Today, Bitcoin is the most valuable asset in the world of cryptocurrencies. Blockchain technology revolutionized not only the concept of finance management but also everything else. Ethereum, another crypto asset launched in 2015, specializes in smart contracts. You can build decentralized apps known as DApps, that provide better security from fraud and third-party interference. However, there is a catch – The Blockchain Scalability Trilemma.

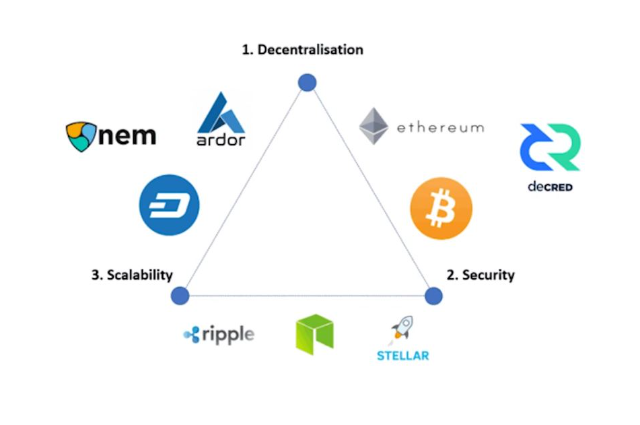

Ethereum’s Co-founder Vitalik Buterin first coined the term. It states that the developers can only sustain two of the three desirable standards – Decentralization, Security, and Scalability. Bitcoin and Ethereum are decentralized and highly secure but lack effective scalability. Hence, the more people join the community, the more mediocre the system gets. As of writing this article, the current average transaction fee is $2.217 and $6.58, respectively. Bitcoin takes five transactions per second (TPS), whereas Ethereum takes fifteen transactions per second. To put it into context, VISA requires 65000 TPS and the NASDAQ Exchange requires 500K TPS. You can see the diagram below for a better understanding of the trilemma.

The mechanism on which Bitcoin works – Proof of Work, is very energy-costly and unscalable. Ethereum has adopted the Proof of Stake workflow and Layer-2 scalability solutions that are more efficient and scalable, but they are still not fast enough. To solve the scalability problem, a team of developers at Qualcomm came up with Solana.

What is Solana?

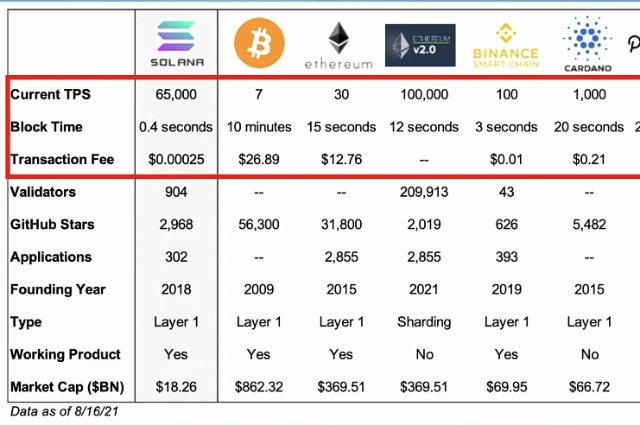

Solana is high-performance blockchain technology. It is fast, secure, and scalable. Unlike other blockchains, Solana has successfully integrated all three desirable qualities into its infrastructure. It is decentralized, safe, and highly scalable. Let’s have a look at the table below:

If you compare Solana with Bitcoin and Ethereum, you will quickly realize the potential of this new blockchain. So, how did the developers achieve this seemingly impossible feat? In 2017, Anatoly Yakovenko teamed up with his former Qualcomm colleagues Greg Fitzgerald and Stephan Akridge to build the blockchain using the Rust programming language. Raj Gokal supported the project and became a co-founder of the blockchain. He is also the founder and advisor of the digital health industry. The platform was earlier named Loom, but they later changed it to Solana as there is already a project called the Loom network. “Solana” name comes from the Solana beach in San Diego. The blockchain was only officially released recently in March 2020.

Why is it so popular?

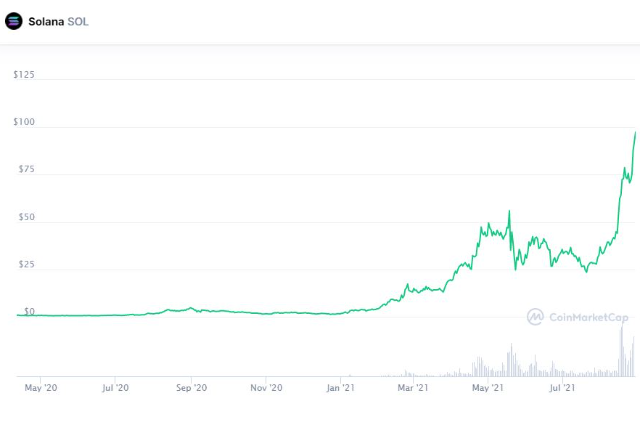

It’s been only a year and a half, and the price of 1 SOL today is $95 and growing. In the last two months, it has increased by more than 200%. In just 24 hours of writing this article, the growth rate has been 12.68%. The reason behind its popularity and momentum is the technological breakthroughs it brings in the field of blockchain.

Proof of History (PoH):

Solana’s workflow model not only depends on Proof of Stake but also the new concept – Proof of History. In simple words, it records the time events at different stages of the transaction and stitches them together in the end. All the validators throughout the world agree on a universal time. Hence the time taken to decide upon a fixed time is reduced to zero, making the transaction incredibly faster.

Practical Byzantine Fault Tolerance(PBFT) Based System:

Introduced in the 90s by Barbara Liskov and Miguel Castro, this algorithm minimizes the risk of malicious nodes connected to the blockchain. Bitcoin and Ethereum struggle at 49.5% and 46% fault tolerance, respectively. It gets more secure as the network grows. Solana has optimized the algorithm based on PoH protocol, reducing the fault tolerance to 33%. In the future, it has the potential to drop down to zero as the network latency approaches infinity.

To Infinity and Beyond – Moore’s Law:

Moore’s law states that the number of transistors on a microchip doubles every two years. Solana’s design protocol allows it to run parallel processes in the GPUs of the system. The speed of Solana will increase along with better hardware and wireless technology over time without changing anything in its core architecture. Solana is capable of 65000 TPS in a 1GB network. It increases to almost 7M when the latter grows to 10GB. Theoretically, Solana can scale up to infinity!

Finality Time:

Finality is the guarantee that your transaction will not be altered or hacked by internal or external elements. As the block time decreases, the finality time decreases. Solana has a finality time of less than a second, making it safer than Bitcoin or Ethereum.

FYI, Bitcoin has a finality time of 60 mins, and Ethereum is at 6 mins!

Solana Ecosystem:

Solana’s incredible web-scale approach has attracted developers around the world to build start-ups using the technology. Currently, there are 302 projects developed, with 400 coming soon in the ecosystem. High scalability and low network latency make it a perfect tool to build your digital platform. You can explore their ecosystem here!

To learn more about the innovations brought by Solana, you can read this article written by the founder Anatoly Yakavenko himself.

If you want to learn about Solana in detail, you can download the white paper here. Now let’s talk about it from a financial point of view.

Should you buy Solana?

Before you rush to buy SOLs, I want to clarify that I am not a financial advisor. I am only providing you the information I have gathered from various websites, including the original ones. You are responsible for your financial decisions, so I advise you to do thorough research yourself before spending or investing your hard-earned money.

Since Solana is a third-generation blockchain with almost no historical record, financial advisors have to rely on its technical analysis to predict its price on the market. As you can see in the chart above, the price has dramatically increased since July. It is supposedly due to mass awareness as well as the launch of Wormhole. It is a bidirectional bridge between ERC-20 and SPL tokens. In simple words, it has the potential to connect Ethereum with Solana! Similarly, Audius, a music streaming platform, chose Solana so that it can scale with ease.

FTX and Alameda Research built Serum – A decentralized finance exchange using Solana blockchain. FTX founder Sam Bankman Fried is also the co-founder of Serum and an enthusiastic supporter of Solana.

USDC and USDT are digital stablecoins that aim to replace fiat currency which currently backs cryptocurrency. These stablecoins have integrated themselves with Solana because of their speed. Mango Markets, Raydium, Integration with Chainlink, the possibilities are endless. And the projects build on Solana are only going to increase with time.

Different websites like CoinMarketCap, Wallet Investor, Cryptocurrency Price Prediction predict the price of Solana to go up. Some are incredibly optimistic, while others are more conservative in their predictions. But they all agree on one thing – Solana is a safe investment, both short as well as long-term. Trading Beasts predicted the price would not cross an all-time-high (ATH) of $55.65, which we can see, didn’t age well. I believe in the potential of the technology, and despite some setbacks, which is natural, I think it is going to explode like Bitcoin soon. In my opinion, I wouldn’t suggest putting your money in now because the Solana market is bullish now. And as per the pattern, it is going to drop soon. So, keep an eye out for the right time to invest and consult an expert before investing!

If you want to invest in Solana, you can register and buy on crypto-exchange apps. In India, you can buy Solana on BuyUCoin, CoinDCXGo, CoinSwitch, and WazirX.

Thank you for reading!