All eyes are set on achieving the vaunted goal of making India a 5 trillion economy. Since the role of banks and financial institutions to attain the target could never be underrated, it would be necessary to realize the value locked up in stressed assets. As we all know, the mammoth responsibility of creating and expanding credit to aid the country's economic development lies solely on the banks' shoulders. Still, the overhang issue of non-performing loans has disabled the banks and other financial institutions to keep pace with the country's capital and money requirements. One of the significant reasons for the downwards economic growth trajectory is the bad loans due to banks.

Non-performing or stressed assets are those of the banks or financial institutions on which the loan or principal amount is due for more than 90 days. These bad or non-performing loans adversely affect the banks' profitability and hurdles the economy's growth as banks are required to provide vast amounts of funds against these loans in the form of provisions. This provisioning reduces not only the profits of the banks but also the interest rates offered by the banks on the deposits and in the long run bank has to face liquidity and solvency crises.

What are the factors that have led to the accumulation of NPAs in the Indian banking arena?

- Historical factors -From 2000 to 2008, the global economy witnessed a boom period that lured the banks to give excessive amounts of loans to corporate sectors. Nevertheless, after the global financial crisis in 2008 that began in the USA, the whole economy was shattered. The earning of corporate began to dwindle, due to which they were unable to meet their financial obligations. Global Financial crisis 2008 led to the accumulation of a massive amount of non-performing loans on banks' balance sheets.

- Relaxed lending norms: One primary reason for rising NPA is the relaxed lending norms practiced by the banks of India, especially for corporate honchos when their financial status and credit rating are left unanalyzed. Also, to gain an edge over the competitors, banks are hugely selling unsecured loans, which attributes to the level of NPAs.

- Lack of contingency planning: Banks did not conduct adequate planning significantly to mitigate project risk.

- Restructuring of loan facility: the facility was extended by the public sector banks to their corporate defaulters either due to the pressure from the political leaders or due to their gains.

Unforeseen economic shocks like Demonetization and Covid 19

The government of India, along with RBI, has introduced several measures and reforms to curb the issue. However, no effort has emerged victorious in sustaining the financial health of the banks.

Somehow, a beacon of hope is seen with the passing of the SARFAESI act in 2002 and the IBC act 2016. SARFAESI act enabled the formation of Asset Reconstruction Companies (ARCs). Asset reconstruction companies are the particular type of financial institutions that acquire stressed assets or bad loans from the banks at fair market price and try to dispose of or resolve them depending on their viability and feasibility. Thus, it helps banks clean their balance sheet and concentrate on their core activities rather than wasting their money, time, and resources behind the defaulters.

On the other hand, the Insolvency and Bankruptcy Code(IBC) 2016 is set to provide a solid legal framework to India's resolution and recovery ecosystem. As in the fiscal year 2020, recovery of non-performing assets through IBC was all-time at 46 percent. The path to resolve or recover the bad loans has never been smooth because the defaulters have normalized and trivialized the concept of not serving the loans and are not ready to give up on their assets.

Non-performing loans need to be solved not only because of their financial costs but also because of the social and ethical costs involved. Elevation in NPAs can make our county hampered, and the goal of a 5 trillion economy would become unattainable.

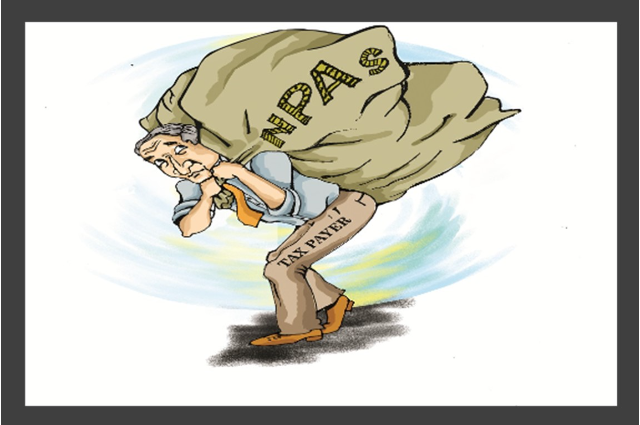

The progress made under IBC over the years is satisfactory. Still, Government and RBI have to come up with more stringent measures to ensure that every penny that belongs to the taxpayers is used for developmental purposes rather than spent lavishly by the defaulters who even flee to other countries to escape the legal proceedings against them.

The concluding statement is that Indian banks need to be more transparent and honest in discharging their intermediation and capital formation services. The interest of the whole country should be served rather than the interest of few people. At the same time, the government of India and the RBI should come up with a better solution to reduce or even remove the problem of NPAs from the Indian economy so that India can strive for a nation where the poor become wealthy, not poorer.