ABSTRACT:

Retirement planning has been a problem for retirees, with this issue being more prominent during the current stage of low interest rates. These interest rate barely beat inflation. This has made it difficult for retirees to earn a steady income that grows with at least inflation.

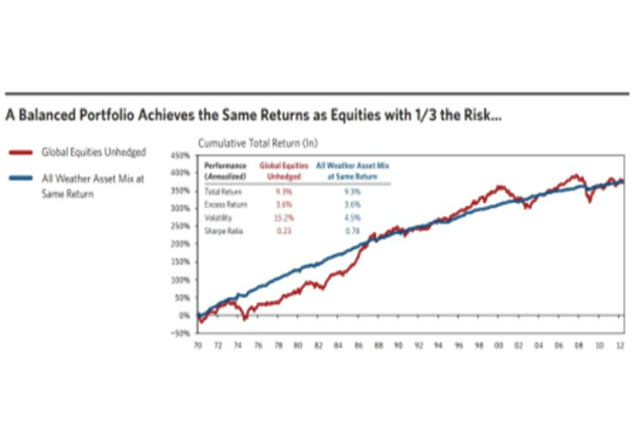

The main aim of this paper is to give an introduction to portfolio management and create a portfolio with low volatility and stable returns, that comfortably beat inflation. This makes it an ideal portfolio for retirees. The said portfolio is an “All Weather Portfolio” that is based on an existing portfolio that is run by billionaire fund manager Ray Dalio. The portfolio has matched the returns that are given by the broader index, with 1/3rd of the volatility of that of the broader index.

INTRODUCTION

A portfolio is a collection of assets. The assets may be physical or financial like Shares, Bonds, Debentures, Preference Shares, etc. The individual investor or a fund manager would not like to put all his money in the shares of one company, that would amount to great risk. He would therefore, follow the age-old maxim that one should not put all the eggs into one basket. By doing so, he can achieve objective to maximize portfolio return and at the same time minimizing the portfolio risk by diversification.

- Portfolio management is the management of various financial assets which comprise the portfolio.

- Portfolio management is a decision–support system that is designed with a view to meet the multi-faced needs of investors.

- According to Securities and Exchange Board of India Portfolio Manager is defined as: “Portfolio means the total holdings of securities belonging to any person”

Portfolio Management refers to analysing various asset classes and allocating them with proper allocation to balance risk and reward of the overall portfolio. A big problem that currently exist is the management of a portfolio for retirees. A portfolio for such people should consist of lower volatility, and hence many of them turn to fixed income options like fixed deposits, annuities, etc. The problem with these options is that currently interest rates are at all-time lows, and due to this the yields of these products are extremely low, with fixed deposits yielding around ~5%, and annuities having similar yields. Inflation being in 4-6% range, these products are destroying the purchasing power of investors. This is the reasons why retirees need a little higher return on their investments, that will allow both of these:

- A safer withdrawal rate, and

- Maintain their purchasing power at the very least

An obvious solution that comes to mind is equities, but considering the fact that these are highly volatile, and can sometimes see drawdown of 40-50%, will see the capital being put a high risk. This paper will be putting forward three alternatives that will both minimize the volatility of the portfolio, and, help the investor maintain their purchasing power by beating inflation at the very least.

STEPS IN PORTFOLIO MANAGEMENT

First, let us understand what portfolio management exactly is.

- Specification and qualification of investor objectives, constraints, and preferences in the form of an investment policy statement.

- Determination and qualification of capital market expectations for the economy, market sectors, industries, and individual securities.

- Allocation of assets and determination of appropriate portfolio strategies for each asset class and selection of individual securities.

- Performance measurement and evaluation to ensure attainment of investor objectives.

- Rebalancing the portfolio, when necessary, by repeating the asset allocation, portfolio strategy, and security selection.

CRITERIA FOR PORTFOLIO DECISIONS:

- In portfolio management emphasis is put on identifying the collective importance of all investor’s holdings. The emphasis shifts from individual assets selection to a more balanced emphasis on diversification and risk-return interrelationships of individual assets within the portfolio. Individual securities are important only to the extent they affect the aggregate portfolio. In short, all decisions should focus on the impact which the decision will have on the aggregate portfolio of all the assets held.

- Diversification across securities will reduce a portfolio’s risk. If the risk and return are lower than the desired level, leverages (borrowing) can be used to achieve the desired level.

- The risk associated with a security type depends on when the investment will be liquidated. Risk is reduced by selecting securities with a payoff close to when the portfolio is to be liquidated.

PORTFOLIO BUILDING

Portfolio decisions for an individual investor are influenced by a wide variety of factors. Individuals differ greatly in their circumstances and therefore, a financial programme well suited to one individual may be inappropriate for another. Ideally, an individual’s portfolio should be tailor-made to fit one’s individual needs.

Investor‘s Characteristics:

An analysis of an individual’s investment situation requires a study of personal characteristics such as age, health conditions, personal habits, family responsibilities, business or professional situation, and tax status, all of which affect the investor’s willingness to assume risk.

Stage in the Life Cycle:

One of the most important factors affecting the individual’s investment objective is his stage in the life cycle. A young person may put greater emphasis on growth and lesser emphasis on liquidity. The investor’s marital status and his responsibilities towards other members of the family can have a large impact on his investment needs and goals.

Attitude towards Risk:

A person’s psychological make-up and financial position dictate his ability to assume the risk. Different kinds of securities have different kinds of risks. The higher the risk, the greater the opportunity for higher gain or loss.

Tax considerations:

Since different individuals, depending upon their incomes, are subjected to different marginal rates of taxes, tax considerations become most important factor in individual’s portfolio strategy. There are differing tax treatments for investment in various kinds of assets.

Individual’s Financial Objectives:

In the initial stages, the primary objective of an individual could be to accumulate wealth via regular monthly savings and have an investment program to achieve long-term capital gains.

Liquidity Needs:

Liquidity needs vary considerably among individual investors. Investors with regular income from other sources may not worry much about instantaneous liquidity, but individuals who depend heavily upon investment for meeting their general or specific needs, must plan portfolio to match their liquidity needs. Liquidity can be obtained in two ways:

- By allocating an appropriate percentage of the portfolio to bank deposits, and

- By requiring that bonds and equities purchased be highly marketable.

Safety of Principal & Investment Risk:

All investment decisions revolve around the trade-off between risk and return. All rational investors want a substantial return from their investment. An ability to understand, measure and properly manage investment risk is fundamental to any intelligent investor or a speculator. Frequently, the risk associated with security investment is ignored and only the rewards are emphasized.

RISK AND EXPECTED RETURN

There is a positive relationship between the amount of risk and the amount of expected return i.e., the greater the risk, the larger the expected return and larger the chances of substantial loss. One of the most difficult problems for an investor is to estimate the highest level of risk he is able to assume.

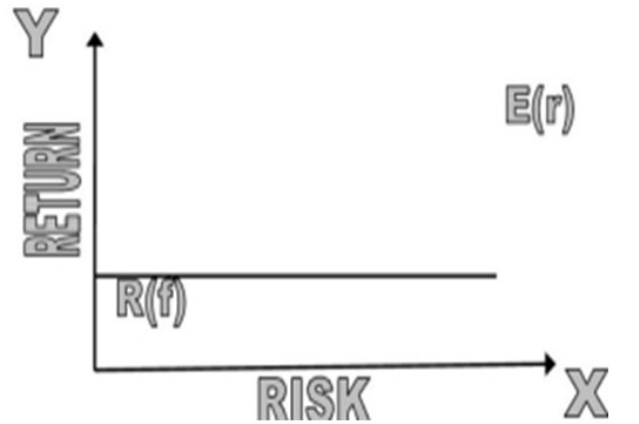

▪ Risk is measured along the horizontal axis and increases from the left to right.

- Expected rate of return is measured on the vertical axis and rises from bottom to top.

- The line from 0 to R (f) is called the rate of return or risk less investments commonly associated with the yield on government securities.

- The diagonal line form R (f) to E(r) illustrates the concept of expected rate of return increasing as level of risk increases.

Let’s put these parameters of Portfolio Building & Risk-Reward into place for retirees.

- Since the age is high, generally above 60, the risk-taking appetite is low.

- Due to age, the aim is income generation, hence a major part of the portfolio should be allocated to income-generating assets.

- The volatility of their portfolio must be minimized

RESULTS

All-Weather Portfolio

Real life is full of such kinds of surprises. Another thing that’s true is that no one can predict surprises. The only thing that you can do is to be prepared for it. With this thought in mind, Ray Dalio, founder of Bridgewater Associates, a leading hedge fund with $160B under management, went on to a mission to find the investment portfolio that would perform well across all environments and that can handle all surprises.

All-Weather is an investment strategy pioneered by Bridgewater Associates. The objective of this strategy is to weather any market storm from Demonetization, recession, etc. Let’s look at basic assumption considered by Ray to come up with this strategy.

- Price of the securities changes only due to change in the expectations of future

- Irrational behaviour in markets only happens for short period of time

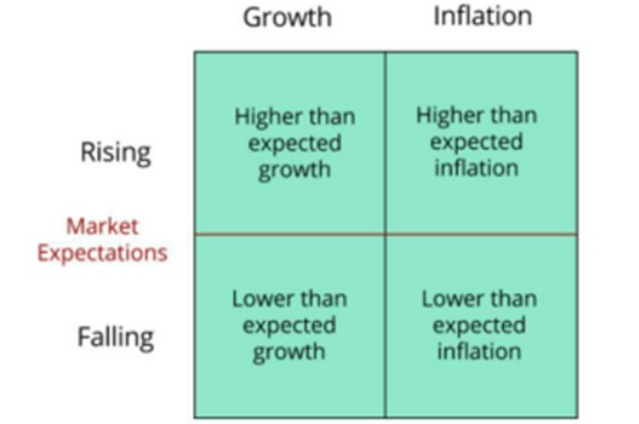

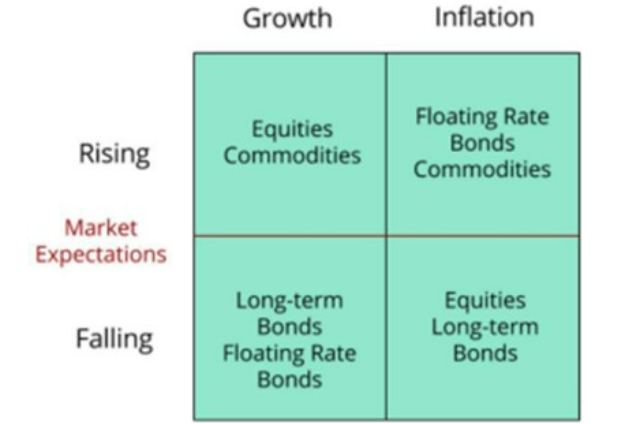

So, all the surprises can be mapped to the following four season of the markets:

Bridgewater Associates, LLP

Source: sweatyourassets.bizThese are the asset classes that are relevant for that particular stage.

Bridgewater Associates, LLP

Source: finance.yahoo.com

Above chart clearly shows the power of All Weather Portfolio strategy. This is the strategy that was back-tested over the past 4+ decades. The blue line shows the “All Weather Portfolio” while the red line shows the chart of global equities. The “All Weather Portfolio” is almost in a straight line, and matches the returns of that of the equities, but with extremely low volatility.

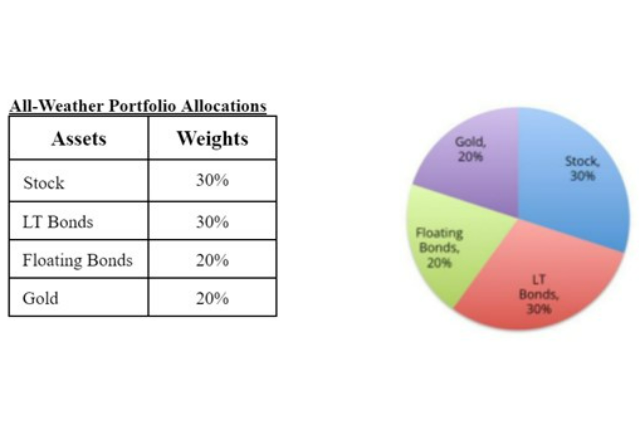

The allocations for this portfolio are given below. This allocation must be rebalanced at least once every year. Rebalancing means if the allocation is changed due to fluctuations, that must be brought back to the original allocations. This way the assets that have underperformed would be bought while those that have given high returns, would be sold.

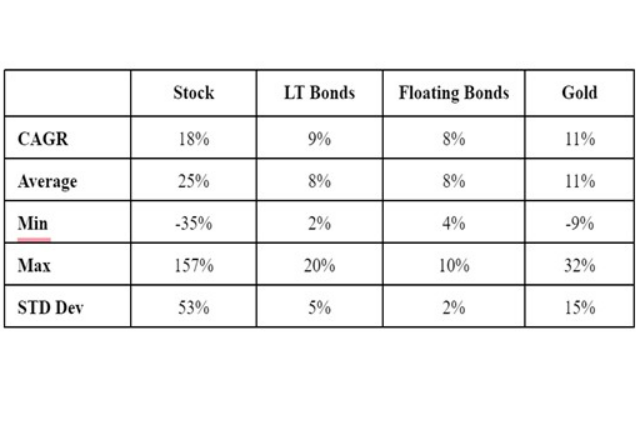

These are the proposed asset allocations that would be relevant to the market of India. Let’s break out the asset classes individually and look at their performance for the last 10 years. It is clearly visible that “All weather portfolio” is able to beat the returns of most of them while keeping risk minimum at the same time.

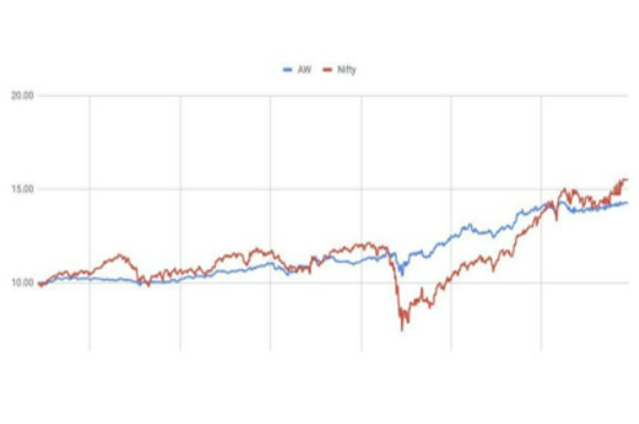

After all this back testing, this strategy was put to use in real time. This is the “All Weather Portfolio” that I have been running over the past three years. The performance is shown in the chart below.

The total CAGR during this period has been ~12%, which is almost similar to that of the broader market, but with very low volatility. The maximum drawdown in Nifty during this period was ~40%, while the same for All Weather Portfolio was just ~7%. At any point in time, it was observed that the rolling one year returns of the “All Weather Portfolio” was always positive.

CONCLUSION

This is a simple strategy where the retirees won’t be losing their money, that not only beats inflation, but also gives a return that is similar to that of the broader index. All this with very low volatility. This makes it easy for the retirees to withdraw on the capital while still preserving their purchasing power. Over the back testing of past 4 decades has generated a return of roughly 10% CAGR (Compounded Annual Growth Rate). This return comfortably satisfies two of our criteria for a retiree – to comfortably beat inflation, and have a safe withdrawal rate.

. . .

SOURCES:

- www.principles.com

- Principles by Ray Dalio book

- www.investopedia.com