Started by Rana Kapoor and Ashok Kapur in 2004. The Bank grew remarkably in the next decade compared to the likes of HDFC, ICICI banks. But the real story started when Rana Kapoor held the chair for the Bank. After 2008, Bank adopted the strategy to aggressively provide corporate loans and advances to become one of the biggest banks in India. The lending process was so lenient that it was called "lender of the last resort". And the tag tells us the story. During 2015, the fault in the operations started to become visible when the non-performing asset ratio was hovering around 0.5%. This value is quite difficult for a bank that is lending aggressively, and even a stable bank like HDFC, which has the lowest of the NPAs, has a 1% value. And after few years, it turns out that the Bank landed more than what it had. With a credit to deposit ratio at 130%, serious underreporting of non-performing assets with a difference between the stated and the RBI release data was 4160 crores. The Bank was brought under RBI scanner, which led to one of the biggest restructuring in India's history of the banking sector.

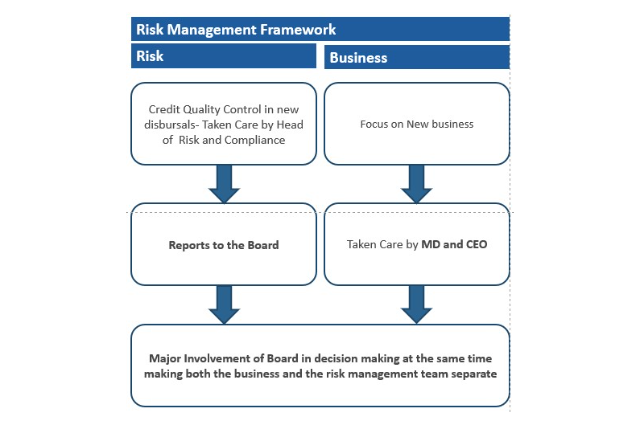

The restructuring brought several changes in the risk management committee, board members, Banks' strategy, area of operations, and various other changes to increase the asset quality and trust in the Bank. The changes brought Prashant Kumar, the SBI veteran CEO of the YES Bank. Which was saddled with a massive GNPA ratio of 18 percentage, NPA ratio of 8%. The first change in the Bank internal operation was in the risk committee, which was brought under the board separate from the purview of the CEO. Having larger NPAs also meant that the Bank would have negative profits for the next few years due to the higher provisions and the shortage of core capital since the Bank had to maintain a specific capital adequacy level.

From a return on equity of -80% in FY20 to +2.5% in Q1 FY 22, the Bank has recovered a lot. Understanding the significance of this ratio is essential.

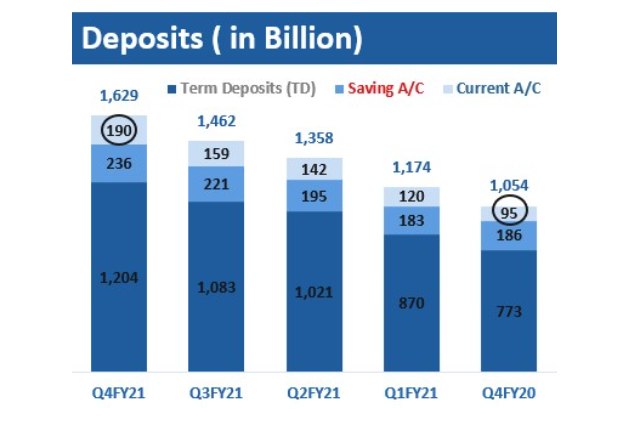

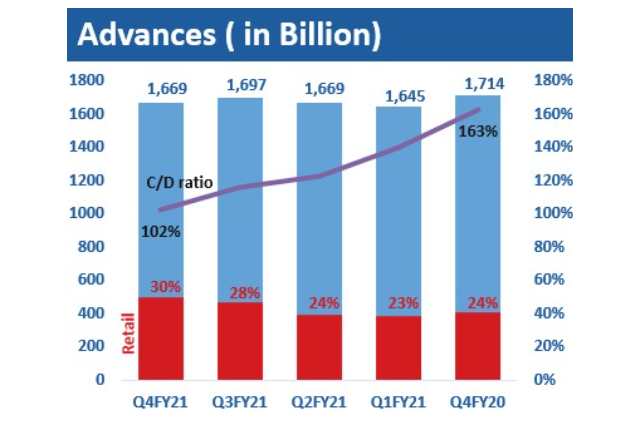

The return on equity depends on two factors, one net profit and another capital structure. The net profit can be increased either by increasing revenues or by reducing expenses. Now, to understand how Yes Banks shall improve its revenue. The Business model for the Bank had to be understood. Bank provide loans and get interest as an income, and at the same time bank accepts deposits and pays interest to the deposit holder, which is an expense for the Bank. Subtracting the interest income from interest expense will get us net interest margin, a key factor for understanding Bank's profitability. Hence, more the interest income from the advances more is the net interest income. For Yes Bank, growing the advances to boost interest income was not viable since Bank could not lend excessively. Hence, increasing the interest rate for advances or reducing the deposit rate for the customers was the only way to grow. Yes Bank had reduced the saving account rate from 5% to 4% this year. Net interest margin improved by 9.2% in FY21. Bank had changed its strategy from corporate advances to retail and CASA (current account and saving account) focus. The Bank targeted a CASA ratio of 60%, retail to corporate advances of 60:40 in favour of retail banking. CASA has shown a sharp 51% growth in the last financial year. The retail share in the Bank's advances has increased from 24% to 30% in FY 21. The retail advances are where the NPAs for the Bank are lowest and have more interest income than the corporate. This factor had contributed by more than 60% increase in the return on equity in the last two years. The most significant advantage of going with this strategy is that MSME in India is generally private firms backed by the owner's assets. The value of those assets is more than the credit they get from the banks. Adding to the advantage is improved collection efficiency, better diversification, far better asset quality than the corporates, and reducing the concentration of loans in small groups of people and industry. And hence the recoveries are easier, and thus the chances of NPAs or reduced.

The next phase of income comes from the fee business. Fee income depends on the Bank's services like file charges, account maintenance charges, credit cards, and other third-party services like insurance. With the growth in the CASA ratio, the number of current accounts in the bank increases where the Bank doesn't have to pay any interest to the account holder. It also provides ongoing fees yearly and hence provides stability to the income to the Bank.

Now, the Bank has operational expenses like employee expense, lease expense, software expense. Provision expense is the largest expense for the Bank.

Going with the current strategy of cost optimization, with an increased focus on growth opportunities. Bank's operating expenses, excluding provisions and contingencies reduced by 21.5%. This reduction resulted in the growth in operating income to 41.5% in FY21. This financial year, the Bank aims to cut the operating expense by 20% by relocating its offices from central business locations to new locations. This year Bank moved from Central Mumbai to Santa Cruz, saving 100 cores in the annual rent.

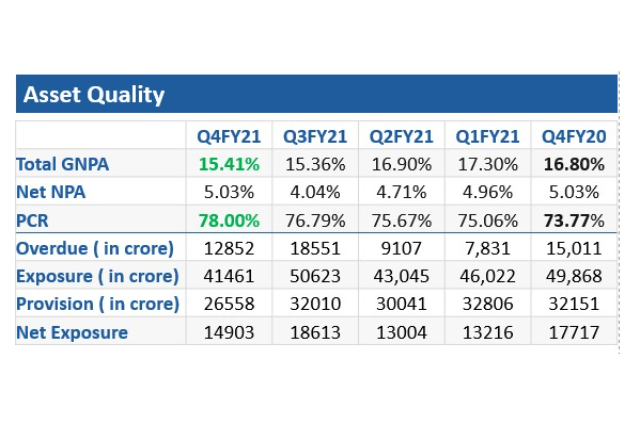

Bank's recoveries outpaced slippages this year with recoveries of 4933 crores. Net exposure reduced by 20% from 17,713 crores in FY20 to 14,903cr. Bank's GNPA reduced by 13% to 15.41% in FY21. The overall coverage increased by 7 percentage points. Even though provisioning increased this year, the CET ratio remains stable at 11.2%. PCR ratio also remains healthy at 79%, with LCR ratio at 114% in FY21. The banks' collection efficiency improved to 96 per cent. The above changes imply that the Bank does not have to make higher provisions in the next few years and will have better profits for the shareholders.

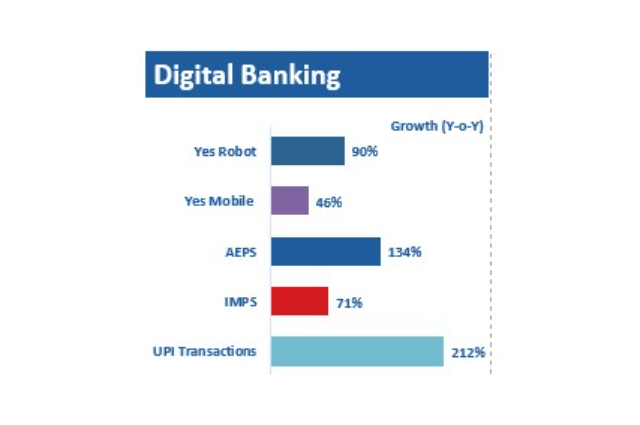

Figure showing growth for financial year 2020

The Bank had ticked all the boxes in the last few years. Although the Bank is saddled with massive GNPAs, the turnaround story for the Bank is starting to show results. With one of the best tech infrastructures in Bank with modern technologies like blockchain, API, and open banking. The growth of the future customers for the bank seems plausible. Faster recoveries have improved the customer perceptions and credit ratings for the Bank. The Bank had fought well, and it will be interesting to see how the future pans out for this exciting Bank.