The current status of the banking sector in India is very dire. It is plagued by several systemic problems like widespread non-performing assets, lack of good regulatory oversight and poor risk monitoring and reporting systems. All this combine to give it a very poor overall stability and put several banks in risk of bankruptcy. As a way to combat this several banks are currently being merged with each other to improve their financial status and to increase their resilience to NPAs. This can also help them to increase their lending capability and hence cater to larger businesses more easily which can generate more revenue.

Steps to improve the Indian Economy through the Banking sector Impetus for agricultural and animal husbandry to be brought into the formal sector: In my opinion the agriculture sector is the backbone of the Indian economy with it employing close to 51% of the total population. This means that a very significant proportion of the Indian population is reliant on the agricultural and associated sectors for their livelihood. It is also worth noting that during the 2008 Financial crisis, India was not affected to as much as the western countries as a large part of the population was not reliant on the formal financial sector but rather the informal sector which also acts as the backbone of the agricultural sector. This sector is also immune to any shocks from the global market and only helps us to increase our exports and reduce our credit deficit with countries like China. We can note that during the COVID pandemic, the agricultural sector was the one that was the foremost to rebound as it supplied the FMCG sector. From all this it is very clear that for having any lasting and meaningful impact on the economy, the agricultural sector is the one where there must be the maximum reform.

The main question now is how to bring in reforms to such a wide and extremely varied sector. It would be difficult to arrive at any broad solutions as there are multiple issues ranging from leakages in the MSP system, hoarding which can lead to price shocks, lack of proper cold storage mechanisms for perishables and several more. It is extremely wide and not one solution can be given. However, there are some broad-based solutions that can be adopted for lasting change. The banking sector has a huge responsibility here to ensure that they are available and able to provide assistance to Indian agricultural and horticulture sector.

Ensuring formal sector financial assistance to farmers: This means that in place of predatory loan sharks and very high interest rates the farmers must have access to the formal banking sector to avail farm loans at subsidised rates. Although they already exist, their penetration is extremely limited and is not availed by a large sector of the farming community. Even when they can avail the loans, they are not able to due to the fact that they require extensive paperwork and these farmers are not educated enough to understand and fill in all the documentation. This means that it is not just necessary to make it available but also to ensure that they are utilized by them. This can be done by providing them with a separate channel for agricultural loans. The NABARD (National agricultural and rural development bank) can play a vital role here. The agency can be tasked by training banking officers to provide a separate and easier channel for the farmers to acquire low interest loans. This ensure credit availability and also enables them to increase their productivity.

Providing low cost insurance for agriculture and allied sectors: This can be the most valuable step in encouraging farmers to actually continue with agriculture especially during uncertain times. This provides them with a safety net in case they have any problems and can encourage them to go in for more ambitious returns. This can also help shield them from climate-based disasters and ensure some returns for them. This could also be valuable for other allied sectors like fisheries and horticulture in case they have some issues. The banking agencies like NABARD can work along with insurance providers like LIC to provide crop insurance, insurance for vehicles and even life insurance for the sectors. This can be a great boon to them as they are then guaranteed some returns and have some surety in their field. This can also encourage more youngsters to consider agriculture and allied to be a viable field for their livelihood and we can limit the increasing joblessness.

Giving preference for modern technologies and best practices: It is important to remember that Indian farmers still haven’t modernised and are using very old and inefficient methods. This gives us very low productivity and poor yields even if the conditions are ideal. To avoid this, we can go in for modern technologies and begin adopting new equipment which can give more output for the same inputs. This can be done by providing some financial assistance to farmers who are going in for new technologies. Also, the Ministry of Agriculture can scout the world for best practices like drip irrigation or hydroponics which can help conserve water. This is especially true in countries like Israel which have been able to maximize their productivity even in very arid conditions. Such technologies and ideas can be adopted in our country. Here again the banking agencies can provide specialized loans for farmers looking to adopt the best practices. This give them a very good financial incentive to improve upon their existing tools and techniques.

The overall picture that we see is that for a country like India, there is a significant scope for improvement in the agriculture sector but this needs to come in from the banking sector and not the government. The government has already given a lot of subsidies and specialised schemes for the small and subsistence farmers and any more would be an enormous drain on the government’s financial resources. This is especially important if we see this from the global perspective. This means that the burden of responsibility for supporting the filed falls on the hands of the free market and the banking sector. This is already the norm in various countries around the world.

Case Study: Agriculture in the USA and China

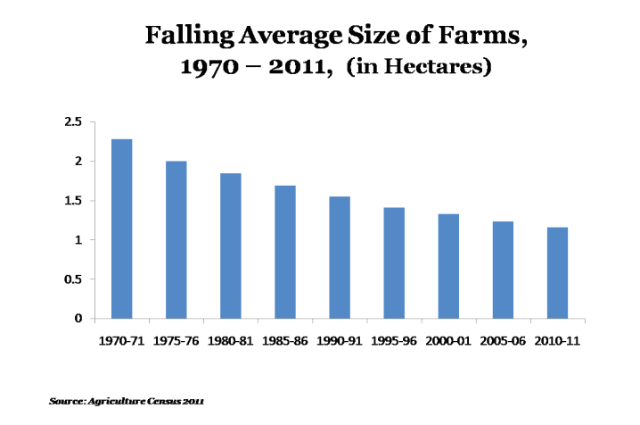

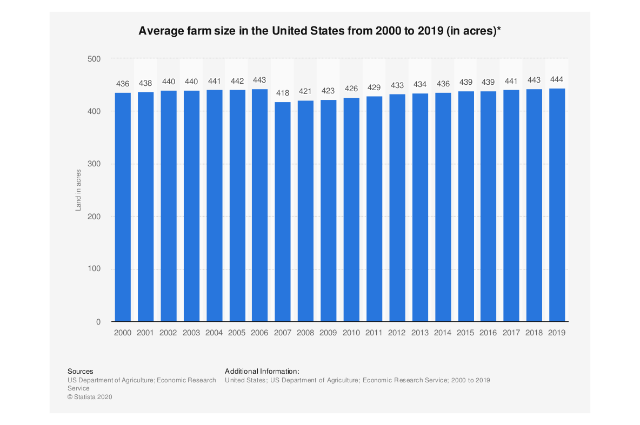

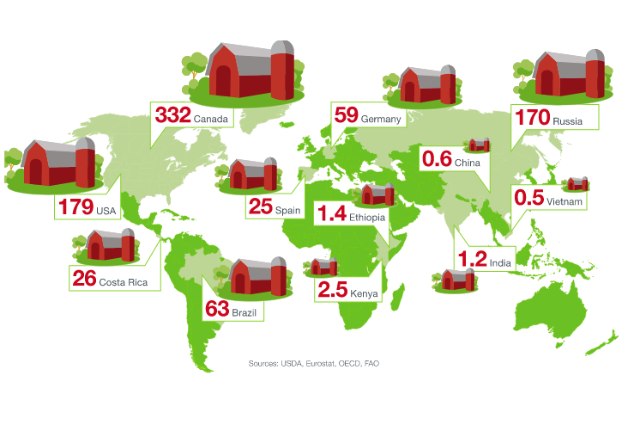

United states of America: In the US, the agriculture sector is dominated by individuals and corporations that own large tracts of lands and they have enormous scale of production. The average size of a farmland in the US is 169 hectares while in India it is 1.08 hectares. They have highly mechanized production and the entire field of agriculture is highly automated. They don’t have a large requirement for farm labor as most of the work is done by automated machines that can sow, plough, irrigate and harvest all with minimal human oversight. This shows the most significant difference with India where we have highly fractured farmlands and hence, we cannot have large scale production as it is financially not viable.

The banking sector has evolved particularly in accordance with the needs of the industry and hence the agricultural loans are very large ones that are take out by the corporates or very wealthy individuals mainly to improve technology or to begin a new sowing season. This clearly shows that the banking sector needs to constantly in sync with the agriculture industry and evolve to meets its needs, which is not the case in India. In India, the banking sector is far more rigid and not suited for scaling up production.

Learnings from the US case

There must be a greater free market approach to agriculture and the banking sector must be able to provide large loans to scale up production for farmers.

The banks must change its lending criteria and encourage more innovative solutions like community farming in villages.

China: China has even smaller land holding capacity than India but it has higher productivity than India. (0.6 hectares per farmland) This shows the various innovative solution that they have adopted to overcome this.

Since 1984 there has been a liberalisation attempt towards the agriculture sector that has given greater control to the free market to dictate prices that has enable them to remain competitive. Also there has been a new push towards organic farming that has given great dividends. Here the banking sector has enabled the widespread adoption of industrial farming, where the factory farms have seen a quadrupling of the total productivity from the 1950s. This is mainly due to large scale lending to commercial farming and adoption of global best practices.

Learning from China:

The banking sector must be enabled to lend freely for the adoption of industrial farming.

Providing financial assistance for the newer and more modern agricultural practices like organic farming.

The big picture:

We can note that there must be a robust link between the agriculture and banking sector. This is the norm in most developed countries and has enabled them to reap huge rewards for the economy. In India, where the significant majority of the population is still dependent on agriculture as a source of livelihood, it is vitally important that banking recognises this need and rises up to the challenge. This could be more valuable for the economy in the long run than investments in other sectors like manufacturing which employ much smaller proportion of the population. It is vitally important the we enable our primary sector to grow and account for up to 25% of our GDP by 2025.