Photo by Kelly Sikkema on Unsplash

Introduction

The public's response to Budget 2024, unveiled by Finance Minister Nirmala Sitharaman, has been overwhelmingly negative, marking a significant shift in sentiment among even the staunchest supporters of the government. Many who previously lauded Prime Minister Modi's administration are now expressing frustration and disappointment, particularly regarding economic policies that appear to disproportionately burden the middle class. Social media has become a platform for this discontent, with viral memes and tweets highlighting the perceived unfairness of the tax system. For instance, one popular tweet humorously critiques the Finance Minister by stating that no matter how one earns or spends money, taxes are inevitable, reflecting a growing belief that the government is squeezing the middle class while favouring wealthier individuals.

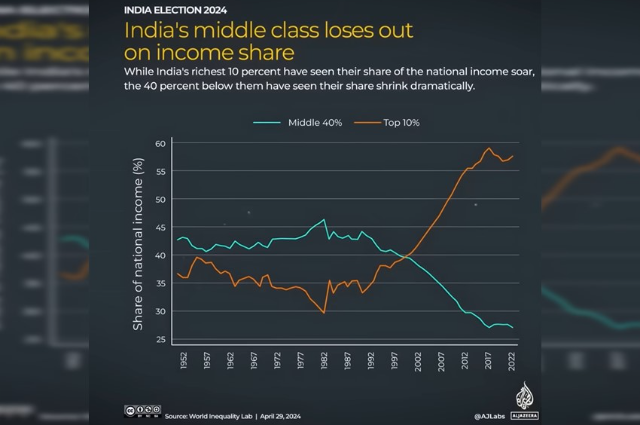

Key themes emerging from this backlash include significant tax increases, escalating income inequality, and the varied impact of these policies across different demographics. Critics argue that the government's approach exacerbates existing disparities, with many feeling that their financial struggles are ignored in favour of policies that benefit the wealthy elite. The budget's proposed changes to capital gains tax and other fiscal measures have sparked concerns about their implications for investment and economic stability. As public dissatisfaction mounts, it raises critical questions about the government's commitment to addressing these issues and whether it can regain the trust of its constituents. The stark contrast between rising taxes for average citizens and continued benefits for affluent business interests has ignited a debate about equity and fairness in India's economic landscape.

Public Sentiment and Reactions

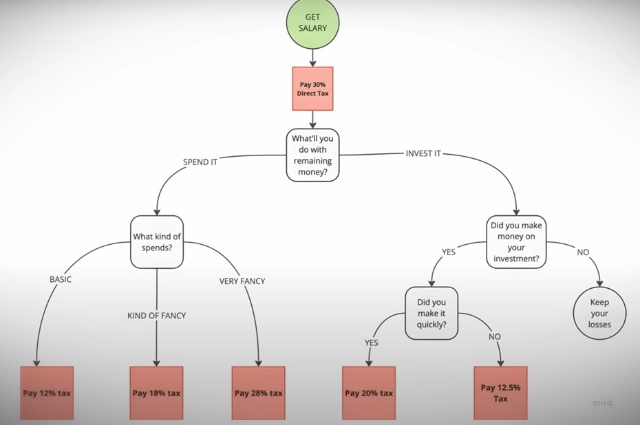

The public sentiment surrounding Budget 2024 has dramatically shifted from initial support to widespread criticism following its announcement by Finance Minister Nirmala Sitharaman. Many individuals who once championed Prime Minister Modi's government are now expressing their discontent, particularly regarding the perceived economic burden placed on the middle class. The budget has sparked a wave of frustration that resonates across social media platforms, where users have taken to sharing memes and comments that encapsulate their grievances. Notably, a viral tweet humorously captures the essence of this frustration: "If I earn money, Nirmala taxes it. If I spend money, then also Nirmala taxes it." This sentiment reflects a growing belief that the government's fiscal policies disproportionately target average citizens while favoring wealthier individuals.

The backlash against the budget is evident in various social media reactions. Users have created memes that highlight the complexities and perceived unfairness of the tax structure. One popular flowchart humorously illustrates how individuals face multiple layers of taxation regardless of their financial decisions—whether earning, spending, or investing. This satirical take on the government's tax policies has resonated widely, underscoring a collective feeling of being overwhelmed by financial obligations. The phrase "You can't defeat me. -I know, but she can," which accompanied one such meme, succinctly captures the public's sentiment towards the Finance Minister and her policies.

The implications of these reactions extend beyond mere frustration; they pose significant challenges to the government's credibility. As public dissatisfaction grows, it raises questions about the administration's ability to effectively manage economic issues and maintain support from its constituents. The shift in sentiment is particularly striking given that many supporters had previously expressed unwavering loyalty to Modi's leadership. However, as tax burdens increase and income inequality becomes more pronounced, even loyalists are beginning to voice their concerns about the direction of economic policy.

Critics argue that the government's focus on increasing taxes for middle-class citizens while providing benefits to affluent business interests creates a perception of inequity in fiscal policy. This sentiment is echoed in discussions about capital gains tax increases and other measures that appear to disproportionately affect investors and everyday taxpayers. The stark contrast between rising taxes for average citizens and continued advantages for wealthier individuals has fueled a narrative that suggests a widening gap between different socioeconomic groups.

Capital Gains Tax Changes

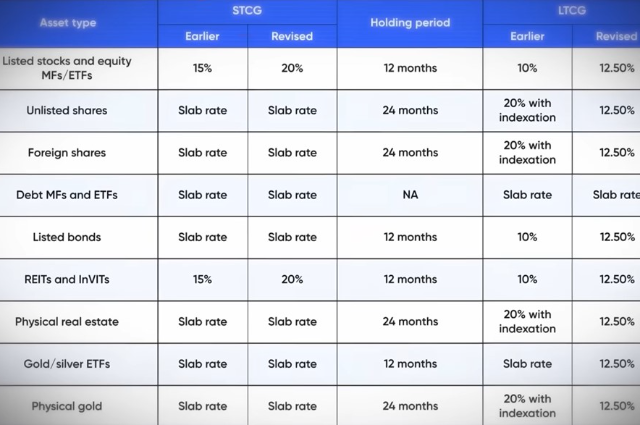

The structure of capital gains tax in India is divided into two categories: Short-Term Capital Gains (STCG) and Long-Term Capital Gains (LTCG). STCG applies to assets sold within one year of acquisition, while LTCG pertains to assets held for more than a year. The tax rates for these categories have seen significant changes in Budget 2024, which has sparked considerable backlash from investors and raised concerns about market stability.

Changes in Capital Gains Tax

Under the new budgetary provisions, the Short-Term Capital Gains tax has been increased from 15% to 20%, marking a 5% rise. For Long-Term Capital Gains, the tax rate has been adjusted from 10% to 12.5%, an increase of 2.5%. While the government has raised these tax rates, it has also introduced a new exemption threshold for LTCG, increasing it from ₹100,000 to ₹125,000. This means that individuals can earn up to ₹125,000 in long-term capital gains without incurring any tax liability.

However, these changes have not been well received by investors, particularly those engaged in stock market trading and mutual funds. The increase in STCG and LTCG taxes is viewed as a direct assault on their investment returns, leading to widespread discontent among market participants. Investors in Futures and Options trading are particularly affected by an additional Securities Transaction Tax increase, with rates rising from 0.0125% to 0.02% for Futures and from 0.0625% to 0.1% for Options.

Public Backlash and Market Implications

The public backlash against these capital gains tax changes has been intense. Many investors feel that the government is unfairly targeting them while providing benefits to wealthier individuals and corporations. Social media platforms have been flooded with memes and comments that express this frustration, portraying the Finance Minister as someone who taxes every aspect of financial activity—whether earning, spending, or investing. This sentiment underscores a broader concern that the government’s fiscal policies are increasingly burdensome for average citizens.

The implications of these tax increases extend beyond individual investors; they pose risks to overall market stability as well. The Economic Survey 2023-2024 indicated that excessively high claims by equity markets on the real economy could lead to instability rather than resilience. This suggests that the government is attempting to cool down what it perceives as an overheated stock market, which could be viewed as a bubble waiting to burst.

Moreover, the removal of indexation benefits on non-financial assets like real estate adds another layer of complexity for investors. Previously, indexation allowed taxpayers to adjust their capital gains based on inflation, effectively lowering their taxable gains when selling property or other assets acquired years ago. With this benefit stripped away, many property owners may face significantly higher tax liabilities when selling their assets.

Economic Survey Insights

The Economic Survey 2023-2024, presented just before Budget 2024, provides critical insights into market stability, unemployment, and the implications of emerging technologies like Artificial Intelligence (AI) on job security. This survey serves as an annual report that outlines the economic landscape and forecasts for the upcoming year, drafted by the Economics Division of the Department of Economic Affairs under the guidance of India's Chief Economic Advisor.

Market Stability and Unemployment

One of the key findings from the Economic Survey is the warning about potential market instability stemming from excessive claims by equity markets on the real economy. On page 65 of the report, it states, "If equity market claims on the real economy are excessively high, it is a harbinger of market instability rather than market resilience." This assertion indicates that while stock market growth has often been touted as a sign of economic health, it can also signal underlying vulnerabilities if not aligned with real economic performance. The government's previous reliance on stock market performance as an indicator of national development is being reconsidered in light of these findings.

The survey also highlights a pressing issue: unemployment. It notes that to sustain economic growth, India needs to create approximately 7.85 million jobs annually until 2030. Alarmingly, it reveals that nearly 50% of Indian graduates are deemed unemployable due to a lack of requisite skills. The unemployment rate among youth aged 20-24 reached a staggering 44.49% in early 2024, underscoring a critical gap between education and job readiness.

Government Perspectives on Stock Market Growth

The government's perspective on stock market growth has evolved in this budget cycle. Historically, rising stock indices were presented as indicators of economic prosperity; however, the Economic Survey suggests that unchecked growth could lead to instability. This shift indicates a more cautious approach from the government regarding stock market dynamics. The Finance Minister's recent statements imply a desire to temper speculative trading practices, particularly in high-risk areas such as Futures and Options. By increasing taxes in these segments, the government aims to discourage risky investments that could jeopardize financial stability.

Concerns About AI's Impact on Job Security

Another significant concern raised in the Economic Survey is the impact of Artificial Intelligence on job security across various skill levels. The report identifies AI as "the biggest disruption for the future of work," highlighting that its effects will be felt by both low-skill and high-skill workers alike. As AI technologies continue to advance, many traditional jobs may become obsolete, leading to increased anxiety about job security among workers across all sectors.

The survey emphasizes the need for proactive measures to address these challenges. It suggests that upskilling and reskilling initiatives will be essential to prepare the workforce for an AI-driven economy. The government acknowledges that without adequate training and skill development programs, many workers could find themselves displaced by automation.

Real Estate Taxation and Indexation

The changes to Long-Term Capital Gains (LTCG) tax on non-financial assets, as outlined in Budget 2024, have significant implications for property owners in India. The government has reduced the LTCG tax rate from 20% to 12.5%, which at first glance appears beneficial. However, this reduction comes alongside the removal of indexation benefits, a move that could lead to higher tax liabilities for many property sellers.

Changes to LTCG Tax and Removal of Indexation Benefits

Previously, indexation allowed property owners to adjust the cost of their assets for inflation when calculating capital gains. For example, if a property was purchased for ₹2 million two decades ago, its inflation-adjusted value today might be around ₹6 million. Under the old system, the capital gains tax would be calculated based on the difference between the selling price and this adjusted cost. With indexation benefits removed, the original purchase price of ₹2 million would now be used as the baseline for calculating gains, significantly increasing taxable income.

This change means that when a property is sold, the entire appreciation—without accounting for inflation—will be subject to taxation. For instance, if a property bought for ₹2 million is sold today for ₹12.4 million, under the old system with indexation, the taxable gain would be calculated as follows:

- Selling Price: ₹12.4 million

- Adjusted Cost (with indexation): ₹6 million

- Taxable Gain: ₹12.4 million - ₹6 million = ₹6.4 million

- LTCG Tax (20%): ₹1.28 million

In contrast, under the new system without indexation:

- Selling Price: ₹12.4 million

- Original Cost: ₹2 million

- Taxable Gain: ₹12.4 million - ₹2 million = ₹10.4 million

- LTCG Tax (12.5%): ₹1.3 million

This example illustrates that property owners could face a tax increase of approximately ₹100,000 due to the removal of indexation benefits.

Financial Impacts on Property Owners

The financial impact of these changes can vary widely among property owners. Those who purchased properties many years ago will likely see a more pronounced effect due to significant appreciation over time. For instance, individuals who invested in real estate before 2001 may still benefit from indexation if they sell their properties now; however, those who acquired properties after that date will not have this advantage.

Moreover, homeowners who have invested in delayed projects or properties that have yet to appreciate significantly may find themselves in precarious situations. If property prices do not rise sufficiently to offset the increased tax burden due to the removal of indexation, these investors could incur substantial losses.

Government Intentions Behind Discouraging Speculation

The government's rationale for these changes appears rooted in a desire to discourage speculation in real estate markets. By reducing incentives for speculative investments and increasing tax burdens on short-term gains, authorities aim to stabilize property prices and prevent market bubbles that can arise from excessive speculation. The Economic Survey 2023-2024 warns against "excessive claims by equity markets on the real economy," suggesting that similar principles apply to real estate.

Government officials argue that high property prices can create barriers for lower and middle-class families seeking affordable housing. By curbing speculative activity and ensuring more stable pricing dynamics in real estate markets, the government hopes to make homeownership more accessible.

Angel Tax and Income Tax Adjustments

The recent changes to the Angel Tax and adjustments in income tax slabs have generated mixed reactions among various stakeholders, particularly startups and middle-class taxpayers. The government's decision to remove the Angel Tax for startups has been widely praised, while the minor adjustments in income tax rates have elicited a more subdued response.

Removal of Angel Tax for Startups

The Angel Tax, which was imposed on startups when they issued shares at a price exceeding their fair market value, has been a contentious issue since its introduction. This tax was perceived as a significant barrier to fundraising for new ventures, discouraging investment in the startup ecosystem. In Budget 2024, the government announced the removal of this tax, a move that has been met with enthusiasm from both the startup community and opposition parties. Congress leaders have expressed their approval, noting that they had long advocated for this change in their manifesto.

The removal of Angel Tax is expected to provide much-needed relief to startups, allowing them to attract investments without the fear of punitive taxation. This decision reflects the government's recognition of the vital role that startups play in driving innovation and economic growth. By eliminating this tax burden, the government aims to foster a more conducive environment for entrepreneurship, encouraging new businesses to flourish.

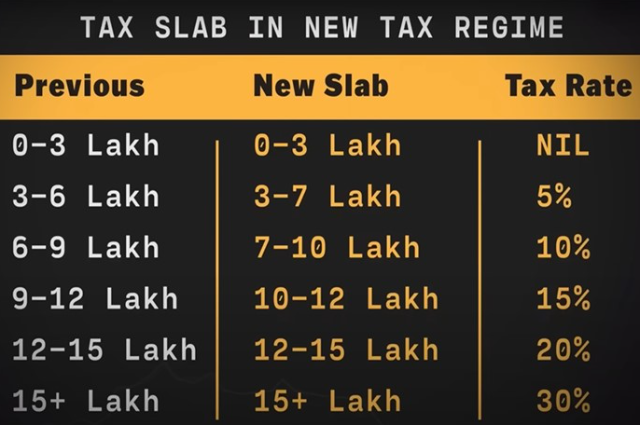

Adjustments in Income Tax Slabs and Standard Deductions

In addition to the Angel Tax removal, Budget 2024 introduced minor adjustments in income tax slabs and increased the standard deduction from ₹50,000 to ₹75,000. The income tax slabs have also seen slight modifications:

- The 5% tax rate now applies to annual incomes up to ₹700,000, an increase from ₹600,000.

- The 10% slab now ranges from ₹700,000 to ₹1 million, previously set at ₹600,000 to ₹900,000.

- The 15% rate now applies to incomes between ₹1 million and ₹1.2 million, up from ₹900,000 to ₹1.2 million.

While these adjustments may provide some relief for middle-class taxpayers, the overall benefit is considered negligible. For many individuals, especially those with higher incomes or fewer deductions under Section 80D or 80TTA, these changes will not significantly alter their tax liabilities.

Overall Benefit for Middle-Class Taxpayers

The overall impact of these tax changes on middle-class taxpayers appears limited. While the increase in standard deduction offers some financial relief, it does not address broader concerns regarding rising living costs and inflation. Many middle-class citizens feel that they are being squeezed by increasing taxes while receiving minimal benefits in return.

Critics argue that despite these minor adjustments, the government continues to focus on taxing the middle class heavily while providing substantial benefits to wealthier individuals and corporations. The perception persists that while ordinary taxpayers face increased financial burdens, affluent business interests enjoy favourable treatment. This sentiment has fuelled public discontent and raised questions about equity in the government's fiscal policies.

Government Schemes and Employment Initiatives

The Budget 2024 has introduced several new employment schemes aimed at job creation, reflecting the government's commitment to addressing the pressing issue of unemployment in India. With the backdrop of rising joblessness and a significant portion of the youth population being deemed unemployable, these initiatives are designed to stimulate economic growth and provide opportunities for millions.

New Employment Schemes

- First Time Employment Support: This scheme offers financial assistance to individuals entering the job market for the first time. Those registered with the Government's Employees' Provident Fund Organization (EPFO) can receive up to ₹15,000 from the government as an incentive for employers to hire new employees.

- Manufacturing Sector Benefits: The budget allocates additional benefits specifically for the manufacturing sector, aimed at enhancing job creation and improving working conditions for employees while incentivizing employers to expand their workforce.

- Employer Support Scheme: To further encourage hiring, this initiative will provide financial support to employers, contributing up to ₹3,000 per month for two years towards EPFO contributions on behalf of new hires. This measure aims to reduce the financial burden on employers while promoting job creation.

- Skilling Scheme: Recognizing the skills gap among graduates, the government has promised to launch a Skilling Scheme that aims to train 2 million youth over the next five years. This initiative is crucial in preparing young individuals for the job market, particularly in sectors where skill shortages are prevalent.

- Internship Opportunities: The government plans to facilitate internship placements for 1 million youth in top 500 companies for a duration of 12 months. This initiative is designed to provide practical experience and enhance employability among young job seekers.

Potential Effectiveness and Implementation Challenges

While these schemes present a positive step towards addressing unemployment, their effectiveness will largely depend on successful implementation. The finance minister has indicated that participation in these job schemes will not be mandatory for companies but rather a "nudge" towards hiring. This raises concerns about whether businesses will actively engage with these initiatives or view them as optional.

Moreover, there are inherent challenges in ensuring that these programs meet their objectives. For instance, the success of the skilling initiative hinges on developing relevant training programs that align with industry needs. If training does not match market demands, participants may still struggle to find suitable employment after completing their courses.

Additionally, there is scepticism regarding whether financial incentives will be sufficient to motivate employers to hire more staff. Many businesses may still prioritize cost-cutting measures over expanding their workforce, particularly in uncertain economic conditions.

State Allocations and Political Implications

The Budget 2024 has drawn attention for its significant allocations favouring Andhra Pradesh and Bihar, particularly in light of the upcoming elections in Bihar. The government has earmarked substantial funds for infrastructure development and other projects in these states, which many perceive as politically motivated efforts to secure electoral support.

Budget Allocations for Andhra Pradesh and Bihar

In this budget, Andhra Pradesh received a notable allocation of ₹150 billion for the development of its capital, Amaravati. Although elections in Andhra Pradesh have recently concluded, the focus on this state indicates an ongoing commitment to its development. Conversely, Bihar is set to receive an even larger share, with the government planning to invest ₹600 billion in various infrastructure projects. These projects include the construction of expressways, power plants, heritage corridors, and new airports, along with ₹115 billion dedicated to flood mitigation efforts. Additionally, the tourism budget allocates significant resources to enhance facilities at key religious sites like the Vishnupad Mandir and Mahabodhi Mandir.

Political Motivations Behind Allocations

The timing and nature of these allocations suggest a strategic approach by the ruling party to strengthen ties with regional allies and consolidate voter support. The BJP's minority government appears to be making concerted efforts to appease its allies, such as the Telugu Desam Party (TDP) in Andhra Pradesh and Janata Dal (United) in Bihar. This shift in focus from traditionally favoured states like Gujarat and Uttar Pradesh to Andhra Pradesh and Bihar has been interpreted by some political analysts as a tactical manoeuvre aimed at securing crucial votes in the upcoming elections.

Opposition leaders have criticized these allocations as a "Seat Conservation Budget," arguing that they reflect an attempt by the government to buy electoral loyalty rather than address broader national issues such as rising income inequality and unemployment. Rahul Gandhi's remarks highlight concerns that these financial commitments may not translate into genuine development but rather serve as temporary measures to win favour among constituents.

Public Perceptions

Public perception of these budget allocations is mixed. While many residents of Andhra Pradesh and Bihar welcome increased funding for infrastructure and development projects, scepticism remains regarding the government's intentions. Critics argue that such allocations are often accompanied by promises that may not materialize or be effectively implemented. Furthermore, there is a growing sentiment among citizens that while funds are directed toward specific states, other regions continue to be overlooked, exacerbating feelings of regional disparity.

Conclusion

The public's reaction to Budget 2024 has been marked by significant dissatisfaction, particularly regarding the government's approach to taxation and its implications for economic stability. Many citizens, including previous supporters of the Modi administration, have expressed frustration over increased tax burdens, particularly on the middle class. The adjustments to capital gains tax, with short-term rates rising to 20% and long-term rates to 12.5%, have drawn sharp criticism from investors who feel targeted by these changes. The removal of indexation benefits for non-financial assets further compounds this discontent, as it could lead to higher tax liabilities for property owners, thus exacerbating financial strain on middle-income households.

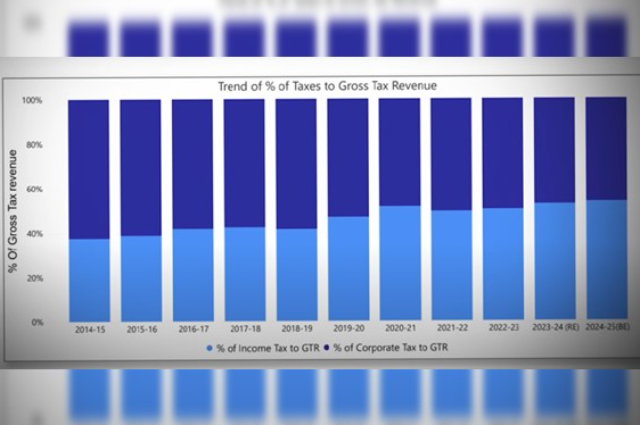

The Economic Survey 2023-2024 underscores a troubling trend in income inequality, revealing that the gap between the wealthy and the poor has widened significantly in recent years. Data indicates that nearly 50% of Indian graduates are now considered unemployable, highlighting a growing disconnect between educational outcomes and job market needs. This disparity is further exacerbated by the government's reliance on taxing the middle class while providing substantial benefits to wealthier individuals and corporations, fostering a perception of inequity in fiscal policies.

Looking forward, the government faces critical challenges regarding accountability and economic direction. As public dissatisfaction mounts, it will be essential for policymakers to address these concerns transparently and equitably. The introduction of new employment schemes aimed at job creation reflects an acknowledgment of these issues; however, their effectiveness will depend on genuine implementation rather than mere political rhetoric. Ultimately, addressing income inequality and ensuring that economic growth benefits all citizens will be crucial for restoring public trust and fostering a more inclusive economic environment. The government's ability to navigate these challenges will significantly influence its credibility and support in the upcoming electoral landscape.

. . .

References:

- https://time.com/6961171

- https://www.cnbctv18.com/market/budget-2024

- https://www.indiatoday.in/education-today

- https://www.hindustantimes.com/budget

- https://indianexpress.com/article/cities/delhi

- https://economictimes.indiatimes.com/news/economy

- https://www.thehindu.com/business/budget

- https://www.hindustantimes.com/business

- https://cleartax.in/s/80c-80-deductions

- https://www.livemint.com/money/personal-

- https://www.businesstoday.in/union-budget

- https://indianexpress.com/article

- https://www.business-standard.com

- https://www.newindianexpress.com/states

- https://frontline.thehindu.com/news

- https://www.livemint.com/budget

- https://www.indiatvnews.com

- https://www.theweek.in/news

- https://time.com/6961171/india