I have observed that from the past 5 years, i.e., from the year when I started earning, I used to wonder where I spend my money. I knew I cannot buy unnecessary things, but I would still end up buying useless things which would lead to a cash crunch at the end of the month. Usually last 10 days of the month I used to have no money at all, and I would spend money like a guy in poverty. But the first 20 days of the month I would spend like a king. I am from a responsible background, I know I should not spend on unnecessary things, but sometimes I would think it is okay to reward myself, like buying an extra ice cream, buying imported perfume, or buying a t-shirt even though I don’t need, just because I found it very good, this would lead to a cash crunch at the end of the month. Hence the majority of the time I used to think to save, but I would not able to save or end up saving very minimally, which in turn saved money that would end in one or the other month due to unnecessary purchases

Over the years I have found that it is important to track our money, I have read many self-help books, and the first step towards saving money is to track the money. I am not telling you how to save money. Because each person has their own way or constraints, and I will not be able to tell. But in this article, I will explain to you how I track my money daily and how it has benefited me to be disciplined.

Importance of tracking, a good Habit:

Habit forms an important part of life, whether it is a good habit or a bad habit. Bad habit affects negatively whereas good habit affects positively. For example, smoking daily affects negatively whereas exercising daily affects positively.

Hence tracking your daily expenses will lead to developing a good habit, initially, it will be a little tough and tedious, and you may forget to follow daily, but once you start tracking at least for 30-45 days, you will develop the habit.

Below are a few benefits of tracking your daily expenses:

- You will track all the expenses in a detailed manner.

- You will have a track of the day, what you have done most of the time

- You will come to know in which area you are spending most and you can take action to save the money.

- You will become disciplined

- You will develop a good habit

- Above all benefits will help you in saving money and growing the money

How to track:

Tracking daily is very easy, but it will be very irritating in beginning, but once you develop the habit, it forms your part of life. As I have listed out the major benefits of this, I highly recommend you do it. If you have your own methods of tracking then well and good, you should follow them, but I m going to explain how I track my expenses daily. I developed this habit once when I read the book The Compound Effect by Darren Hardy in which the author explained the real-life example of a lady and how she benefited from tracking her expenses. Her example motivated me to track my day.

For tracking my expenses, I have developed a small excel sheet which I call the ‘Tracking Sheet’, in which I fill my daily expenses half an hour before sleeping. The tracking sheet is straightforward and can be developed by anyone who knows basic MS Excel. Let me explain the content of the tracking sheet.

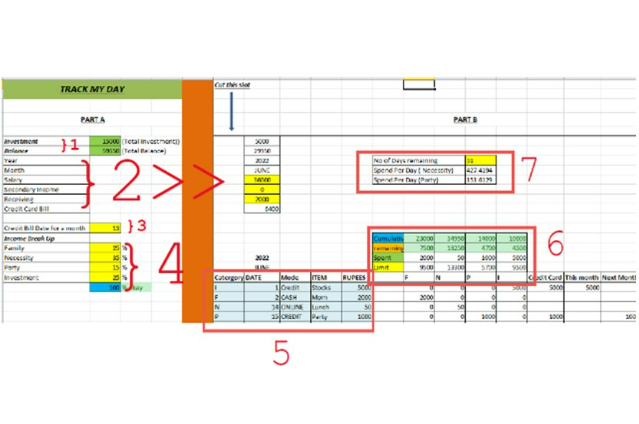

Please find the snip below of the sheet:

The sheet is divided into two parts, Part A and Part B.

Part A gives basic details and necessary information, whereas, in part B, you have to fill in the daily expenses.

Section 1: It details the total investment and balance left to date from the start date of filling the tracking sheet.

Section 2: Gives the basic information, which needs to fill such as the month, year, salary and income received, and also tracking sheet is designed in such a way that, if you are using a credit card, you will get the expected credit card bill.

Section 3: I have tried to incorporate credit card tracking also in this sheet, the main reason was that credit card gives us the illusion of having money, but in reality, it is not our money. Whatever money we should spend should be within our limit or the money we possess. Or else we will go negative and be on loan with a credit card company. Hence I have tried to incorporate the credit card bill. So section 3 is to mention the date of the credit card bill you get.

Section 4: Here we divide the income allotting to various needs. Based on considering the general Indian case I have divided it into 4 parts. That is Family (F), Necessity (N), Party(P), and Investment (I). As an Indian, I feel that we must give something in return to our parents for their sacrifices, hence I have included family as an additional section. Here you have to divide your income and enter it into each need. This allows you to know how much you have to spend on each need, and you will have an idea to maintain the expenses. And try to spend the amount based on the amount allotted each month for each need.

The Four Needs:

- Family: This is part of the income that you give to your parents or any of your family members.

- Necessity: This is part of the income that u spend on daily needs such as food, petrol, clothes, etc.

- Party: This is part of the income that you spend on enjoying or rewarding yourself, such as outings with friends, buying costly clothes or going on trips, or maybe learning a musical instrument, it can be anything that you feel is not necessary to survive.

- Investment: This is part of the income where we invest in stocks, mutual funds, Life insurance, Fixed deposits, etc. Please remember health insurance comes under the necessary category.

Section 5: It is the section where you have to enter your daily expenditure.

Section 6: This section shows you how much amount you have to spend each month in each category i.e., N, F, P & I. This section also shows how much you have spent, how much amount is remaining from the current month's income, and the cumulative amount remaining to date in each category.

Section 7: Shows how much amount you have to spend that particular day in the N category and P category.

I have prepared this tracking sheet considering all the factors in my case, i.e in each Indian household case. If you think, that I have missed anything or If you have any observations in my way of tracking please do comment below, I always support positive feedback and positive criticism.

For Students:

I know that students who are reading this are wondering whether they can use this tracking sheet. I know that you people spend your parent's money daily and you also want to keep it on track so that you don’t burden your parents. Filling this excel sheet will help you track money daily, and you can review and take action on monthly expenditures. Also, you can keep track of all the money you have spent during your education, which if you want you can return to your parents. Also at the end of the education, you will know how much money you have spent and how much loan you have taken.

Conclusion:

My laziness had made me to lost track of my hard-earned money. Which has cost me a lot. I have taken a step to track my money daily to rectify this mistake. I am doing it from the past one year. Yes, I m finding a lot of changes and positive impacts with this exercise and I believe it will help me personally in developing in a long run. I am a believer in positivity. Hence I believe this exercise will help you too, I request you to strictly follow it and experience the changes in the long run of life.