Introduction:

A country is said to be potential and prosperous only when its basic unit- “YOUTH” is safe and secured, focus will be on both the gender’s equal upliftment (male and female) in the Society. In the light of this, the present chapter is an attempt to move a step ahead towards understanding the importance of “saving"," protection” and “investment" in one word i.e. “life insurance of young generation” or young policy holders in Indian Society. India has been working towards empowering her youth ever since independence and especially since the 1990s.The government and non-government sectors have both been pushing ahead with programmes aimed at imparting education, giving them better health care, providing them with means of livelihood and opportunities to participate in the decision making process at home and in the society. Special attention is being paid to improve the lot of their protection giving them the better chances of survival and opportunities for living a meaningful life. While reservation is important but the real challenge is to ensure that younger generation are involved in the decision making process at home and in the society. While these initiatives have created the wider space for the younger generation, they have not been able to guarantee a non discriminative or conducive environment for a safe and secured life. Beside illiteracy, dominance of patriarchal values in the society, lack of access and control over income and other resources, restrictions to public spaces and insensitive legal systems continue to impair their effective participation in social, political and economic spheres of life. Reasons are due to illiteracy: If we see literacy rate in India, it is just 74.04% in 2011. 82.14 males per 100 males are literate, and only 65.46 out of 100 females are literate. Literacy in rural areas is worse than urban India. Dominance of patriarchal values in the society, Low sex Ratio (940 females per 1000 males in India), source-census of India 2011. Lack of access and control over income and other resources, restrictions to public spaces and insensitive legal systems continue to impair the younger generation’s effective participation in social, political and economic spheres of life. The challenge is to develop their capacity, so that they can perform their roles properly. Is there any “plan” which helps younger generation to develop their capacity, to think rationally and do positively? Insurance for younger generation can be a right solution for their future protection for a free, fair and fearless life in the society. To understand the socio-economic profile of the young policy holders one needs to understand the soci-economic conditions of the young policy holders. More than 125 million U.S. adults—or 49%—own life insurance, and roughly 25 million bought a new policy last year. But the way they buy life insurance is changing as more customers begin their journey online while still preferring in-person channels for applications: over the past five years, the percentage of life insurance researchers who research online has grown from 22% in 2005 to 39% today, yet nearly 90% of life insurance applications are still made offline. It is critical that insurance eBusiness and channel strategy executives recognize the multichannel shopping behavior that now exists in the U.S. life insurance market. And it is critical to integrate systems for your Web site, call center and agent systems to turn around and stabilize this fluctuating market.

Review of Literature reveals that Women are closing the gap with men when it comes to life insurance ownership, but women’s coverage level, on average, is only 69% of men’s coverage, according to a life insurance study released by LIMRA Research Group .LIMRA’s study found that almost six out of 10 women owned some sort of life insurance in 2010, about the same as men’s ownership. While overall life insurance ownership levels have declined since 2004, the decline was smaller for women. “In our recent studies of women’s sentiment toward life insurance, we found that women (70%) place more value on life insurance than men (62%),” said Cheryl Retzloff, senior research director, LIMRA markets research, in a statement.{Source: Data posted in e-journal in www.google.com the internet site,2011}.The literature on this issue reveals that Indian women’s life is less likely to be protected by insurance cover (Literature collected from www.mint.com internet site on 2011} Data collected by Mint shows that women constitute 20-30% of total lives covered by the country’s life insurers, including Life Insurance Corp. of India, or LIC, the largest insurer by premium collected. There are many reasons put forward to explain why such a gender gap exists, from the fact that many Indian young women are home-bound to their relatively low exposure to risks. “Indian society doesn’t recognize the value of this important asset in the Society.. Importance is not given to a youth unless they are earning and therefore, when the question comes up for life insurance, it is very difficult to get youth insured,” . “In group insurance schemes, however, the coverage of women is higher than men because the government pays the premium and they automatically get covered.” According to the 2001 census, there are 933 women per 1,000 males in India—48% of India’s billion-plus population. In comparison, women had a lower weightage in a life insurance market of Rs2.2 trillion, or 4.4% of gross domestic product, at the end of March.“In LIC, around 28% of total lives covered are women,” said a senior official of LIC. “The figures have risen recently after young men and women in metro cities started working, otherwise around five years back, the percentage was as low as 18-19%. Insurance penetration among women is not sufficient in comparison with men in India.” Coverage is low with private insurers, too. “Around 24% of our customers are women than men,” said Gaurang Shah, managing director of Kotak Mahindra Old Mutual Life Insurance Co. Ltd. “Women do not come out so often, resulting in low penetration.” Rajiv Jamkhedkar, chief executive of Aegon Religare Life Insurance Co. Ltd, says, “Insurance coverage of young women is relatively on the lower side than young men...because financial matters are still decided by male members of the family. Currently, around 18% of total lives insured with us are women in comparison with men.” “Around one third of our customers are women and this number has shown increasing trend over last few years,” said Debashis Sarkar, director, marketing, products and corporate affairs, with Max New York Life Insurance Co. Young policy holders do not take only youth-specific policies, they take other policies, too,” LIC has given 17 lakh self-help groups covering young women. They are also planning to launch several youth-specific policies in future.” What young policy holder’s Want -- And How to Sell it to Them. (By Heather Trese, NOVEMBER 8, 2010). According to the 2010 Independent Brokerage Study conducted by Agent Media* in partnership with NAILBA, 27 percent of producers said that young women make up 25 percent or less of their insurance sales, and another 50 percent said that young female clients constitute only between 26 and 50

percent of their sales. In an age where young women make 80 percent of the household buying decisions and where women control $14 trillion of wealth in the United States, it seems more and more clear that this is the time for insurance agents to start shifting their prospecting and sales focus to young females. Over the ages, traditionally, young women have been home makers in Indian society. The scenario has changed drastically among younger generations in recent times. The Indian woman's transition from home maker to bread winner has been phenomenal. Moreover, they have taken a march over their male counterparts by juggling with aplomb multidimensional roles - professional, home-maker, mother, financial planner... With this in mind, we turn our sights on life Insurance young customers. World over it has been found that young women have either no or little life insurance. Max New York Life – NCAER India Financial Protection Survey revealed that the same is true for India also. Of the life insurance owners in India only 14% are young women. Is that youth do not require life insurance or is it lack of awareness of the need for life insurance for them? Even in a highly developed market like US, it has been found that though 59% of the women own life insurance as compared to 64% of the men, the average death benefit on men is nearly double that for women. Life Insurance for young generation: Nature has created men and women differently but their reason to buy life insurance remains broadly the same for both the genders. Common Need: Both men and women buy life insurance for following reasons:

- To protect their family,

- To replace lost income in case he / she dies,

- To provide for own retirement,

- To fund long-term needs such as children’s education and marriage.

- To pay off mortgages.

- There are certain reasons for the people of Mining Industry to buy life insurance mentioned bellow-:

- Mental Peace

- Security & Stability

- Planning of secured Future

- Long-term Investment

- Self Reliance

- Tax benefits

- Security in investment

- Security against loans.

What is Income Protection?

Income Protection pays a % of your income if you can’t work because of sickness or injury. It will continue to pay you whilst you are unable to work; even up to age 65.It is one of the most ‘claimed on’ insurance products as most people have some time in their working lives when they are off work due to an illness or accident. Income Protection is also known as: income replacement, salary continuance, TTD – total but temporary disablement, wage insurance, salary insurance cover. Income Protection premiums are fully tax deductible and any benefits received are assessed as income. The payment provides a regular income stream that could allow your family to continue meeting their daily living expenses such as a mortgage and personal loans, general living expenses, school fees etc.

Both men and women buy life insurance to protect their family, replace lost income in case he / she dies, provide for own retirement, fund long-term needs such as children’s education and marriage and to pay off mortgages. But here comes the difference. Though the needs are the same, men and women think and behave differently in many aspects of life, including financial planning and protection. The financial needs of young women become different because they have higher life expectancy than young men, which results in more young women living alone after their partner is gone. Life Expectancy at birth in India: In1997‐ 2001, Male 61 years, Female 63 years. In 2001-2006, It increased 63.87 years for Male, 66.91 years for Female. In 2009-2011 estimated, Male 67.46 years, Female 72.61 years. Source: Ministry of Health & Family Welfare, GOI.. It shows that with the passage of time life expectancy increases day by day. So, young women must think for their financial security according to their life expectancy. Youth must think how to lead their life with self-esteem, life time protection & financial Security. Specific reasons to buy Life insurance products by young generation are as follows:

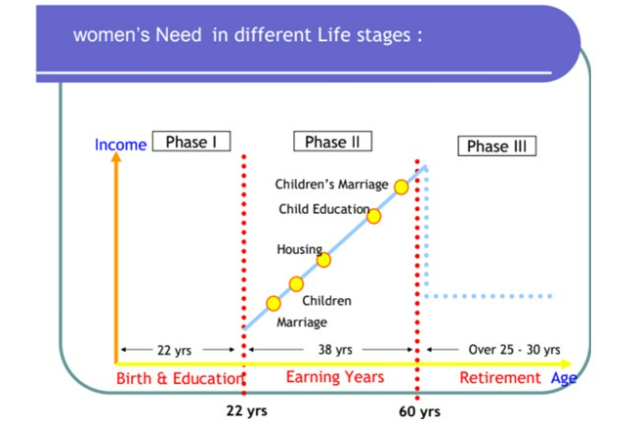

Women’s Need in different Life stages :

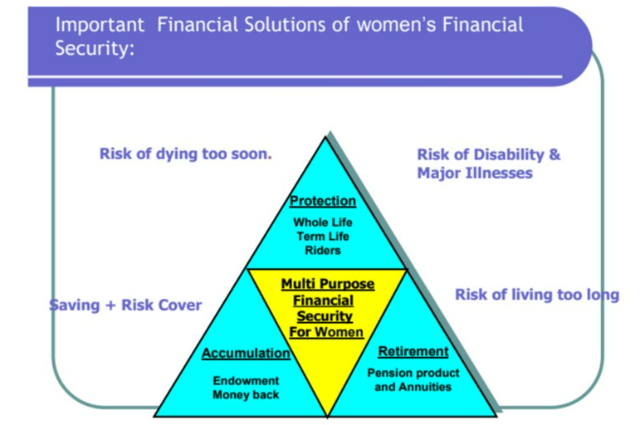

For Mental Peace, Security & Stability, Planning of secured Future, Long-term Investment, Self Reliance, Tax benefit for young professional, Security in investment, Security against loans are main reasons of youth to buy life insurance products in Indian society. In this country, in the early years of the insurance industry, the trend was to insure only young male lives. The logic was that the young female of the species was home-bound anyway, wasn't exposed to any risk, and consequently didn't need any sort of insurance. The bread winner was the male and it was against his lost income that cover was required. A major additional disincentive was the extra risk to young female lives that was an inevitable part of the childbirth process. All that has changed with young women rivaling men at the workplace (and frequently doing a better job than them). In addition, better education for the female child, increased economic contribution by women, better medical facilities for safer childbirth and post-natal care have all contributed to more and more Life insurance products that are generation-specific: Modern women, who are an earning member and an equal partner in managing the finances of the household, require life insurance as much as the earning male members. It has been found that when it comes to planning for long-term needs like children education, marriage and other social events, women are better planners and take the lead in the household. But to meet such need the instruments opted by them are not appropriate. Young generation should consider bundled life insurance products that offer both protection and wealth creation to meet such needs. Unit Linked Insurance Policies (ULIP) and other endowment policies and money-back policies are found to be the best tools for such needs. The younger generation in two income households should also consider taking financial protection cover. They should consider if anything happened to them and the income they generated, would their family be able to maintain the standard of living in their absence? Would their children be able to achieve their education goals? They should consider taking protection cover through a combination of term and bundled products, so that if anything happens to them, the life could go on as earlier. Many a time it is argued that homemakers or students do not require life insurance as they are not the earning members and their loss would not result in financial stress. However, it has been found that it is not true. In fact, they are also needed financial security and protection in their life.

As young generation customers have higher life expectancy than elder, they also need to plan for their financial security for those years when their caring partner would not be there to provide for their financial needs. They should consider retirement planning instruments, which continue to give them annuities (pension) till their last days. Several retirement plans and whole life plans are available in the market. The need for life insurance is most pronounced in the case of single earning member heading a household. This could have happened due to divorce or the death of spouse. As a single parent, he/she may be the sole breadwinner, responsible for the support to his/her children and hence must invest in financial protection insurance so that the life insurance can replace the income he/she is bringing to the household.

Does single man/woman, with no children to support, require life insurance? He/She may not have anyone to support but may still have loans and mortgages. These obligations, which could fall on parents or other loved one, can be met through life insurance. Life insurance is also important to protect his/ her old age and cover against the risk of living too long. It would not be incorrect to say that for men/women at any life stage and of any demographic profile, life insurance is important to meet her financial protection and long-term wealth creation needs. It is never too early to invest in life insurance and hence the day you start earning, you should start investing in life insurance. At the same time it is never too late. If you have not started, the cost of getting financial protection and creating corpus to meet your financial needs would be higher, but it is never too late to start. The people of all age groups and of every profile should consider their needs, consider income and expenses and must allocate a certain portion of disposable income towards buying appropriate life insurance. The best option is to consult an expert financial advisor and take immediate action on the suggested financial plan to live a stress free life. Apart from this caveat, all basic covers such as life, personal accident, mediclaim, critical illness etc. form a part of young generation life insurance policies too. There are also some special covers afforded in young women life insurance policies that include: Cover for certain felame critical illnesses.Occurrence of certain congenital disabilities in new born. Cradle care - covers the newly born child's defects, deformity, malformation, congenital abnormality of any kind at time of delivery. Now come the exclusions to the above-mentioned special covers: Post delivery complications, Still-born child, Death of the mother during childbirth, Miscarriage, infanticide, any defect that is not congenital, malfunctioning of any organ (as opposed to malformation), any defect, which manifests itself after 200 days of the delivery. Most of these policies are benefit-only policies i.e., they come to effect on the specified event happening. Another important point - most pre-natal and birth-related policies have to be taken not later than the 20th week of pregnancy. Womankind carries the future of the race, literally. They can never be thanked enough for the commitment, pain, and dedication they bring to their various roles as home-maker, mother, wife, and professional. Having said that, these insurance policies can go a fair bit in reducing the monetary impact of the financial loss in a home.

Youth can be a better Financial Planner:

This is where advisors come into the picture. “Effectively connecting with young women requires different approaches than with young men,”said Retzloff, senior research director, LIMRA markets research,“Our research has found that young women are more interested in developing a relationship with their advisor than men.They are more deliberate than men when making the decision to buy life insurance. Advisors should expect to spend more time answering questions and providing educational materials than they might with their male clients. There is no doubt that women and men are fundamentally different. Multiple studies have shown that women tend to be more emotional, communicate more effectively, and react differently to pain. But what about their insurance-buying habits? A modern woman, who is an earning member and an equal partner in managing the finances of the household, requires life insurance as much as the earning male members. It has been found that when it comes to planning for long-term needs like children education, marriage and other social events, women are better planners and take the lead in the household. But to meet such need the instruments opted by them are not appropriate. Younger generation should consider bundled of life insurance products that offer both protection and wealth creation to meet such needs. Unit Linked Insurance Policies (ULIP) and other endowment policies and money-back policies are found to be the best tools for such needs. Meanwhile, a prior LIMRA study of young women buyers of life insurance revealed that young women place more value on referrals than men and they are more likely to provide referrals to their friends and family if they are happy with their advisor. Advisors can help young women make critical decisions about life insurance. “Our study shows that too many women are uninsured or underinsured, which leaves their families at risk,” Retzloff said. “Our industry can help young women protect their families from the financial damage that premature or unexpected death can cause.” Scope of Life Insurance Market for women in India: Women are the biggest emerging market in the world, according to Pepsico’s Chief Executive Officer, Indra Nooyi. “Across the globe, women are the biggest emerging market in the history of the planet – more than twice the size of India and China combined,” she said, according to NDTV Profit, which reproduced her valedictory speech at Ad Asia 2011, a media, marketing and advertising event that concluded on Thursday, on its website. “There is plenty to give us cause for optimism. But we need to know how to unlock the potential.”That point was reinforced by a study by Boston Consulting Group discussed at the event, which said women control two thirds of the global consumption expenditure of $18 trillion, according to a report in The Economic Times.

However, young women in Asia control a smaller proportion of the household spend than their western counterparts. In Japan, young women control 63 percent of the household’s total consumption, while it is 50 percent in China and 44 percent in India. The report also said, young woman, whose buying power is much larger than the total consumer spending in India and China, are dissatisfied with the marketing efforts in categories such as financial services, cars, banking, investments and life insurance, according to the study, ‘Young Women Want More’, which surveyed 15,000 women across the world including 5,000 in Asia.

Every year we celebrate Youth Day with same enthusiasm when several programmes are organized internationally to celebrate it as a day when we take a bow for the betterment of our Nation’s future. But do things really change with every youth Day? Have they become really independent financially? Has young generation’s empowerment really happened? This can be explored more with this case study. Indeed this century has brought in dramatic changes in the status of younger generations world over and have proved their mettle in almost all the fields. Economic independence has contributed a great deal in this transformation of youth status. But has economic independence actually made them self-dependent in terms of taking their own financial decisions? Not really! Still they are very much dependent on their fathers and brothers (before marriage) and partner (post marriage). They understand the economics of running the households but lags behind in terms of financial literacy especially in India. Financial Literacy Index reveals that while 61.4 per cent women and 38.6 percent men in India are financially literate while in Asia Pacific this percentage is 65.7 per cent women and 34.3 men are financially literate. The parameters on which this Index rests are: Basic Money Management, Financial Planning and Investments. There is a need for youth to become financially literate as only financial literate person can take care of their family and future in a much better way than a financially illiterate one. Not just the understanding of investments but also the understanding of complex financial products is important for actual financial empowerment of our youth. While working professionals have some understanding of complex financial products, it is the homemaker who takes great pains in running the household be it male or female, but doesn't actually know how she/he can put his/her money to better use. How prudent investments done every month can fetch their money which can ensure a better education for their children or a better life ahead? How they can better utilise the 'pin' money. Case Study of Swarup Mohanty , 34 years old young man is a bright example for all the Indian youth who concern for their Family’s financial planning. In this I will touch upon the case of Swarup

Mohanty, based in Bhubaneswar a working young man who has shared his details with the researcher and the financial planning for his family which help him to develop his capacity to play triple roles as loving husband, caring father and sincere professional in his single life span. He has put together a financial plan for his family, which can be a reference point of many young men as well as working professional across the country. Since Swarup is married with a child, life insurance becomes an absolute necessity for his future. But he did not know what amount of coverage will be adequate for his family, and hence required enough knowledge as well as clarity of goals to get the right amount of coverage. Several factors like his age, salary, and family status were to be considered to determine the coverage amount.

Finding out adequate cover for him and his family:

Swarup needed to ensure that the insurance cover he is getting is adequate for him and his family so that in case there is an impact on existing income due to some unfortunate event like his death or loss of job then the situation can be managed. Insurance requirement can be found out by comparing the income and expenses and looking at the savings available over the life, which is then brought down to today's prices. The other way is to look at the earnings and savings over the lifetime of the earning member at today's values.Swarup selected a whole-life endowment plan as an adequate solution of his problem:

Whole life endowment life-insurance can be a good idea:

At a young age, a whole life endowment plan provided Swarup enough cover at a reasonable cost. In event of his death, his family will receive sufficient amount to maintain their standard of living. It will provide adequate fund for his child's education, help pay off dues and provide capital for his wife's business.

Ensuring good future for his child’s Education:

Swarup might required some additional money back and term policies to provide the necessary cover for his child apart from the whole life insurance plan. That ensured him a regular cash flow coming in at specific points in time, covering the education needs or some other requirements of the child. Here the point to note is that there is a cover on the life of the parents till the child becomes adult and not the child because she was a minor. The funding was available from the parents.

Thinking of retirement:

Insurance is considered to be an effective way to manage retirement expenses. Swarup needed to choose policies like whole life or endowment that was accumulate cash value over the time and pay dividends on a regular basis. Another reason to get a life insurance for wife’s lifetime security because women tend to live longer than men, so it is more likely that his wife has to take care of her expenses incase the death of the respondent. This case study shows that need based financial analysis helped Swarup to provide an adequate Solutions of the said financial problem of Swarup and his Family too. Many insurance companies have launched youth-specific policies to attract young policy holders. These are targeted at young customers and hence might seem to be sufficient to meet some basic requirements. However, Swarup should also consider other possibilities and opportunities available in the market. In many cases, the requirement might be completed by general policies.

Building it up:

Life Insurance portfolio is built up in a systematic manner over a period of time. The life insurance need has to be considered at different points in time.

. . .

References:

- In the present study, data was collected from 114 policy holders from Bhubaneswar city.

- Ali Sajid, Mohhamad Riyaz, Ahmed Mansharique (2007). Insurance in India. New Delhi: Regal Publications.

- Arora, D. (2008). A Comparison of Advisory Services Offered by Selected Life Insurance Intermediaries and Consumers Perception towards Service Quality of Life Insurance

- Companies: An Empirical Study in Punjab and Chandigarh. Unpublished Ph.D. Thesis, submitted to Faculty of Business Management and Commerce, Panjab University, Chandigarh.

- Arora, M.N. (1987). The Life Insurance Corporation of India (Financial & Organizational Aspects: 1956 to 1986). Unpublished Ph.D. Thesis, submitted to Faculty of Commerce, Banaras Hindu University, Varanasi.

- Arora, S. (1988). The GIC of India – An Appraisal. Unpublished M.Phil. Dissertation, submitted to Department of Commerce, Delhi School of Economics, University of Delhi, Delhi.

- Kanungo, Archana (2013). ‘Reducing the Risk of Miners by providing Life Insurance Services in India’, ENTMS, The Mineral industries journal.

- Kanungo, Archana (2013). ‘Towards understanding the Importance of Women’s Life Insurance in India’, IRJSSCE, Vol.1, No.2.

- Kanungo Archana (2012). ‘Minimizing the Impoverish Risks of Displaced Women and Children by providing Life Insurance Services in India’, international conference proceedings, XIMB, Bhubaneswar.

- Bala Neetu and H.S Sandhu (2011).‘Analysis of Factors Influencing Agents’ Perception towards Life Insurance Corporation of India’ International Journal of Industrial Marketing, Vol. 1, No. 1.

- Balachandar, G .N. and K. Panchanatham(2011).‘Impact of Job Situation on the Motivation of Insurance Companies Officers: A Developmental Perspective’, International Journal of Trade, Economics and Finance, Vol.1, No.4, December.