Female hygiene products in a store

Image by wikipedia

Today we are going to talk about a concept that is rarely being discussed when we talk about discrimination against women and it is also rarely being noticed by those who are most affected by it, i.e. Women. Yes, today we are going to talk about pink tax. Let us try to understand this concept through a short story.

In a small town called Berhampur, there lived two best friends named Sarah and Mike. They were both excited to go shopping for their daily essentials one sunny afternoon.

Sarah and Mike strolled through the aisles of a local department store, searching for shampoo. Sarah, being a woman, reached for a bottle with a floral design on it labelled "For Her." It smelled great and had all the features she desired. The price tag read $10.

Meanwhile, Mike, being a man, grabbed a bottle of shampoo labelled "For Him" from the adjacent shelf. The packaging was simple and sporty, with a masculine fragrance. Mike was pleased with his choice, especially when he saw the price tag: $8.

As they continued their shopping spree, Sarah noticed another striking example of women's products being more costly than men's. She admired a stylish razor with an ergonomic handle, marketed for women. It was pink and had a "For Women" label. Sarah liked the design and the promise of smooth skin. The price? $15.

Curious, Mike ventured to the men's section and spotted a similar razor, but in a bold, neutral colour. It was labelled "For Men" and had the same features as the one Sarah was eyeing. Mike picked it up and could not believe his luck when he saw the price: $10

Sarah and Mike compared their shopping carts and realized the unjust pattern. They discovered that many products marketed towards women, from personal care items to clothing, had higher price tags than similar products for men. It was as if the mere association with femininity triggered an invisible surcharge.

Sarah and Mike felt frustrated. They could not understand why products that essentially performed the same functions or had similar qualities had such a difference in price based solely on gender. And here comes the concept of pink tax. Whatever they experienced was nothing but pink tax!

What is pink tax?

The term "pink tax" refers to the phenomenon where products and services marketed toward female customers are priced higher than similar or identical products marketed toward male customers. It is called the "pink tax" because it primarily affects items that are traditionally associated with femininity, such as personal care products, clothing, and toys. Essentially, it means that women often end up paying more for products simply because they are designed or marketed specifically for them.

In the above story, Sarah ended up paying more for the almost similar products as Mike due to the effect of pink tax that imposes higher rates on products marketed towards women.

Examples of pink tax:

Let us now look at some of the areas where pink tax is prevalent. Here are five examples of it:

- Personal care products: Items such as shampoo, conditioner, face cream and body wash marketed towards women often have higher prices compared to similar products targeted towards men. This price difference can also be seen in razors, shaving creams, and deodorants.

- Clothing and accessories: Women's clothing and accessories, such as shirts, jeans, shoes, and handbags, tend to be priced higher than similar items marketed towards men. This applies not only to everyday wear but also to formal attire like suits and dresses.

- Healthcare products: Feminine hygiene products, such as tampons and pads, are subject to the pink tax, as they are often more expensive than comparable products for men, like shaving razors or aftershave.

- Toys and children's products: Toys and products targeted towards girls, such as dolls, playsets, and pink-themed items, often have higher price tags than similar items marketed towards boys. This disparity can also extend to children's clothing and accessories.

- Dry cleaning and tailoring: Services such as dry cleaning and tailoring often charge higher fees for women's clothing compared to men. This can be attributed to the perception that women's garments require more delicate handling or specialized techniques that requires more labor.

These examples demonstrate how the pink tax can affect various aspects of everyday life, leading to increased costs for products and services specifically marketed towards women.

Proof that pink tax exists:

- Example, Razor Cartridges

Image source: Pinterest

- Example, Brush and Comb set

Image source: Pinterest

- Example, Shaving gel

Image source: Pinterest

- Example, Foam Earplugs

Image source: Pinterest

Causes of pink tax

The pink tax can be attributed to several factors and causes. Here are some of them:

- Gendered marketing and packaging: Companies often use gendered marketing techniques to target specific demographics, emphasizing femininity or masculinity in their product design and packaging. This allows them to create separate product lines and justify higher prices for products marketed towards women in the name that women products require higher cost of production due to added aesthetics or ingredients as compared to men. But in reality, most of the times the only difference that exists is of different color packaging.

- Societal expectations and stereotypes: Traditional gender roles and expectations can contribute to the pink tax. Society often associates femininity with higher maintenance and beauty standards, leading to the perception that women are willing to pay more for products and services catering to those expectations. These expectations also lead women to think that in order to look beautiful and to maintain that beauty, expensive products are needed that are marketed to solve their problems and it is absolutely fine to spend extra bucks on your beauty.

- Product differentiation and perceived value: Companies may introduce slight variations or additions to products marketed towards women, such as adding scents, different colors, or other features. These perceived differentiations can be used as justifications for higher prices, despite the core functionality of the product remaining the same. You can see the proof of this in your daily razors or daily creams.

- Lack of price transparency: The pink tax can thrive in an environment where pricing practices are not transparent. If consumers are not aware of the price discrepancies between gendered products, companies can continue to charge higher prices without facing significant backlash. This reason can be said to the most supportive pillar for the existence of pink tax.

- Limited competition and consumer awareness: The pink tax may persist in markets where there is limited competition or where consumers are unaware of the price disparities. Without sufficient market pressure or consumer knowledge, companies may continue to impose higher prices without facing significant consequences.

These causes contribute to the existence and persistence of the pink tax, highlighting the importance of raising awareness, promoting transparency, and challenging gender-based pricing practices.

Economic impact

The economic impact of the pink tax on women can be significant and multifaceted. Here are some key aspects:

- Increased expenses: The pink tax leads to higher prices for products and services marketed towards women, such as personal care items, clothing, and healthcare products. Over time, these additional costs can accumulate and strain women's budgets, leading to increased expenses for essential items and also those items that are targeted towards women in the name of making them more beautiful and youthful.

- Gender-based price discrimination: The pink tax perpetuates gender-based price discrimination, creating an additional financial burden solely based on one's gender identity. This discrimination can contribute to gender inequality and reinforce stereotypes about women's willingness to pay more for certain products to maintain their beauty.

- Limited purchasing power: The higher prices resulting from the pink tax can reduce women's purchasing power. It can restrict their ability to save, invest, or allocate funds to other essential needs, affecting their overall financial well-being and economic independence.

- Cumulative impact over time: The economic impact of the pink tax can be more pronounced when considering its cumulative effect over a woman's lifetime. From childhood toys to personal care products to healthcare items, the price disparity adds up, potentially resulting in thousands of dollars in additional expenses over the years.

Popular findings/stats

One government research in the US examined 800 gender-specific items from almost 100 brands. According to the study, similar personal care items marketed toward women were 13% more expensive on average than comparable items marketed toward men. Adult clothing and accessories cost 7% and 8% more, respectively. According to the study's findings, "women are paying thousands of dollars more over the course of their lives to purchase similar products as men." Another US study revealed that the cost of dry cleaning women's dress shirts was up to 90% greater than that of men's shirts.

Women's deodorant was, on average, 8.9% more expensive than men's, according to a UK survey. The cost of face moisturizer for women increased by 34.28%.

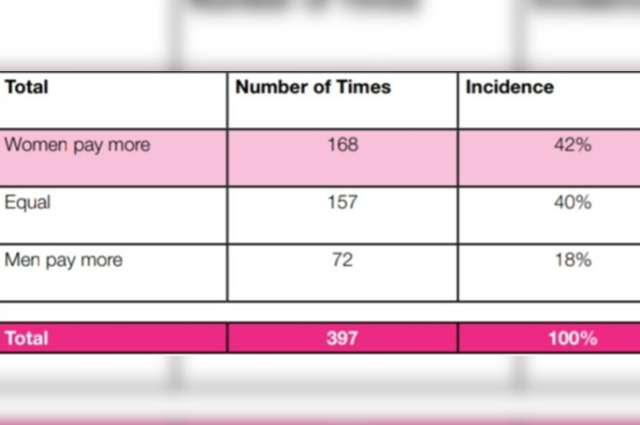

Image source: Boxed.com

Image source: A study by NYC on Gender Pricing

Additionally, the study by NYC also found following data through its study.

“In every industry, products for female consumers were more likely to cost more. Specifically:

- Girls’ toys cost more than 55 percent of the time, while boys’ toys cost more than 8 percent of the time.

- Girls’ clothing costs more than 26 percent of the time, while boys’ clothing costs more than 7 percent of the time.

- Women’s clothing cost more than 40 percent of the time, while men’s clothing costs more 32 percent of the time.

- Women’s personal care products cost more than 56 percent of the time, while men’s products cost more than 13 percent of the time.

- Senior home health care products cost more for women 45 percent of the time and cost more for men 13 percent of the time.”

The pink tax is blatantly discriminatory, affecting women from all walks of life from the cradle to the grave. - Congresswoman Jackie Speier of California

How We Can Fight Against Pink Tax

- Educate yourself: Learn about the pink tax and its impact on consumers. Understand the products and industries affected by this issue. Knowledge is the first step towards addressing the problem.

- Raise awareness: Once you are aware about the issue, share information about the pink tax with your friends, family, and social networks. Use social media platforms to highlight examples of price discrepancies and educate others about this issue. Encourage others to join the conversation and educate more people about the issue.

- Comparison shopping: Compare prices and product offerings across different brands and retailers. Look for similar products marketed towards both genders and compare their prices. Choose products that offer similar quality and functionality at a fair price.

- Support gender-neutral or unisex brands: Look for brands that offer gender-neutral products or market their products to all genders without price discrimination. By supporting such brands, you contribute to the demand for fair pricing practices.

- Advocate for change: Reach out to your local representatives and consumer advocacy organizations to voice your concerns about the pink tax. Support legislation or initiatives that aim to address this issue. Write letters, sign petitions, or participate in campaigns that raise awareness and push for fair pricing practices.

- Shop smart: Be a conscious consumer. Look for alternatives to products that are subject to the pink tax. Consider buying from smaller businesses or independent brands that offer fair pricing practices. Support businesses that actively work to eliminate gender-based price discrimination.

- Share your experiences: If you encounter instances of the pink tax, share your experiences with the brand or retailer. Leave reviews, provide feedback, or contact customer service to express your dissatisfaction with the pricing disparities. Companies may take note of customer concerns and reconsider their pricing strategies.

- Stay informed about developments: Keep up with news, research, and studies related to the pink tax. Stay informed about any progress made in addressing this issue. Knowledge of ongoing initiatives and changes can help guide your actions and support the collective fight against the pink tax.

Remember, the fight against the pink tax requires sustained effort and collective action. By raising awareness, making informed purchasing decisions, and advocating for change, we can work towards reducing gender-based price discrimination and promoting fair pricing practices.

Conclusion:

In conclusion, the pink tax remains a persistent issue that requires our attention and action. The unfair practice of charging higher prices for products marketed towards women not only affects our wallets but also perpetuates gender stereotypes and inequality. However, by educating ourselves, raising awareness, and making conscious choices as consumers, we can contribute to the fight against the pink tax.

It is crucial to stay informed about the products and industries affected by the pink tax and to actively seek out brands that offer fair pricing practices or gender-neutral options. Comparison shopping and supporting businesses that prioritize equal pricing can make a difference. By sharing our experiences, advocating for change, and supporting legislative efforts, we can amplify our voices and push for meaningful reforms.

The fight against the pink tax is a collective one. It requires us to challenge societal norms, question unfair practices, and demand equality in pricing. Through these collective efforts, we can create a future where gender-based price discrimination is eradicated, and individuals are free to make purchasing decisions based on quality and functionality rather than arbitrary gender labels.

Let us stand together, raise our voices, and work toward a society that values fairness, inclusivity, and gender equality. By fighting against the pink tax, we are not only advocating for fair pricing but also taking a step towards a more equitable world for all.