get attracted to an Urban class of people because they can afford the insurance. The insurance sector in India is Capital starved as it lacks sufficient capital for its smooth perusal. Investment in this sector was itself not sufficient and it got dwindled further due to the crisis in Banks and NBFCs (Non-Banking Financial Companies).

Besides Challenges, Insurance laws have some improvement opportunities as well which if availed judiciously can work wonders and help the country overcome the challenges. The Insurance sector has already been liberalized for domestic and foreign companies and has also seen the arrival of many Global players. The platform is also open to Professionals willing to serve the industry. The industry needs people which expertise and technical brilliance which is possessed by Chartered Accountants (CA). Some problems in the sector can be solved by a dedicated study of the problems and their origin. To increase penetration rates and density, the Uninsured public of majorly rural areas needs to be brought under the ambit of insurance coverage. Long-term commitment needs to be shown to rural people to firm their confidence in the industry. The distribution mechanism needs to be thought upon and managed more efficiently. Insurance needs to be made pocket friendly and should be formulated for all classes of people. Easement of the application procedure for the same and help a lot towards this. A simultaneous and complementary thrust should be given towards spreading awareness and improvement of Financial literacy. The government has taken some steps towards it like unfolding schemes such as PM Jan Arogya Yojana, Jeevan Jyoti Yojana, etc. to lower the premium rates for insurance which was eventually attract more people towards this sector. The application of Technology in this sector can help in the expansion of this sector by leaps and bounds.

The Implementation of these suggestions is a long way and it’s not going to be easy for the country. Although it’s quite early to predict results, yet if these challenges are looked upon sincerely and ways are formulated judiciously, they can truly change the shape of the insurance sector of the country and can make India an educational hub. These Pandemic times are challenging but should not be a hindrance to the effective developmental enhancement because: -

“The path to success is to take massive, determined action.”

-Tony Robbins

References:-

- https://en.wikipedia.org/wiki/Insurance

- https://youtu.be/u1BP33RVS_c

- https://www.ideasforindia.in/topics/money-finance/india-s-insurance-sector-challenges-and-opportunities.html

- https://www.pinterest.com/blissquote/life-insurance-quotes-and-sayings/