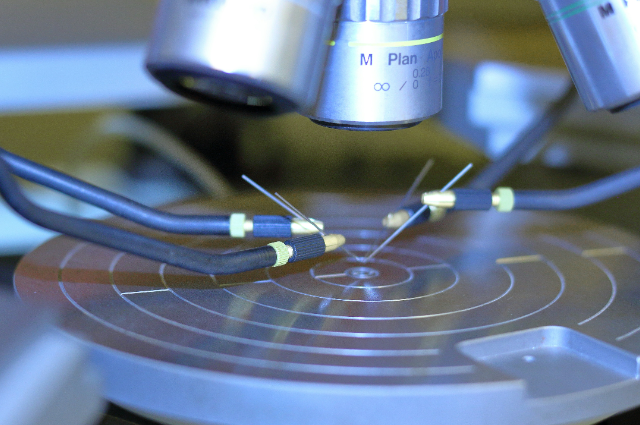

Photo by L N on Unsplash

India is positioning itself as a vital contributor to the global semiconductor industry, as the sector grapples with an increasing demand for skilled professionals. According to a recent report by Motilal Oswal, India’s vast engineering workforce has the potential to significantly ease the workforce shortage that has emerged in this rapidly growing sector.

Global Shortage of Semiconductor Professionals

A key finding of the report highlights that, according to Semiconductor Equipment and Materials International (SEMI), the global semiconductor industry will require approximately 1 million skilled professionals by 2030. This demand stems from the industry’s expansive growth prompted by technological advancements in areas such as artificial intelligence (AI), the Internet of Things (IoT) and quantum computing.

India’s Engineering Output: A Solution to Global Needs

India’s vast pool of engineering talent offers a strategic solution to this looming shortage. With the country producing 800,000 new engineers annually alongside a strong foundation in software development and design, India is well-positioned to address the global talent gap. These engineers that are equipped with both technical knowledge and expertise in digital systems, could play a pivotal role in the development and innovation of semiconductor technologies worldwide.

Semiconductor Market Growth: A $1 Trillion Opportunity

The global semiconductor market is on track to reach an astonishing USD 1 trillion by 2030. Three key technological waves are driving this growth: the first is the surge in IoT applications, led by cloud computing and Industry 4.0 advancements; the second wave centers around the rise of AI and the third wave focuses on quantum technologies that is fuelled by the emergence of 6G/7G networks and Industry 5.0.

India’s Domestic Semiconductor Growth: A Promising Trajectory

India’s own semiconductor market has experienced rapid expansion. Between FY17 and FY23, the market recorded an impressive compound annual growth rate (CAGR) of 12.6%, ultimately reaching a market value of USD 33 billion. This remarkable growth reflects the increasing demand for semiconductor components in India’s burgeoning electronics and technology sectors.

The Path Forward for India in the Global Semiconductor Arena

As India continues to strengthen its presence in the semiconductor industry, its engineering talent will likely become a cornerstone of the sector’s future. With sustained investments in education, research, and infrastructure, India could emerge as a key player in solving the global semiconductor workforce crisis while also capitalizing on the technological innovations shaping the future.

Growth Projections in the Semiconductor Market

According to recent reports, the semiconductor market is poised for significant expansion. Projections suggest that by the fiscal year 2028, the market size could reach USD 80.3 billion which represents a compound annual growth rate (CAGR) of 19.6% from fiscal year 2023 to fiscal year 2028. This remarkable growth trajectory emphasizes the increasing demand and importance of semiconductors in various sectors.

The Profitability of Semiconductor Manufacturing

Although semiconductor manufacturing requires substantial capital investment but it is recognized as a highly lucrative industry on a global scale. The high profitability stems from the essential role that semiconductors play in modern technology by driving everything from consumer electronics to advanced computing systems.

India's Strategic Initiatives

In light of this promising market potential, the Indian government has implemented several initiatives aimed at enhancing domestic semiconductor manufacturing capabilities. By studying and matching the strategies of leading global players in the semiconductor field, India is striving to establish a robust semiconductor ecosystem. This initiative not only aims to strengthen India's position in the global market but also seeks to foster innovation and self-sufficiency within the country’s technology sector.

India’s Semiconductor Ambitions: A Strategic Overview

India’s push to localize semiconductor production is gaining momentum with plans to significantly increase the share of domestically sourced components. As of 2021, only 9% of the semiconductor components used in India were locally produced. However, the government aims to increase this to 17% by 2026, representing a sixfold growth in locally sourced semiconductor revenue compared to 2019 levels. Despite these efforts, the country remains heavily reliant on imports to meet its semiconductor needs.

Electronics Production and Job Creation

India’s electronics manufacturing sector is experiencing a rapid expansion. Valued at $101 billion in 2022, it is projected to triple to $300 billion by 2026 with the potential to reach $500 billion by 2030. This growth is expected to generate over 6 million jobs with the mobile phone sector playing a pivotal role. Mobile phone production is anticipated to surge from $44 billion in 2023 to $110 billion by 2026, making India the second-largest mobile phone manufacturer globally. In recent years, India has doubled its share of global smartphone production to 19% which is a clear indicator of the country’s growing influence in this sector.

Growth in Electronics Exports

India’s electronics exports have shown impressive growth, tripling between March 2018 and April 2023. The trend is expected to continue with exports projected to nearly 4 times from $25 billion in FY 2023 to $120 billion by FY 2026. This rise mirrors the overall performance of India's merchandise exports which have consistently surpassed $100 billion per quarter since the second quarter of FY 2022.

Global Semiconductor Value Chain

The semiconductor value chain is highly complicated as involving multiple stages spread across various regions. Key steps include research and development (R&D), chip design, fabrication, and assembly, testing, and packaging (ATP). Most ATP activities are concentrated in Asia with China and Taiwan together accounting for 75% of the global ATP market.

India’s Role in the Semiconductor ATP Market

India is self-confident to increase its participation in the semiconductor ATP market, thanks to successful investments from companies like Micron. The country’s proximity to a thriving electronics manufacturing ecosystem combined with cost advantages and favourable government policies makes it an attractive location for semiconductor ATP activities. By focusing on this segment, India could replicate the strategies of other nations that began with ATP and later moved up the value chain to more advanced semiconductor manufacturing.

Government Support for the Semiconductor Sector

The Indian government has launched several initiatives to strengthen domestic semiconductor production. The India Semiconductor Mission (ISM) represents a significant step forward with the government committing around $10 billion to support the industry. Incentives under this program include a 50% subsidy for semiconductor projects such as factories, ATMP units and display fabs with additional state-level incentives ranging from 20-25%. India has already attracted INR 1.5 trillion in investments from major companies such as Micron, Tata Electronics, CG Power and Kaynes Technology.

Additionally, the Production-Linked Incentive (PLI) Scheme offers companies 4-6% incentives on incremental sales of domestically manufactured products. This will help local manufacturers scale their operations and compete internationally.

Building a Skilled Workforce

Recognizing the importance of skilled labor in the semiconductor industry, the Indian government has introduced the "Chips to Startup" (C2S) program. This initiative is in collaboration with companies like Synopsys which seeks to create a talent pool by partnering with over 400 universities. India already contributes 20% of the global semiconductor design talent and efforts are underway to train 85,000 professionals in areas such as semiconductor design, fabrication, and packaging.

International Collaborations

To ensure the competitiveness of its semiconductor industry, India is also focusing on international partnerships. Collaborations with countries like the United States and Japan aim to secure critical raw materials and foster technological cooperation. These alliances will play a key role in making India’s semiconductor industry more self-reliant and globally competitive.

India is making significant strides in the semiconductor sector, supported by strong government initiatives and international collaborations. While the country still relies on imports for most of its semiconductor needs, the ambitious goals laid out for 2026 signal a shift toward greater self-sufficiency and a more prominent role in the global semiconductor value chain. As India's electronics production and exports continue to grow, the semiconductor industry will be a key driver of the nation's economic transformation.

. . .

References: