The cycle of operations is the most salient and primitive platform for a country’s economy to be functionable. The mere fact about the contribution from determining sectors such as agriculture, trade and administration, bolsters the overall economic condition. With the concept of trade being the pivotal part, the expenditure and expense synopsis encapsulates in a recurrent balance sheet, thereby persistently maintaining the market equilibrium. The fiscal deficit becomes the cynosure when the balance amongst the contributing sectors turmoil into a severe ramification and its preceding shebang enchants the handier trade channel into an egregious labyrinth.

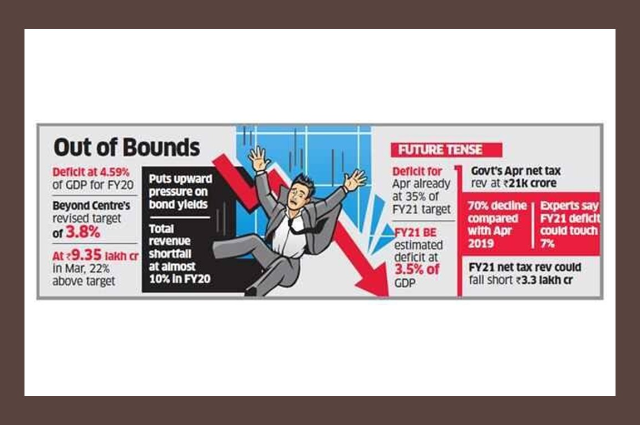

The developmental changes witnessed across the nation, have impacted the country’s economy at a greater extent but doesn’t guarantee equalized increment in the domain of deficit. Major parameters such as investment, consumption and its ilk effects have melted the scenario at its own juncture. Such factors can help understand the crux behind the downfall of the Indian economy in the incumbent period, alongside the debated imbalance emerging from the prolonged fiscal deficit. Briefing from the incumbent state, the fiscal deficit lashes out to Rs.8.7 lakh crore which is equivalent to 109.3% of the annual budget target alongside today expenditure of Rs.12.5 lakh crore.

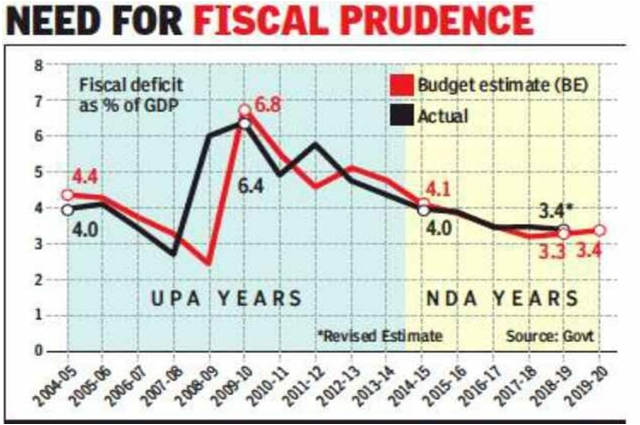

The correlation between the economic and structural enhancement of a country also depends upon the schemes and agenda the notary makers have opted. With a constant average GFD of 7.5% of the net GDP have made the condition static and its public debt is significantly higher than that of its neighboring countries. The implantation of tax system has resisted the injunction capacity in its hold, and the cumbersome procedure orchestrated by the working sectors, especially government sector, which has acted as a catalyzer in the equation of trade, thereby strengthening the fiscal junction.

On comparing the domestic stakes with the vehement style of economic functionalities prevailing internationally, myriads of protocols and parameters are considered before postulating the penultimate dogmas. The surrounding environment analyzes the position foiled by the respective government, the plausible consequences and multifold of permutation and combination while stretching its annual termed financial budgetary. As per the statement made by the director of IMF, the global public debt is expected to exceed more than 100% of the net GDP, which is 20% more than previous year records. The salient dynamics observed from magnus purveyors of global finances such as Japan, Europe and the US.

On comparing by the global fiscal deficit which have been increasing by approximately 10% from the preceding year, the variant has been safeguarded from excess inflation and detrimental situations. The prolonged actions opted now would act as a safety net across sectors, and would remain dormant unless a crisis or declining service costs are been tackled. But with the roaring incremental percentage in the lane of GDP and liberalization, the nominal interest rate has severely plummeted even in the well-established economic platforms and countries.

The effect of population on such diversified portfolios, often leads to lament about the situation. The stakes of population make the situation patchier, thereby making the long-term debt less sustainable. Majority of the under-developed countries, which are severely been impacted by the incumbent pandemic, would require subsequent backing from various international junctions. From the concept of Debt service suspension initiative as discussed in the G20 summit, can be the anecdote for international collaboration.

As per the monitored view, the holdings of such under-developed and developing country hasn’t been jovial and approving. The massive outbreak in the working zone and repatriation during COVID-19 has shown us the extreme disruption and dismay across time. Therefore, to channel the process in an apt way, it’s necessary to deduce conducive stances, which would upshot the economical and bearable options into the process. The usage of green energy and devoting sufficient percentage to healthcare domain have already used 5.8% of the global GDP, and big names such as the international monetary fund and Bill & Melinda Gates foundation have agreed to invest more if the situation worsens.

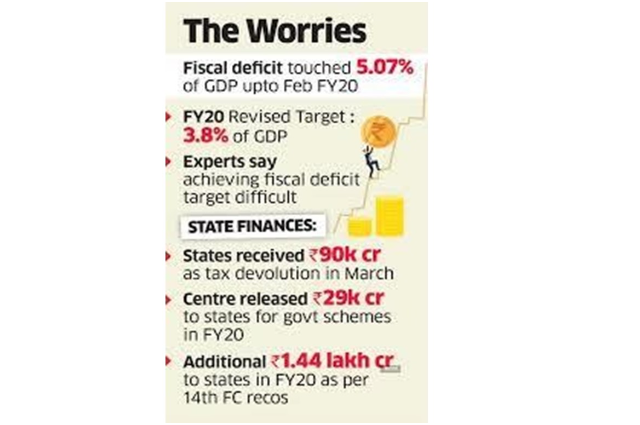

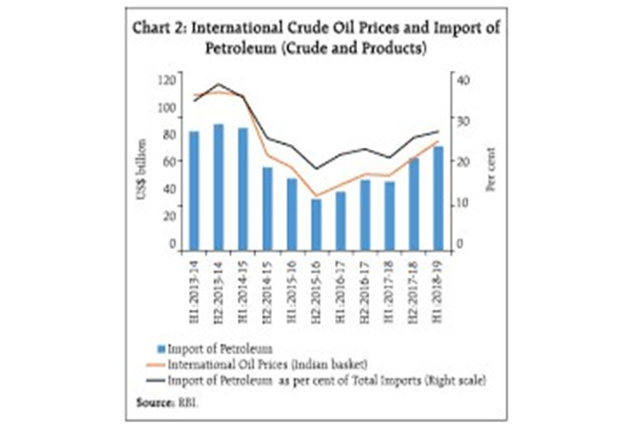

The annual fiscal report showcased a bloom in their expenditure column, with buyout courtesy to the tax collection. However, the same situation can’t be repeated as the transaction in the market have been plummeted beyond expectation, thereby forging the downfall rate from all major contributing sectors. The concept of dearness allowance has been kept on hold for the related government employees and ex-employees. Following which, the increase in tax on oil and petroleum have become impasse for the majority of Indian citizens. As the administrations acquire more to back their financial shortfalls and aggregate more obligation, loan costs will boost. The Reserve Bank of India (RBI) is attempting to drive down loan fees and in the process gets back from bank fixed stores (FDs).

A spike in government expands of the peril rating organizations minimizing India's FICO assessment much further. This will affect everything from methodical speculation plans (SIPs) to the estimation of the rupee regarding the US dollar. Plainly, a higher monetary deficiency isn't simply something that the legislature needs to sort, however it likewise affects our budgetary lives. In late April, the focal government concluded that the expansion in dearness stipend was because of its workers and retirees (beneficiaries) won't be paid.

Further, it additionally chose not to pay any expansion due until 1 July 2021. State governments have additionally executed comparable measures and are relied upon to spare roughly ₹82,566 crore.

Henceforth, government representatives, both at the focal and the state level, are now bearing the expense of the higher financial deficiency. Ordinarily, in any financial slump, the buying intensity of government representatives stays flawless. The aberrant effect of this loss of pay will mean lesser spending from the administration workers and retired people. What doesn't help is that few governments (like Telangana, for example) have been not able to pay a full compensation to their representatives. Once more, this implies a cutdown in spending which will affect others.

Frantic governments have been attempting to support their duty incomes. This is fundamentally on the grounds that the association extract obligation on petroleum charged by the focal government has been expanded significantly. The stoppage in charge assortments was clear even before the keep going money related year finished on 31 March 2020.

To deal with this and an easing back economy, RBI has been attempting to drive down loan fees. It has done as such by cutting the repo rate or the loan cost at which it loans to banks to 4% right now, from 5.15% in February 2020. It has likewise siphoned cash into the money related framework by purchasing securities. The overabundance liquidity in the monetary framework remained at ₹4.02 lakh crore. This is abundance cash which banks haven't had the option to loan and thus, have kept with RBI. In January, the administration had the option to obtain for a very long time at a yield of 6.6%. By June, this had tumbled to 6%.

With so much overabundance liquidity winning in the monetary framework, loan costs on stores have gone down. Information from Center for Monitoring Indian Economy (CMIE) proposes that between the finish of March and 22 May, the enthusiasm on fixed stores is down around 50 premise focuses. One premise point is 100th of a rate. Lower fixed store loan fees are another way how individuals will pay for a colossal lull in charge income assortment. One viewpoint that is frequently passed up is that stores are a significant type of reserve funds for a larger part of Indians. On the off chance that we take a gander at information between 2011-12 and 2017-18, stores conformed to half of family unit money related reserve funds.

In straightforward terms, this fundamentally implies that RBI should print cash and hand it over to the legislature to spend and meet its consumption. Actually, this was a standard until 1997, when an arrangement among RBI and the administration finished this. Take the instance of the US. Between, end February and end May, the Federal Reserve of the US has printed near $3 trillion.

Notwithstanding this enormous cash printing, financial specialists haven't left the US. The explanation behind that is other than being the significant worldwide hold cash, dollar is additionally regarded to be a place of refuge money. Henceforth, financial specialists like holding the dollar.

The equivalent can't be said about the Indian rupee. Indeed, even a trace of direct cash printing by RBI can prompt global speculators leaving India. Above all else, the financial exchange will fall, harming retail speculators, who contribute through the SIP course, the most. Strikingly, the unfamiliar speculators have propped the securities exchange up by net putting a sum of ₹22,707 crore.

The other side to not printing cash is by acquiring more cash. Past a point, that can prompt an evaluation minimize. Given that, the legislature is essentially stuck between the fallen angel and the remote ocean. Having said that, right now, the market feels good with the possibility of getting more. This can be found in the way that the yield on the 10-year depository security has pretty much stood consistent at around 6%, since May. Subsequently, obtaining obviously appears to be a lesser evil than printing cash.

To finish up, the administration needs to take a gander at imaginative ways—like selling land banks, curtailing merchandise and ventures charge (GST) and pay charge rates—to support charge incomes. Likewise, it needs to organize its consumption for sure. As things stand, it would seem that the residents should bear the expense of falling duty incomes and a higher monetary shortage.

. . .

References:

- Persistent Fiscal Deficits and Political Economy Transitions in India : An Empirical Investigation. (2020, March 28). Retrieved October 21, 2020. (Source)

- Pti. (2020, July 10). Global public debt, fiscal deficits to reach all-time high, IMF warns. Retrieved October 21, 2020. (Source)

- Noronha, G. (2020, May 29). Fiscal deficit widens to 4.6% of GDP in 2019-20. Retrieved October 21, 2020, (Source)

- Correspondent, S. (2020, July 31). Fiscal deficit touches 83% of full-year target. Retrieved October 21, 2020, (Source)

- Reuters / Sep 30, 2. (n.d.). Fiscal Deficit: India's April-August fiscal deficit passes 109% of full year budget target - Times of India. Retrieved October 21, 2020, (Source)

- Kaul, V. (2020, June 03). How India's soaring fiscal deficit affects you. Retrieved October 21, 2020, (Source)