INTRODUCTION

The Impossible trinity or the monetary trilemma states that a nation cannot maintain all three factors at the same time: Fixed exchange rate, Free Capital flows and Autonomous monetary policy; at the same time.

In this paper, I have explained the concept of impossible trinity using a simplified example and I have further analysed the current scenario of Impossible trinity in India.

1. CONCEPT

To understand the concept of impossible trinity, let us assume that there are two departments, Business Economics Department (BBE) and Economics Department (ECO).

They each want to maintain a few criterions:

- Any number of students can invest any amount of money in either of the two, i.e Any member of BBE can invest as much as he wants in ECO.

- Each department prints their own currency and has control over its supply and interest rates within the department. Thus, the BBE maintains complete control over the BBE dollar and the ECO maintains complete control over the ECO dollar.

- BBE wishes to have a fixed exchange rate of the BBE dollar against the ECO dollar.

Let BBE try and maintain all three.

Due to failing prices, BBE is now facing recession and to counter this the BBE increases the supply of BBE dollars in the market and this decreases the interest rate. But now that its interest rate is lower than that of its trading partner, ‘ECO’.

So now all BBE students will take their money and invest in ECO, since interest rate there is higher and they can earn more money overseas.

But by doing so, the amount or supply of BBE dollars has increased in the forex market. But remember the BBE government wishes to maintain a fixed exchange rate and thus it must stimulate the demand of BBE dollar. To do that It will sell foreign currency or ECO dollars to buy back its own BBE dollars to increase the demand of BBE dollar and maintain the fixed exchange rate.

This is not sustainable, it will eventually run out of foreign reserves. Also, by the very fact, that is buying back its own currency means that it has lost monetary autonomy. Thus, we have the concept of impossible trinity, like the U.S, India has opted for monetary policy independence and free capital flow.

2. EXPANSIONARY MONETARY POLICY

This form of monetary policy is also known as ‘Dovish’ stance. It is utilized to counteract an economic crisis that the nation is facing. Interest rates are decreased, thereby increasing the money supply in the market, which in turn decreases the value of the currency.

Advantages:

- It gives the nation the benefit of having cheaper exports.

- As exports are cheaper and the imports have become costlier, the current account deficit of the nation decreases.

Disadvantages:

- It gives rise to inflation, if left unchecked over a period.

- It increases the price level within of goods within a nation by:

- The prices of imported goods have risen, and also many of such goods are raw materials used in production of other domestic goods, hence a rise in their prices leads to a rise of price of domestic goods.

- The now reduced value of currency makes the exports cheaper and therefore more competitive in the world markets. This causes the exports of goods to increase and reduces the supply and availability of goods in the domestic market which tends to raise the domestic price level. Besides, due to higher prices of imported goods, people of a country tend to substitute domestically produced goods for the now more expensive imports.

3. CONTRACTIONARY MONETARY POLICY

This form of monetary policy is also known as ‘Hawkish’ stance. It is utilized to counteract inflation crisis that the nation is facing. Interest rates are increased, thereby decreasing the money supply in the market, which in turn increases the value of the currency.

Advantages:

- It reduces the inflation prevalent in the market due to:

- Import prices are cheaper. The cost of imported goods and raw materials will fall after an appreciation.

- With export prices more expensive, manufacturers have greater incentives to cut costs to try and remain competitive.

- It decreases the price of goods within the market.

Disadvantages:

- If a severe contractionary monetary policy is in place, it may lead to recession by stifling the demand of the market.

However, its impact on the current account deficit is not all clear, on one hand, , we would estimate that an increase in value of currency to worsen the current account position. Exports have become more expensive, so there will be a fall in exports. Imports have become cheaper and so there will be an increase in imports. This will cause a bigger deficit on the current account. However, on the other hand, an increase in value of currency, will tend to reduce inflation. This can make domestic goods more competitive, leading to stronger exports in the long term, therefore, this could help improve the current account. (Bag 2020)

4. INDIA’S TRILEMMA

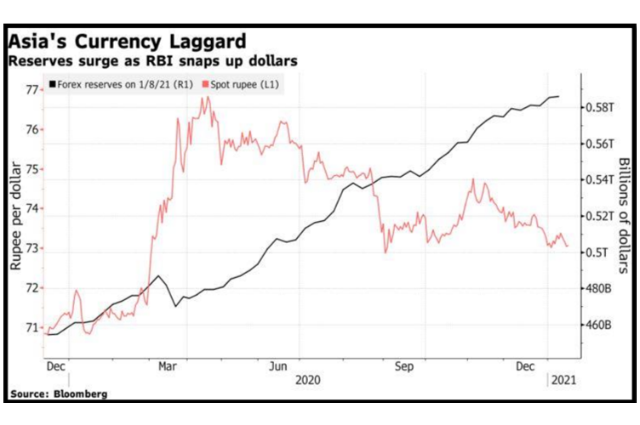

In November 2020, RBI Governor ‘Shaktikanta Das’ had said that India is dealing with monetary policy trilemma. He further said on 20th Jan, 2021 that “Emerging markets need to build reserves as buffers against external shocks even at the risk of being added to the U.S. watchlist for currency manipulation.” India re-joined the list in December due to RBI’s sustained forex purchases and a large goods trade surplus with the U.S. (Sircar 2021)

Due to heavy foreign inflows and various fundraising events, such as those of Reliance industries, the Rupee is under heavy pressure to rise. Amidst the ongoing pandemic, due to supply chain disruptions and lockdown, inflation has persisted in the economy, due to which the RBI has been reluctant to cut domestic interest rates.

RBI has been purchasing the excess dollars with the aim of keeping the local exchange rate stable. India’s forex reserves subsequently have risen to a record $586 billion, catching up with Russia, which has the world’s fourth-largest stockpile. (Chari 2020)

5. STABILIZING LIQUIDITY

Since March 2020, we have seen consistent banking liquidity surpluses of over Rs 6 lakh crore. On Jan 11, 2021 RBI announced that it would restore normal liquidity operations in a phased manner while ensuring ample liquidity in the system.

However, certain risks must be kept in mind:

- Food inflation may get generalized due to high inflation

- Firms can continue to retrench labour as production activities continue to get restored.

- The savings of common man has been affected a lot, between low interest rates on one hand and due to increased inflation on the other hand.

- The excess liquidity will prove to be a risk to financial stability

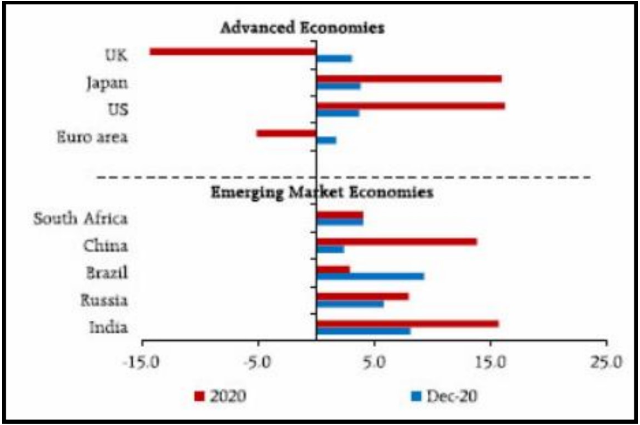

Due to massive improvement in global macroeconomic outlook and vaccination efforts that are being undertaken huge gains have been registered in November 2020, which has also benefitted from the Brexit deal and the US stimulus towards end-December.

On the other hand, surging gains in stock markets of EMEs pulled in strong portfolio flows. The total portfolio flows into EMEs in December were US$ 45.9 billion, and for the year as a whole, they amounted to US$ 313.6 billion. (Reserve Bank of India 2021)

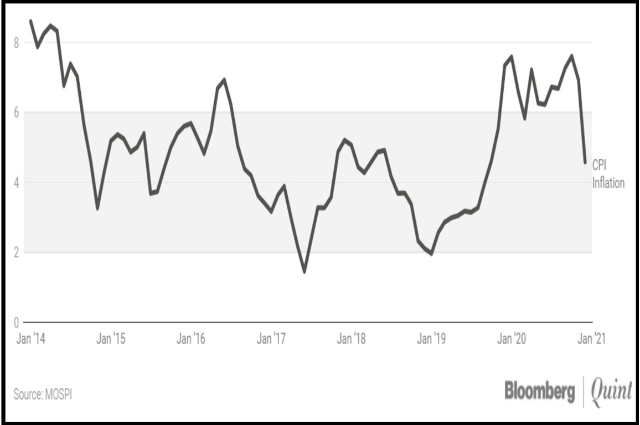

Inflation band target is 4% plus-minus 2%, it will be reviewed in March 2021.

Retail inflation took a downturn in December 2020, led by a crash in vegetable prices. With this decrease, inflation fell back within the MPC’s target range of 4 (+/-2) % for the first time since March 2020. Inflation in December reached its lowest in 15 months, while inflation in food and beverages dropped to 16-month low of 3.87% in December 2020.

CONCLUSION

As various notable economists have pointed out, we are heading towards a ‘V’ shaped recovery. However, the RBI on 5th February 2021, has announced its benchmark interest rate to remain unchanged at 4 % for now. It has further projected GDP growth at 10.5 % for 2021-22.

The recently announced Union budget indicates the Government’s assurance to work towards revival of sectors, such as Healthcare and Infrastructure.

RBI has been dealing with monetary trilemma for a long time now, after all it is the bane of emerging market economies. We can only hope that our recovery from this pandemic is swift as along side we begin to exit this trinity.

Works Cited:

- Bag, Anirban. 2020. The Print. October 27.

- Chari, Arvind. 2020. Bloomberg Quint. December 5.

- 2021. Reserve Bank of India. January 21.

- Sircar, Subhadip. 2021. Bloomberg. Januray 21.